As natural catastrophes proved once again to be few and the Property & Casualty industry continued to be viewed as an attractive investment for alternative-capital sources looking to place their bets, carriers looking to get rate in a market made increasingly competitive — and soft — had different ideas about how to achieve growth.

Which is to say, insurers put on a brave face and wondered just how they were supposed to take back share, in conditions like these.

For some, that answer came in the form of merger and acquisition deals executed to achieve scale. Long-inadequate investment returns from low interest rates, in addition to fierce competition on pricing, have created an environment in which to many, size does in fact matter — and leverage is needed. As many analysts expected, M&A became a popular strategy for putting available capital to work and to bolster return on equity in 2015.

In April, Progressive Corp. closed the purchase of its majority stake in ARX Holding Corp, expanding its reach into home coverage. By May, XL Group had stealthily acquired Catlin. In June, Tokio Marine Holdings Inc. announced it was buying U.S. specialty insurer HCC Insurance Holdings Inc. for $7.5 billion in the biggest M&A deal this year by a Japanese company, and July saw ACE's acquisition of Chubb. The Chubb deal, valued at $28.3 billion and expected to close next year, marks the biggest acquisition in the industry since the global financial crisis, according to research by global law firm Clyde & Co.

Hours after announcing the XL Catlin deal, CEO Mike McGavick told me he believed more major players would likewise be pondering increased acquisitions to bolster their strength, and that some already were. Adding that he was seeing the beginning of a new wave of strategic deals being sought for better positioning, he said, "The good news for us is, we were already putting ours to bed."

As of this writing, Towers Watson & Co. and Willis Group Holdings PLC had just sweetened the terms of their $18 billion merger (increasing a special cash dividend payable to its shareholders to $10 a share from $4.87). This move came after insufficient support for the deal was gained from Towers Watson shareholders, who criticized the deal's price as being too low. The two firms, whose investors must also approve the transaction, said they would hold new votes by Dec. 16.

It's a very safe bet that the M&A trend will continue into 2016 as P&C insurers continue to weigh their options in an evolving market where even its strongest players have had a hard time of making hay.

"Consolidations, both on the broking and carrier sides, are certainly having an impact, and we see no end in sight to this trend," says Glenn Spencer, chief operating officer (U.S.) at Lockton Cos.

The implications for buyers, he notes, include fewer choices, but, in theory, broader capabilities. Mergers and acquisitions, Spencer says, represent a significant degree of change to any organization; with that change come opportunities and challenges. "They also generally involve personnel changes, which can cause disruptions," he adds. "Again, the counterbalance to this is that organizations that manage this effectively, potentially have greater capabilities and scale that can be beneficial to their clients."

These transactions "reshape distribution and capacity," says Tim Turner, president and CEO of RT Specialty, Ryan Specialty Group's wholesale brokerage. "Mergers and acquisitions on both the carrier and broker side have had a tremendous impact."

In addition to the M&A activity, adds Turner, the increase in capacity and lack of significant losses continue to drive rates down. The impact of alternative capital has reshaped the P&C industry in such a way that many consider it a "new normal" in most sectors, forever altering the playing field for the competitors.

"Moving into 2016, the most important factor for the P&C industry will be the continued deployment of alternative capital in the reinsurance and primary segments," says Robert Rheel, president, Aspen U.S. Insurance. This growing source of capital is providing customers and brokers with many alternative choices, he adds, and "will also cause a 'Butterfly Effect' for years to come, as it will change the competitive landscape, product solutions, utilization of capital and distribution."

The oversupply of capital and overcapacity in the P&C market has pushed industry surplus to record levels, says Danny Kaufman, corporate vice president at Burns & Wilcox. "New capital continues to enter the market, and it is outpacing overall economic growth," he notes. "I don't see that changing in the near term."

Whether it be alternative capital or the emergence of primary capacity spawned from traditional reinsurers, the need to get closer to the client has been a leading priority for many—and that trend appears to be showing signs of permanency, says Michael Sillat, CEO and president of WKFC Underwriting Managers, a part of Ryan Specialty Group's RSG Underwriting Managers.

