With thousands of baby boomers turning 65 every day, and thenumber of defined-benefit pension plans available to support themcontinuing to decline, the pool of prime prospects for annuitiesoffering lifetime income options should theoretically bedeepening.

|Yet despite seemingly optimal growth conditions, individualannuity sales last year were actually 11% lower than their peak in2008, according to estimates by the LIMRA Secure Retirement Institute.

|This counterintuitive trend can be partially explained by thefact that some annuities carriers have scaled back in recent yearsto de-risk their portfolios, with persistently low interest ratesmaking it problematic to generate the returns necessary to maintainprofitability targets on certain products.

|[Related: Failing to plan means planning to fail withretirement security]

|However, a Deloitte Center for Financial Services surveyof annuity buyers and non-buyers identified several morefundamental, systemic challenges that insurers will need to addressif they expect to increase market penetration, widen their prospectbase, and propel sales on a steadily upward trajectory over thelong term.

|Based on our analysis of the Center's survey data, standardindustry practices, and recent regulatory changes, there are atleast four opportunities for annuity writers to bridge the gap inreaching a broader array of prospects in both traditional andunderserved markets:

|Increase focus on repeat buyers andcross-selling

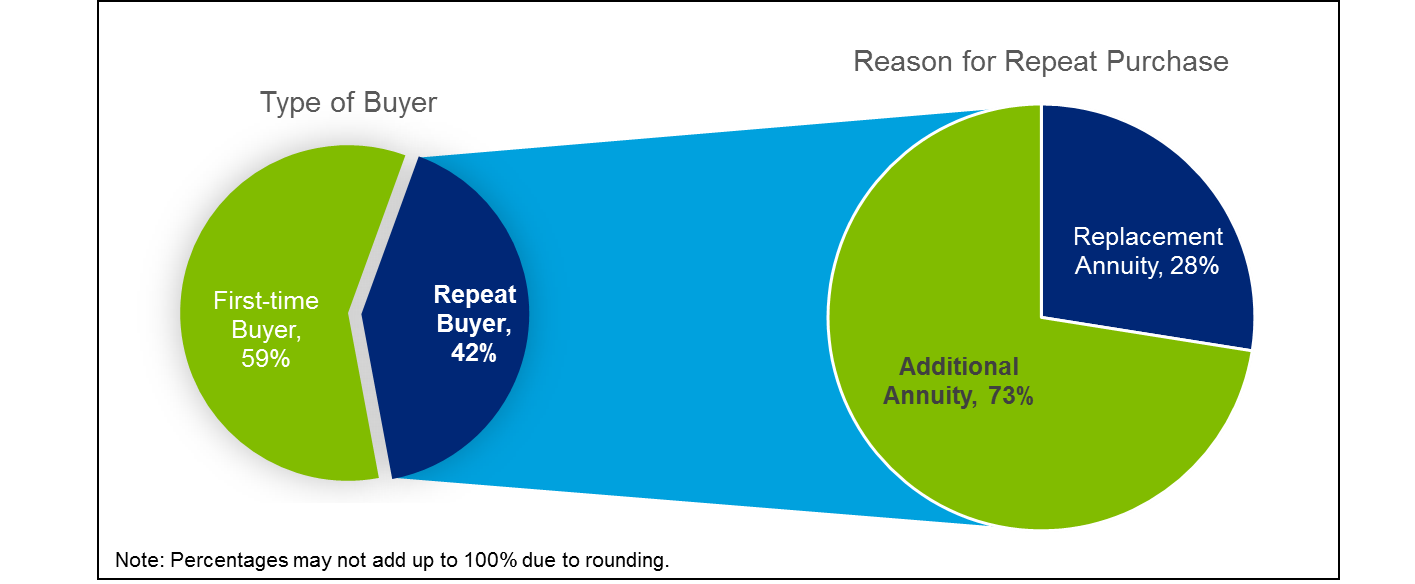

|Forty-two percent of the annuity buyers Deloitte surveyedalready owned at least one other annuity prior to their most recentacquisition. Even more interesting is that 73% of these repeatbuyers bought an annuity in addition to—not as areplacement for—their prior purchase, indicating that this segmentis prone to stockpile their annuity holdings.

|

Meanwhile, familiarity with an annuity writer and seller createscross-selling opportunities to reach first-time buyers. Nearly halfof buyers surveyed had already owned at least one other financialproduct from their annuity company, while about two-thirds saidthey also had purchased other financial products from theintermediary who sold them their most recent annuity.

||Repurpose the product

|To capitalize on the high potential for repeat sales, prospectsneed to first be sold their initial annuity, preferably early intheir financial lifecycle. That means building bridges totraditionally overlooked segments, perhaps by augmenting thistraditionally retirement-focused product line with innovativeelements to appeal to a wider—particularly younger—audience.

|Nearly 40% of non-buyer respondents said they wanted to waituntil they were closer to retirement to purchase an annuity.Getting this segment interested in annuities earlier may requireshifting the focus of the conversation from pure retirementsecurity issues to other potential uses for the product.

|For example, a lower-cost, less complex, and more limited"starter" annuity for younger age brackets could provide annuitizedoutlays for a child's eventual college tuition, or even help recentgraduates and/or their parents pay off student loans aftergraduation.

|Appeal directly to consumers

|While our survey indicates that insurance agents, financialplanners, and other intermediaries are likely to remain thelinchpin in annuity prospecting and sales, that finding should notdiscourage providers from directly communicating more often withconsumers.

|The goal is not necessarily to disintermediate, as relativelyfew respondents overall expressed interest in buying annuities ontheir own over the web (although over one in four in the youngestage segment—30-44—were open to the idea). Instead, carriers shouldmore actively engage prospects directly to better inform them aboutthe benefits annuities offer and thereby develop warm leads fortheir sales force.

|To overcome the lack of awareness and understanding of theproduct among the vast majority of respondents to Deloitte'ssurvey, carriers need to be more proactive in getting their messageout about what annuities can do, how they work, how much they cost,and how they stack up against other investment alternatives.

|Options range from a robust social media campaign to moreaction-oriented advertising—perhaps following the pharmaceuticalindustry's model, which seeks to prompt consumers to ask for theirproduct, rather than wait for a health care intermediary to suggestit.

|Leverage the workplacechannel

|Carriers with sufficient capital and risk appetite can absorblarge numbers of annuity risks via pension risk transfers, whichare becoming increasingly popular among employers looking totransition out of defined benefit programs.

|Meanwhile, recent federal regulatory actions have bolsteredopportunities to market annuities to more individual buyers via theworkplace. In July 2014, the Internal Revenue Service (IRS) issuednew rules allowing individuals to buy longevity annuities in boththeir 401(k) and Individual Retirement Accounts. The IRS also putout a notice in 2014 allowing employers to include deferred-incomeannuities in target date funds used as a default investment optionin 401(k) plans.

|What else might insurers do to appeal to a wider array ofconsumers, create a more receptive audience for their messaging,and ultimately make an increasingly compelling case for annuities?Download our full survey report in Deloitte University Press, which I coauthoredalong with my Center research colleagues, Michelle Canaan andNikhil Gokhale. Also, listen in on our debrief webcast on June 2, orcatch the archived version after that date.

|Sam Friedman ([email protected]) isinsurance research leader with Deloitte's Center for FinancialServices in New York. For many years, he was Editor in Chief ofNational Underwriter. Follow Sam on Twitter at @SamOnInsurance, as wellas on LinkedIn. These opinions are his own.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.