Property and casualty insurers are on the financial “frontlines” of climate change and its impacts. As a result, a smallgroup of insurance groups have laid out plans for how theircompanies will deal with the problems that are expected toaccompany stronger storms and rising sea levels.

|That's the good news.

|The bad news is that the majority of insurers are still notonly unprepared, they’re down-right scaling back operations in thisarea, according to a new report from Ceres.

|Two years ago, 2012, was one of the warmest years on record witha number of severe storms such as Superstorm Sandy which resultedin almost $64 billion in total losses with private insurance groupspaying out close to $14.5 billion. Since then, government reportshave said that rising sea levels are an increasing threat.

|“The P&C segment’s reaction has frequently been to limitcoverages or entirely withdraw from certain catastrophe-pronemarkets, especially coastal regions such as Long Island, Virginia,Delaware and Florida,” read the report. “In the long run, thesecoverage retreats transfer growing risks to public institutions andlocal populations, and reduce the resiliency of communities, whichmay struggle to pay the costs of post disaster recovery.”

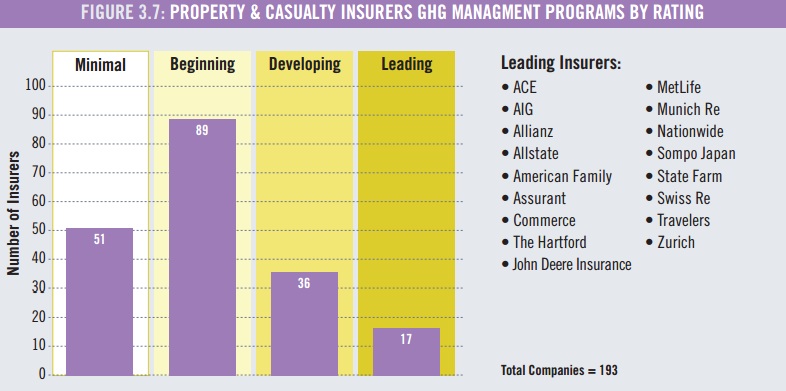

|Despite the expected losses that P&C insurers will have toface within the next century, only eight companies out of 193surveyed have comprehensive plans on how to deal with climatechange.

|Eight!

| “Every segment of the insurance industry facesclimate risks, yet the industry’s response has been highly uneven,”said Ceres president Mindy Lubber in a press release. “Theimplications of this are profound because the insurance sector is akey driver of the economy. If climate change undermines the futureavailability of insurance products and risk management services inmajor markets throughout the US, it threatens the economy andtaxpayers as well.”

“Every segment of the insurance industry facesclimate risks, yet the industry’s response has been highly uneven,”said Ceres president Mindy Lubber in a press release. “Theimplications of this are profound because the insurance sector is akey driver of the economy. If climate change undermines the futureavailability of insurance products and risk management services inmajor markets throughout the US, it threatens the economy andtaxpayers as well.”

However, insurance groups have claimed that the Ceres report issubjective and misguided.

|“Ceres’ insurer ‘scorecard’ simply reflects the degree to whichindividual companies conform to Ceres’ agenda,” Bob Detlefsen, vicepresident of public policy for the National Association of MutualInsurance Companies (NAMIC), told PC360. “If acompany chooses a different path, it either doesn’t understandclimate change risk or is ‘not addressing climate risk … in acomprehensive manner.’ It is hard to understand how anyonecould take seriously this doctrinaire and simplistic approach.”

|Detlefsen argued that insurers increase premiums and limitcoverage because they are the most direct and effective tools tomanage climate-related risk, not as a way of sneaking out andshelving burdens.

|Click through to see who performed best in these areas,according to Ceres’ report.

||Climate Risk Governance

Is there senior level management of climate change policies andrisk?

Only 7% of P&C insurers earned the highest grade, “Leading,”while the vast majority of companies didn’t have senior leadershipadvising on climate matters. Many of the companies surveyed placeda high emphasis on the need for CEO’s and board members to bebriefed regularly on policies along with the latest scienceregarding climate change.

||Climate Risk Management Statement

Has the company released a public statement on their stance andapproach to climate change?

A staggering 88% of insurers have not released a statement onclimate change.

|Some issues that would be addressed in such a statement includeconfirming and understanding the science of new climate changereports, explaining the risk involved with climate change andconsidering investments in climate risk. A public statement alsogives companies an opportunity to rebrand themselves, according toCeres.

||Enterprise-Wide Climate Risk Management

How does the company utilize climate change in forecastinginvestments in capital and insurance needs for policyholders?

Over 100 companies have some kind of plan in place that analyzesboth assets and liabilities in regard to climate change.

|For example, ACE evaluates climate risk yearly and consults withsenior management on the status of climate change in regards totheir business and investments. However, only 12 companies earned a“Leading” score.

||Climate Change Modeling & Analytics

Does the company take steps in using catastrophe (cat) modelingtools to analyze perils associated with climate change to determinethe implications of plausible outcomes?

Cat models are the cornerstones of all P&C insurers and havebeen used for a wide variety of disasters. The majority of insurerssurveyed had modeling practices in place, with 50 companies at a“Leading” rating. Many of the leading companies surveyed used awide array of cat models and academic sources to determine risk forunderwriting, rather than relying too heavily on worst-casescenarios.

||Stakeholder Engagement

How much input and feedback does the company offer from theirpolicyholders, shareholders and the public?

Five percent of P&C insurers actively took part in engagingwith their customers and the public. This includes tellingpolicyholders about green- and climate-friendly products orservices. For many surveyed, rooftop solar panels or small windowinstallations were underwritten in their policies. Also, partneringwith independent researchers or even using technology as anoutreach tool has helped in educating policyholders. SwissRe, forexample, has a Flood Risk App available for free on iTunes.

||Internal Greenhouse Gas Management

Does the company do their part in carbon reduction in theirdata centers?

Seventeen insurers were given “Leading” scores based on twocategories: annual carbon reports done by the company and specificson how their company takes part in reducing greenhouse gases. Only28% of companies had earned a “Developing” grade but majority ofinsurers have little to no practices in reducing greenhousegases.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.