Sillat shares the opinion that alternative capital is here to stay, but if and when a major event does occur, he says, "I am convinced that some markets, namely those that deploy capacity without properly applying disciplined underwriting convention, will retreat back into their traditional investing roles. But in general, I do see an insurance marketplace that will consist of not only the traditional insurance carriers, but also a mix of alternative capacity providers and primary markets that emerge from capital emanating from reinsurance markets.

"Given that trend, it will be difficult to gain traction in terms of rate in just about every line of business," he continues. "However, opportunities always exist in areas where most standard markets do not venture. And within those classes, there are segments that, with diligent underwriting and sensible terms, can be written profitably. I believe that the opportunity for rate increases and tightening of terms continues to exist."

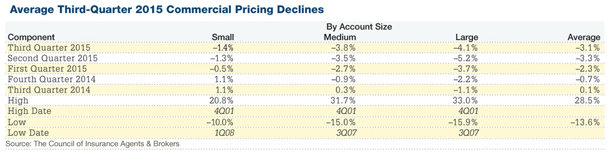

Primary Casualty rates are falling for most buyers in the soft market, Willis notes in its recent "2016 Marketplace Realities" report. Property rates are also expected to fall, Willis says, though slightly less steeply because they've now slipped for so many renewal cycles that they don't have much farther to go.

(Photo: Thinkstock)

Opportunities for rate include lines of business where the market has determined underwriting experience has deteriorated, says Tim DeSett, Risk Practice leader at Lockton Companies: "Current pricing is deficient, and new markets—traditional or alternative—are not willing to fill in the void. It has yet to be seen if this will be the case for large transportation risks, Construction General Liability, and insureds with historically challenging loss experience in 2016."

Although few P&C lines are gaining traction in rate, that's only one part of the equation, says XL Catlin Chief Executive/Americas Joe Tocco. "While we'll certainly look to achieve appropriate pricing, we're more focused on providing value," he stresses. "Companies are well-capitalized. Many are in the position to self-insure. So they have to receive from us more than just the benefit of [what] an insurance policy has to offer after a loss.

"I'm still concerned at how the state of the market is affecting risk management efforts," adds Tocco. "Given the low occurrence of natural catastrophes, rates have continued to slide—but what worries me more than that is overall complacency. If we're satisfied with how things are, we don't take precautions or look for improvements. That's when, if something does occur, the losses really start to add up because we've done nothing to help minimize or prevent damage."

Tocco believes the most important aspect influencing P&C lines now and going into 2016 is the soft market: "While many may opine about the super-competitive pricing, many others—including myself—are not going to let it be an excuse in our plans not to achieve growth and maintain profitability now or in the near future."

In Casualty lines, Willis predicts that rates will slip up to 5% in General Liability, and up to 10% for Umbrella/Excess. Property rates are expected to fall by 10% to 12.5% for non-cat exposed risks, and slightly more (12.5% to 15%) for cat-exposed risks. The two exceptions to this rule: E&O and Cyber, whose fates have become intertwined.

Cyber/E&O Watch

This year's rise in Cyber claims, especially those seen from retailers, are expected to send rates through the roof—up to 150%—for those clients with point-of-sale exposures, says Willis. Premium increases for Cyber renewals in other sectors are expected to hover around 15%. First-time buyers (with the exception of point-of-sale retailers and healthcare organizations, whose data is the most valuable and attractive to information thieves) can expect favorable terms, conditions and pricing.

Underwriting around Cyber continues to intensify, however, for organizations of various sizes. Third-party security experts are part of the conversation far more often than not. Cyber is still largely a new risk, despite headline-topping losses.

"There's a significant increase in the take-up rate for Cyber, and it is rapidly becoming part of most clients' portfolio of coverages," says Jeremy Johnson, president and CEO of Lexington Insurance, AIG's Excess & Surplus division. "The exposures evolve rapidly, and the challenge for the insurance industry is to make sure we are providing access to state-of-the-art pre- and post-loss risk mitigation services, technical expertise and consulting to our customers."

