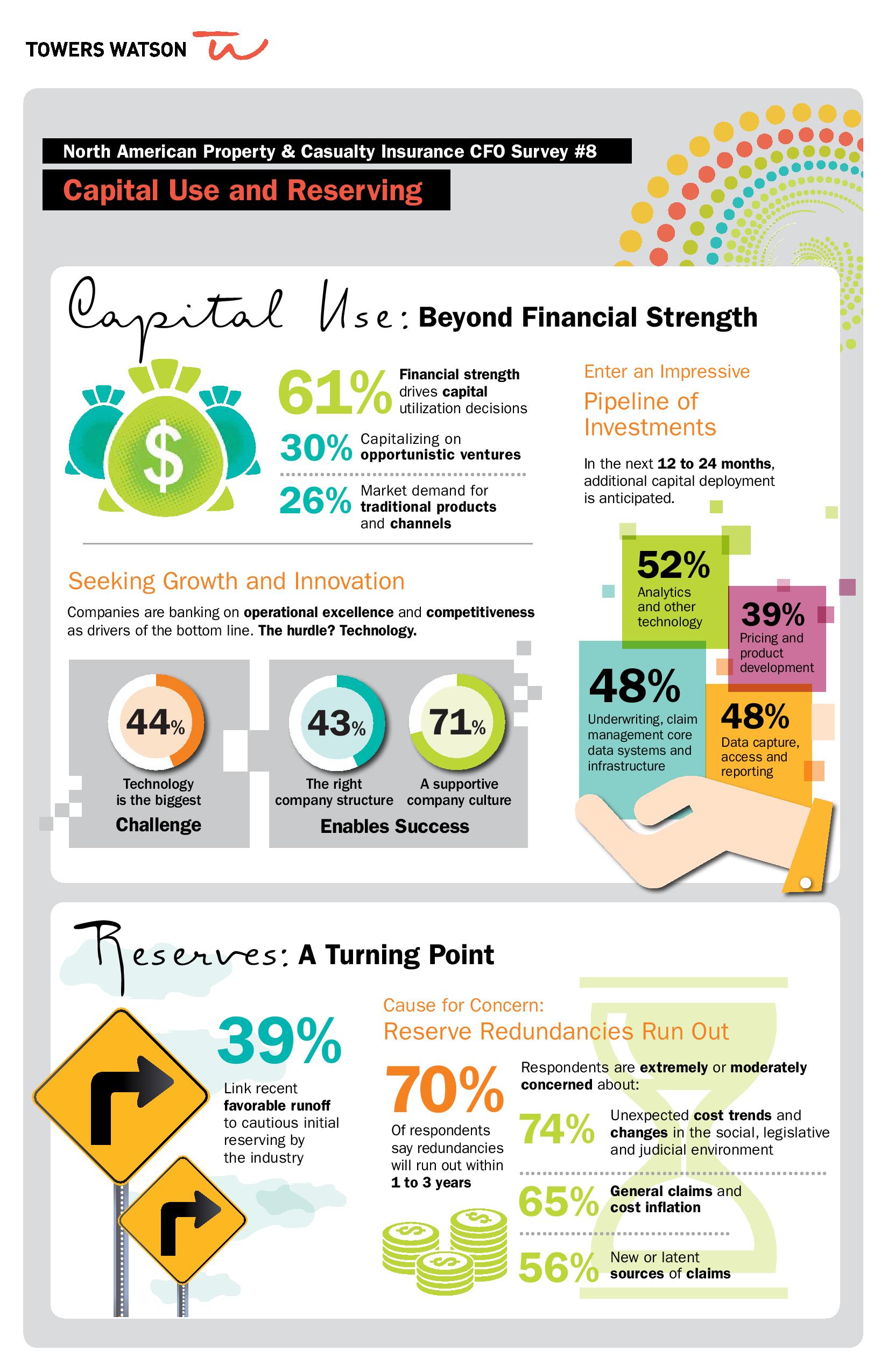

The biggest hurdle to executing capital utilization plans forP&C insurers? Technology, according to 44% of respondentsin Towers Watson in its "P&C Insurance CFOSurvey."

|Chief financial officers also say that data, human resources,know how and timing (all 30%) are the next biggest challenges toimplementation.

|To address that need, half of all respondents plan to addadditional capital deployment to analytics, data and othertechnology-related areas in the next one to two years. CFOs saythey are somewhat or very likely to invest in core systems inpricing (74%), underwriting (74%), marketing/sales/distribution(65%), product development (65%) and claims management (65%).

|But CFOs are relying on their companies' financial strength. At61%, this clearly ranks as the primary driver of capital use. At adistant second and third, opportunistic ventures (30%) and marketdemand for traditional products and channels (26%) also arefactors.

|"The focus on financial strength, however, seems to be supportedby CFOs' concerns about the risks inherent in loss reserves," saysAlejandra Nolibos, director in Towers Watson's P&C business."They see reserve releases that may dry up soon and fear a turn inthe relatively benign claim environment we've experienced in thelast decade."

|Indeed, the survery reports that 70% of respondents say thatreserve redundancies will run out within the next three years,which is on the minds of most. Three-quarters of CFOs are extremelyor moderately concerned about unexpected costs trends in thesocial, legislative and judicial environment, and 65% worry aboutgeneral claims and cost inflation.

|Towers Watson provided an infographic of survey highlights.Click to expand.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.