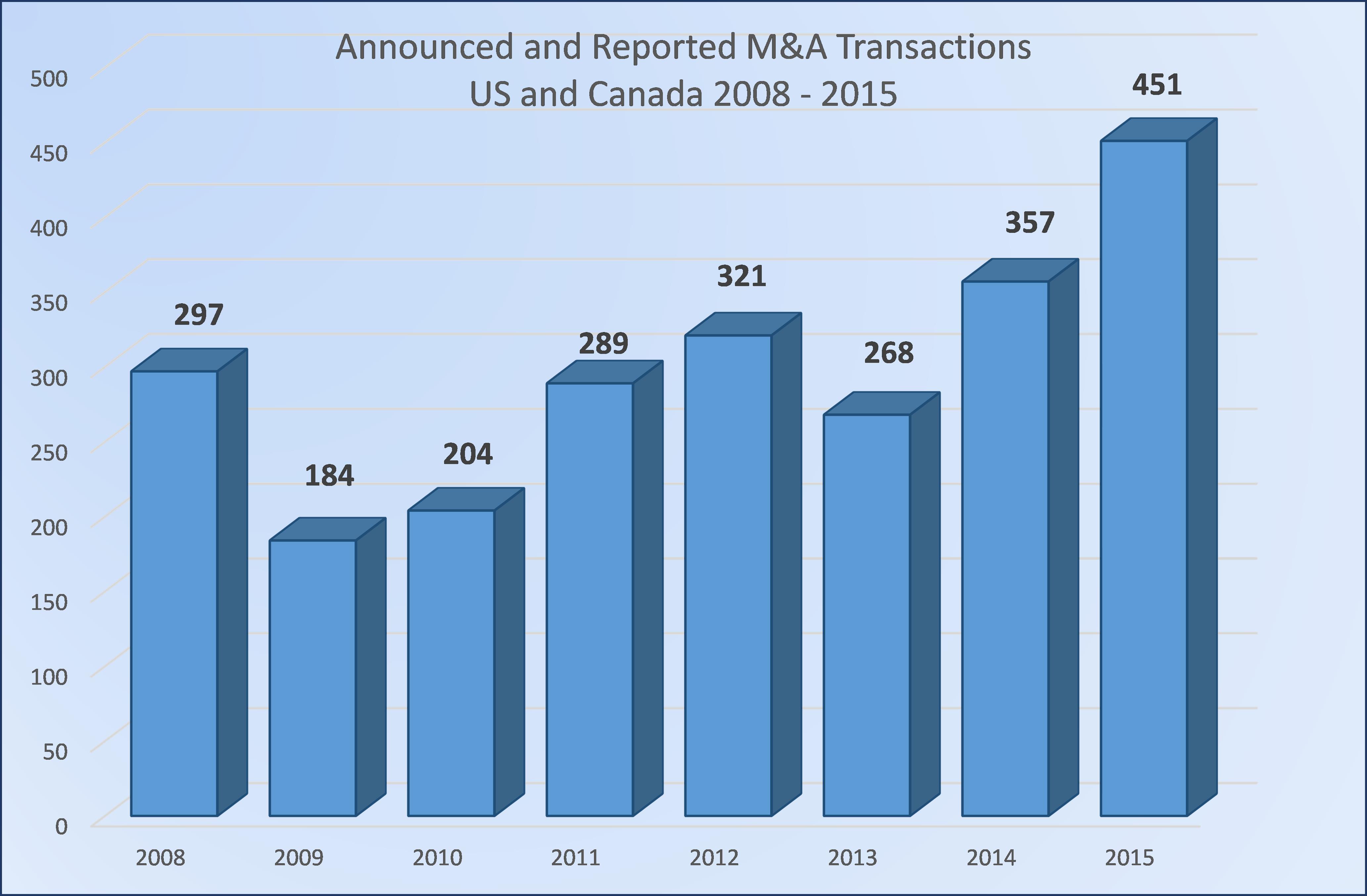

Insurance agency mergers and acquisitions hit a record high of451 reported transactions for the U.S. and Canada in 2015,surpassing the previous record of 357 in 2014, according toa report from Optis Partners.

|“This is strong evidence of a steady, entrenched shift in buyerdynamics,” said Timothy J. Cunningham, managing director ofOptis, aChicago-based investment banking and financial consulting firmspecializing in the insurance industry, and National Underwriter Property & Casualtyadvisory board member. “Private-equity backed buyers wereresponsible for virtually all of the year-over-year growth, whileP&C agencies dominated the seller category.”

|Indeed, private-equity-backed agencies were 2015’s biggestbuyers, with 242 transactions, which is an increase of more than50% from the year previous, the “2015 Agent-Broker Mergers & Acquisitions”report states. This is the first time that any buyer group hasaccounted for the majority of transactions, Cunningham says.

|Caledona, Mich.-based brokerage Acrisure (which is backed byGenstar Capital) made the most transactions, with 56 acquisitions.Lake Mary, Fla.-based AssuredPartners, backed by Apax Partners,came in second with 38 transactions, followed by Chicago-basedbrokerage Hub International, backed by Hellman & Friedman, with37 transactions.

|What’s driving this trend is the “limited options available toinvestors to generate the returns they seek,” the report states.“Interest rates have been paltry for years; the U.S. stock markethas become more volatile after years of growth … Meanwhile, theinsurance brokerage business has proven to be an opportunisticvehicle that meets investors’ return demands.” As such,private-equity-backed buyers are “willing to push agency values tolevels not seen in many years.”

|Privately owned insurance companies purchased 109 agencies in2015, followed by public brokers (50 transactions), banks (24transactions) and all others, which includes carriers (26transactions).

|Property and casualty agencies drive sales

|Fifty-seven percent of merger and acquistion sales were ofP&C-focused agencies, Optis says in its report. Agenciesspecializing in both P&C and employee benefits represented 17%of the sales, which is the same percentage of transactions foragencies with employee benefits only.

|The report covers agencies selling primarily property andcasualty insurance, agencies selling both P&C and employeebenefits, and employee benefits agencies.

|Data for the report comes from reported transactions in theinsurance distribution sector for both retail and wholesaleproducers, including managing general agencies and managing generalunderwriters.

|Data is restricted to those agencies providing P&C, employeebenefits, or a combination thereof. The total number oftransactions actually is greater than the 451 reported, as manybuyers and sellers do not report transactions, Optis said in itsreport.

|(Click image to enlarge)

||Trends in annual number of insurance agency mergers andacquisitions, 2008-2015. Source: OPTIS Partners.

|Have you Liked us on Facebook?

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.