Information-security perpetration "is the crime of the future, and the Cyber risk marketplace has the potential for growth well into the billions in the future," says Rheel. "Both producers and prospects need to anticipate liabilities and communicate openly about the various facets of how cyber risk can impact a specific industry or company. As producers, we need to be creative and intuitive in the ways we anticipate our clients' needs and in the ways we write risk."

"Cyber attacks and hacking are a real and present threat to every business, and the need for extremely diligent and constant data security protocols are required at every level," Sillat says. "In the absence thereof, the efficiencies gained by technology will be marred by the damage incurred when data and privacy breaches occur."

In E&O, most insurers are standing firm on deductibles, according to Willis, which adds that technology service providers are now being regularly asked to provide more concrete evidence of coverage. Far more attention is now being paid to the number of E&O claims related to cyber breaches, as executives are increasingly targeted for not having done enough to keep their organization's most precious data safe from intruders. When a major data breach occurs, the citizens often call for the king's head.

At Lockton, "demand for Cyber insurance is skyrocketing," says DeSett, who notes that this is particularly true for industries such as financial, retail and healthcare that handle large volumes of personal data. "Chief information security officers now admit that risk avoidance is very difficult, and now see Cyber insurance as a key component of an enterprise risk management program."

However, even with the best underwriting, the biggest challenge to insurers is how to price this risk. Capacity remains constrained at $300 million, DeSett says, "held back by a lack of actuarial data at a time when loss severity is growing." Excess Cyber losses, Willis notes, have caused a few markets to stop writing large accounts and have driven others to increase their premiums sharply in upper layers of $75 million-plus placements.

"A marketplace that has sustained three to four $100 million losses over the last couple of years now understands that it must change its approach," DeSett adds.

For clients, he says, Cyber risk quantification is the other side of the same coin. Brokers, aside from insurers, must also decide whether to invest in technology to help their clients identify corporate assets at risk, understand the size of the exposures and ultimately decide how much coverage protection is required.

At Burns & Wilcox, "Every month we see a significant uptick in Cyber binders, but greater opportunities remain," says Kaufman. Despite the rate of breaches, he says, many businesses with Cyber/tech exposures still do not feel compelled to purchase coverage. "We believe the onus is on the industry to help educate insureds on why Cyber coverage isn't just an extra expense; it is an absolute necessity in today's world."

Kaufman believes Cyber risks are best left to the E&S market because of the broad coverages the market provides — "and the more the coverage is talked about, promoted, quoted, presented, etc., the more mainstream it will become."

While many carriers want to get a piece of the current $2 billion total annual pie of Cyber premiums, the line itself is "primarily and absolutely an E&S play," agrees Brady Kelley, executive director of the National Association of Professional Surplus Lines Offices. "More standard carriers are starting to develop some level of programming around it, but they're not offering the broad coverages that the surplus market is."

E&S Success

A.M. Best's annual report on the state of U.S. surplus lines showed that E&S writers continued to report profitable results in 2014, including profits from favorable reserve development. Utilizing the freedom of rate and form, surplus lines companies continue to innovate and outperform the overall P&C industry, and recorded a second straight year of underwriting profitability following three years of underwriting losses.

"The surplus lines industry is healthy, and the industry has reached an all-time high with $40.2 billion in surplus lines premiums in 2014," Kelley notes. The abundance of capital also obviously impacts the competitiveness of the market and puts pressure on rates, he adds, but "rate seems to be offset by organic growth in demand for complex insurance solutions and the overall economy. There has also been a reprieve from significant catastrophic loss events, which always impacts the market's competitive landscape."

Additionally, for the eleventh year in a row no financial impairments were seen in the E&S industry. "We are seeing strong balance sheets and resulting secure ratings, so signs point to good conditions for surplus lines for the coming year."

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.