Things are looking up when it comes to how millennials feelabout the auto claims process following an accident. In the latestJ.D. Power 2015 U.S. Auto Claims Satisfaction Study, claimants bornbetween 1977-1994 (Gen Y) showed some improvement in terms ofoverall satisfaction with the claims-filing process, moving from819 in 2014 to 827 in 2015 based on a 1,000-point scale. The numberof Gen Y claimants also grew from 28% in 2014 to 33% in 2015.

|However, Gen Y claimants are still less satisfied with theclaims process in comparison to other age groups. Gen X customers(born 1965-1976), who comprise 20% of claimants, showed a markedimprovement, jumping from 847 last year to 855 this year.Pre-Boomers (born before 1946), are still the most satisfiedclaimants, but experienced a drop in satisfaction, falling 17points from 911 in 2014 to 894 in 2015.

|Gen Y customers growing

|“The efforts the insurance providers are making to improve theclaims experience among Gen Y and Gen X claimants are having animpact,” said Mark Garrett, director of insurance industryanalytics at J.D. Power. “Gen Y is the onlygeneration of auto insurance customers that is growing. It’scritical that providers continue to focus on those youngergenerations as they are the future of their business.”

|Garrett said that the improvements among Gen Y customers crossedall factors with some of the largest increases noticed in firstnotice of loss (+7), settlement (+8), repair process (+14) and theappraisal (+19). “Some common themes where we noticed improvementswere in explaining the claims process, being kept informed, and thespeed of the settlement and repair work,” explained Garrett. “Somenew questions we added showed that technology adoption during theclaim is much higher among Gen Y and proving to be asatisfier. For example, 42% of Gen Y received electronicupdates during the claim (e-mail, text, website) and providedhigher satisfaction than those who did not use technology such asboomers, who have 34% usage.”

|The 17% of Gen Y claimants who submitted photos via a mobile appwere also more satisfied with the process, scoring 850 vs. 823among Gen Ys who did not submit photos. “This usage rate ismuch higher than other age groups with Gen X at 8% and Boomers at4%,” added Garrett.

