Commercial rates for all P&C lines continued in a holdingpattern in May, while personal insurance rates held steady at plus1%, matching the rate increase reflected in April 2015.

|The United States commercial insurance marketplace rates areholding steady and the majority of commercial accounts are securingrenewal terms as expiring. Therefore, premiums held steadyunless the exposure base changed.

|[Related: Composite P&C rates down 1%, personal rates up2% in March 2015]

|A lot of business renewed in May 2015, according toMarketScout. The only notable exception in flat rates was intransportation, where the auto portion of these accounts is drivingan average 2% increase.

|Business Owners Policies (BOP) were up from flat to plus 1% inMay as compared to April 2015. EPLI coverage was down from plus 1%to flat, or 0% increase.Contracting was the only industryclassification to change from April to May 2015. Contracting was up1%.

|Here are the May 2015 composite raw numbers fromMarketScout:

By Coverage Class | |

Commercial Property | Up 1% |

Business Interruption | Flat |

BOP | Up 1% |

Inland Marine | Flat |

General Liability | Flat |

Umbrella/Excess | Flat |

Commercial Auto | Up 2% |

Workers’ Compensation | Flat |

Professional Liability | Flat |

D&O Liability | Flat |

EPLI | Flat |

Fiduciary | Flat |

Crime | Flat |

Surety | Flat |

By Account Size | |

Small Accounts | Up 1% |

Up to $25,000 | |

Medium Accounts | Up 1% |

$25,001 – $250,000 | |

Large Accounts | Flat |

$250,001 – $1 million | |

Jumbo Accounts | Down 2% |

Over $1 million | |

By Industry Class | |

Manufacturing | Flat |

Contracting | Up 1% |

Service | Flat |

Habitational | Up 1% |

Public Entity | Flat |

Transportation | Up 1% |

Energy | Flat |

Keep reading to learn more about the rates in the U.S. personallines market.

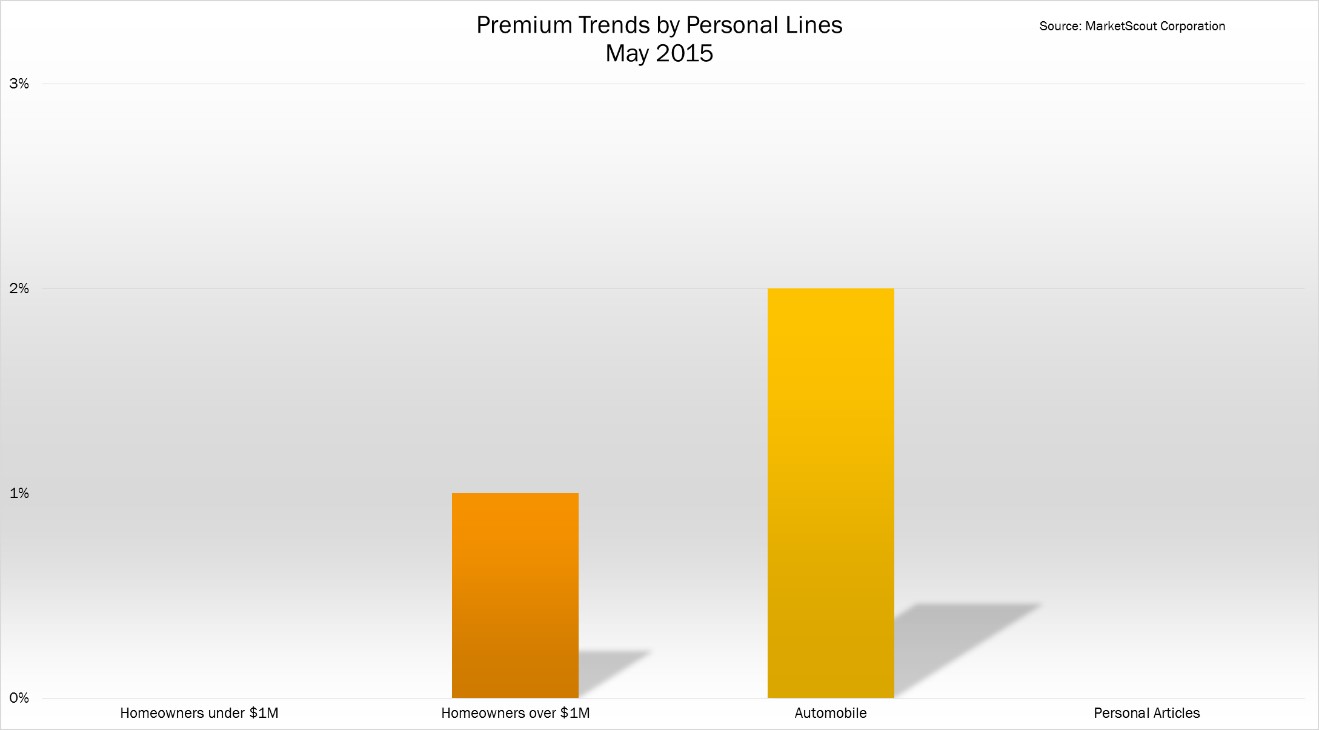

||Personal insurance rates up 1% in May

|The U.S. composite rate for May 2015 held steady at plus 1%,matching the rate increase reflected in April 2015.

|The only change in rate was for homeowners with Coverage Avalues under $1,000,000.

|"The reduction in pricing for homes under $1,000,000 is notsurprising," according to Richard Kerr, CEO of MarketScout. "Thisis a much sought after market with literally dozens of insurerstrying to gain market share," noted Kerr.

|Below is a summary of the May 2015 personal linesrates.

Personal Lines | |

Homeowners under $1,000,000 value | Flat |

Homeowners over $1,000,000 value | Up 1% |

Automobile | Up 2% |

Personal Articles | Flat |

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.