I hate winter. Being from the northeastern U.S., I can't standthe cold and think snow is a major inconvenience — and manyhomeowners probably share my feelings.

|The frigid temperatures and heavy snowfall in cold-weatherstates, along with wind and hail storms in other areas, can causedamage to homes, and in many instances result in homeowners needingto file an insurance claim.

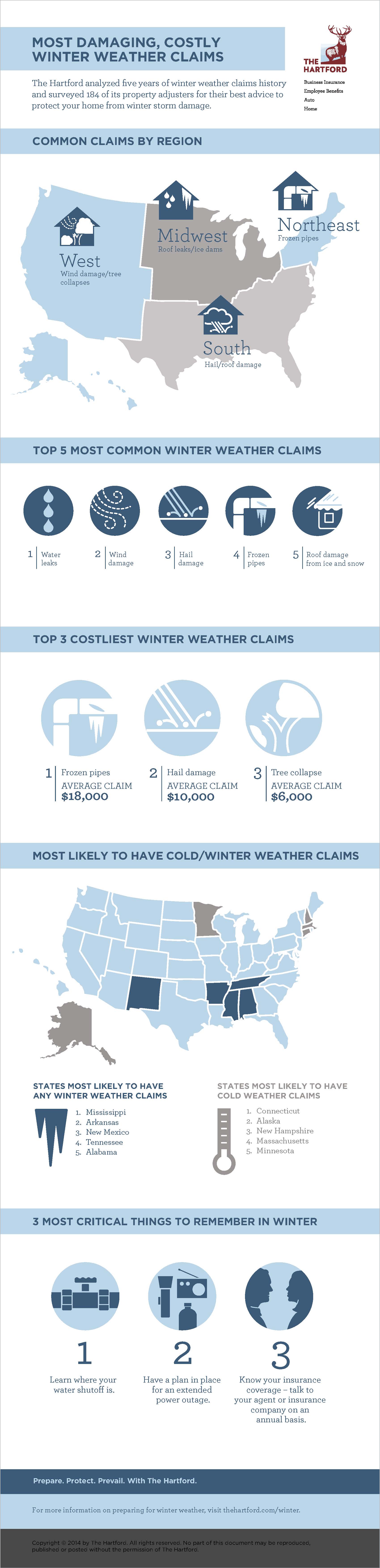

|The Hartford recently analyzed homeowner claims data from thelast five full winters (December to March) and conducted an onlinesurvey of 184 of its property adjusters to find out what are themost costliest winter claims. The analysis also determined the fivemost common winter weather claims and the top five U.S. states forwinter weather claims.

|Click “next” to see the top three costliest winter weatherclaims and where they're most likely to happen. Read through to theend to see an infographic from The Hartford for its full findingson the most damaging winter weather claims.

||3. Tree collapse

Average Claim Cost: $6,000

|Tree collapses are the third most costly winter weather claim.Trees in the western U.S. are generally larger than in other partsof the country and claims in this area average more than $10,000.By comparison, tree collapse claims range on average from $3,000 to$5,000 in the northeast, midwest, and south.

|The Hartford recommends regularly assessing the trees and othervegetation on your property. Weakened tree limbs can easily comedown in windy weather, so the company suggests maintaining andtrimming trees near the home that could fall on the house, otherbuildings or vehicles, before storm season.

||2. Hail damage

Average Claim Cost: $10,000

|Hail damage is the second costliest winter weather claim.

|In the south, it is three times more common than in other areas.Roof damage from hail is more likely at the end of winter and canlead to claims that average $10,000.

|Claims for hail damage are often filed late because the damageisn't always easy to see. After a large hail storm, a homeowner maywant to consider hiring a professional to examine the roof ifthey're not able to safely inspect it. Filing an insurance claim assoon as damage is noticed allows the insurance company to startworking with the homeowner sooner to minimize the damage.

||1. Frozen pipes

Average Claim Cost: $18,000

|According to The Hartford, the costliest cold weather claim isfrozen pipes.

|While most common in the northeast and midwest, frozen pipeshappen in all areas of the country and average about $18,000 perclaim.

|The Hartford's adjusters recommend learning where the watershut-off is before you're faced with a frozen pipe or water leak.If damage occurs from a water leak or frozen pipe, a homeowner mayneed to find a service company to help clean up the mess, which mayhelp save money and prevent further damage.

||To help homeowners prepare for the worst winter can throw atthem, The Hartford suggests the following tips:

- Perform seasonal maintenance: Have the heatingsystem serviced on an annual basis, including testing to make surethe heat is working throughout the home. It's also important toinsulate any pipes that are susceptible to freezing and unhookhoses from outdoor faucets.

Prepare for winter storms: Movevehicles off the street and/or away from large tree limbs. Have thesnow blower serviced. Become familiar with how to trip the manualrelease on overhead garage door openers and have shovels readyahead of the storm.

Prepare for winter storms: Movevehicles off the street and/or away from large tree limbs. Have thesnow blower serviced. Become familiar with how to trip the manualrelease on overhead garage door openers and have shovels readyahead of the storm.- Stock up on supplies: In the event of anextended power outage, have bottled water and non-perishable foods,clothing and blankets, batteries and flashlights. It's also helpfulto have a supply of rock salt, other ice melt or sand, in case thestores run out during a storm.

Half of The Hartford's adjusters surveyed say they beginpreparing their own homes for winter at the end of summer, aroundLabor Day. Another 45% said they start as soon as the first coldfront hits. Only 4% said they wait for a specific stormwarning.

|In the event that a customer does need to file an insuranceclaim after winter storm damage, The Hartford's adjusters recommendhomeowners avoid making the most common claim filing mistakes: Nottrying to mitigate or limit damage while waiting for an adjuster toarrive, waiting to file a claim, and throwing away items withouttaking an inventory or capturing documentation.

|See the infographic below for more tips from The Hartford andmore information on the most damaging winter weatherclaims. (Click image to enlarge.)

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.