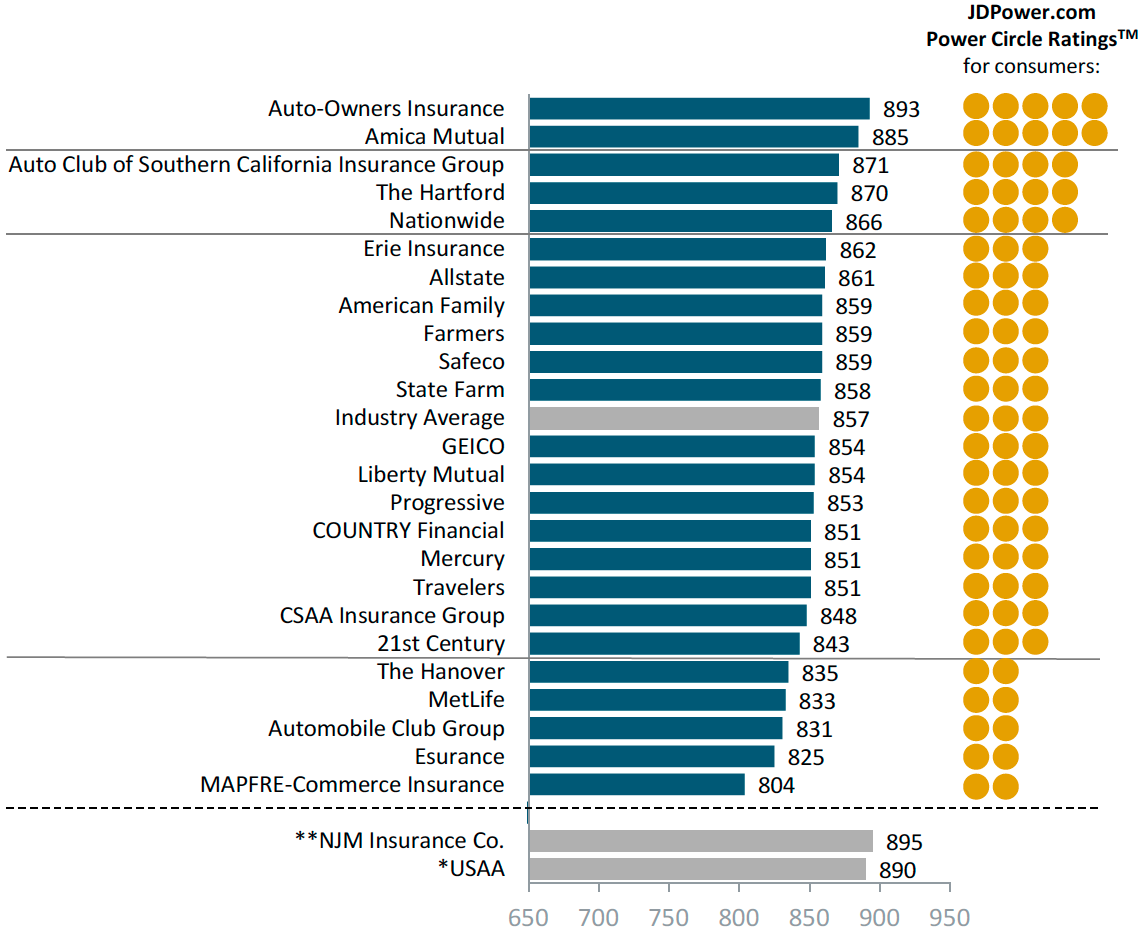

|Auto-Owners Insurance ranked the highest in the survey, with ascore of 893 – a jump of 14 points over last year’s score. AmicaMutual placed second with a score of 885, and Auto Club of SouthernCalifornia Insurance Group (871), The Hartford (870) and Nationwide(866) rounded out the top five insurers.

|Overall, customer satisfaction with the auto claims processremained a steady 857, the same as in 2014. According to the study,over the last five years there has been a notable increase in thenumber of severe claims that required either a tow or were deemed atotal loss. Claim severity has a definite impact on customersatisfaction, with the figure dropping to 855 among customers whorequire a tow. Still, that number has increased by 16 points overthe past two years, a positive sign given that the number of carsrequiring a tow has increased to 22%, up from 15%.

|Customers whose cars are a total loss accounted for 17% of thosewho file a claim and their satisfaction drops to 811 – the lowestscore since 2011.

|Among the reasons for their dissatisfaction are the length oftime it takes to be notified of how much the insurer will pay andwhen the insured actually receives payment. “Our data shows thatpayment is not typically received until 19.5 days from FNOL(compared to 12.5 if a customer is paid for a repairable claim),”said Garrett. “Furthermore, the time from appraisal to when thecustomer is informed of what the insurer will pay is 7 days onaverage—so these customers are waiting a full week to find out whatthey will receive. Their expectations are not always being managedfor how long the process will take as only 62% state they wereprovided an accurate expectation of the claimlength.”

|He said the delay creates more reasons for customers to calltheir insurer and sometimes there are delays in reaching arepresentative. How much an insured receives also impacts thesatisfaction scores, especially for those who receive $3,000 orless.

|Know your customers

|Garrett says that insurance providers should understand theircustomers and tailor solutions to fit a broad range of needs.“Consumers’ needs vary greatly based on their attitudes,preferences, plans, intentions and behaviors,” he said. “Providersneed to know their customers and focus on channels and solutionsthat work for them.”

|The 2015 U.S. Auto Claims Satisfaction Study was based onresponses from more than 11,000 policyholders who had settled aclaim within the previous six months prior to taking the surveybetween November 2014 and September 2015.

|The chart on the next page illustrates how the companies rankedin the study.

||

*USAA is an insurance provider open only to U.S. militarypersonnel and their families, and thereforeis not included in the rankings.

|**NJM Insurance Co. is an insuranceprovider open only to New Jersey Business& Industry Associationmembers, State of New Jersey employees, NJM'spreviously insured drivers,and/or previous/currentauto/homeowner policyholders, and therefore isnot included inthe rankings.

|Includedin the study but not award-eligible due to not meetingminimum sample requirements areAlfa Insurance, Infinity P&C, Kemper and NationalGeneral.

|Rankingsare based on numericalscores, and not necessarily on statisticalsignificance.

|Source:J.D. Power 2015 U.S. Auto Claims SatisfactionStudySM

|Related: Ranked! The top 5 insurers in auto claims customersatisfaction (2014)

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.