Claims organizations are under increasing pressure to manage thelegal expenses associated with claims litigation. The legal spendfor the P&C insurance market remained flat at $21.3 billionfrom 2008 to 2012, while premiums shrank, according to SNLFinancial and PwC analysis. A general increase in claim complexityand severity, a 3-4% rise in law firm rates, and greater litigationfrequency and billable hours over the last five years, as well as ahigher focus on short-term productivity for adjusters, have drivenhigher-than-expected legal service utilization. As a result, therewas a 5-15% increase in overall legal expenses for many U.S.P&C insurance carriers from 2008 to 2012.

|For these reasons, P&C insurers need new ways to manageclaims legal performance. Leading carriers are integrating claimsand legal data and developing multi-variable predictive models tofacilitate decisions on counsel selection and case budgeting, aswell as on choosing to litigate or opt for alternative disputeresolution (ADR).

||

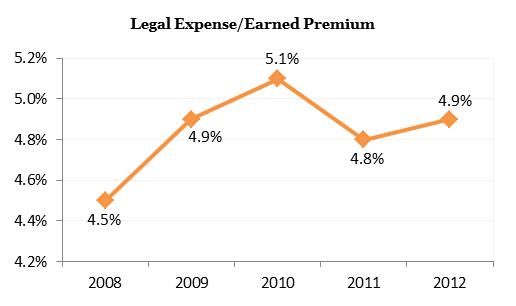

Source: SNL Financial and PwCAnalysis

|Legal expenses have had a growing impact on the industry'scombined ratio. Our industry research, observations and experienceshow most top tier insurance carriers (gross written premiums above$1bn) are trending above the industry average on their legalexpense spend. This graph shows the ratios of legal expense toearned premium in recent years.

||

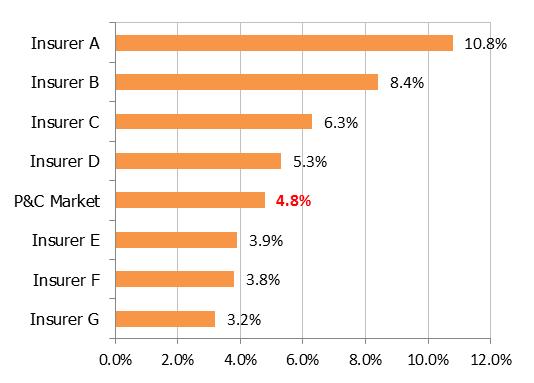

Source: SNL Financial and PwCAnalysis

|This graph depicts the ratio of legal spend over earned premiumat various top tier insurance carriers and compares it to theoverall industry standard from 2008 to 2012. The chart shows thatsome P&C insurance carriers spend considerably more on claimslitigation than the industry average.

||

|

Insurance Carrier Challenges

|Economies of scale achieved through contract negotiations,establishing an upfront litigation strategy, and the adoption ofe-billing have led to some advances in both claims and litigationmanagement systems. However, only a handful of insurance companieshave taken full advantage of the opportunity to improve theirclaims legal operations. Many companies still find themselvesrelying on legacy systems, incomplete data, and cumbersomeprocesses that erode profitability and jeopardizecompetitiveness.

- Challenge: Legal and claims data quality is low andpoorly integrated with core claims systems and legal managementsystems.

At many companies, much of the data that supports an effectiveperformance-based decision support system exists in multipleoperational systems. This lack of a central data source impedesinsurers' ability to make decisions, which in turn affects attorneyperformance ranking, case assignments, and case management.Moreover, even when carriers do establish formal legal performancemanagement practices, they often fail to capture the underlyingdata that supports meaningful metrics (e.g., outside legal spend byphase by defense plan, negotiation savings, and inside counselsavings).

- Challenge: Current litigation processes lack ananalytical basis.

Management faces constant pressure to deliver quick, efficientand effective claims processing. Even in environments that stresseffective claims processing, the underlying foundation – businessknowledge, strategy and plans – may not have a strong analyticbasis. Without a clear understanding of how to improve processes,even the best intentions are likely to fall short.

||

- Challenge: The parties involved in the process do nothave the tools or understanding that facilitates objectiveperformance.

Claims professionals in insurance companies usually do not haveenough supporting information and the appropriate tools toeffectively manage claims legal expenses. In addition, many lawfirms are unaware of the performance metrics insurance carriers useto evaluate them. Lack of formal performance metrics andcommunication with these parties often results in misunderstandingsabout performance expectations.

|However, when they have appropriate techniques to evaluateperformance and support day-to-day operational decisions, such asselection of counsels, and adoption of alternate dispute resolution(ADR), claims departments have demonstrated that they can meet (andoften exceed) corporate goals. A well-defined case-level litigationstrategy driving attorney assignment, quicker dispute resolution,common terms of reference with legal services providers, andimproved financial outcome of cases can help companies achievetheir claims level performance objective.

||

The solution: Claims legal performancemanagement

|Many carriers focus on managing vendor expense – including legaldefence costs – because they recognize there are opportunities tointegrate granular claim, suit, rate and usage data by suit type(no fault injury, personal injury and general liability) andjurisdiction to improve quality and consistency of legal vendorservice outcomes. Leading carriers are managing legal spend viadetailed analysis of case and claim outcome data from modern claimsand legal bill management systems.

|These carriers also have adopted an approach that utilizes theextensive data that resides in claims and legal systems. Thisfacilitates an updated claims legal performance managementstrategy, cleansed and integrated data, KPIs (key performanceindicators) and advanced predictive tools for attorney selectionand assignment, as well as case budget and reserving. (Sample KPIsinclude settlement rate, settlement cycle time, adjuster assignmentscoring, staff vs. external counsel, loss & expense metrics,and claim and case outcome metrics.)

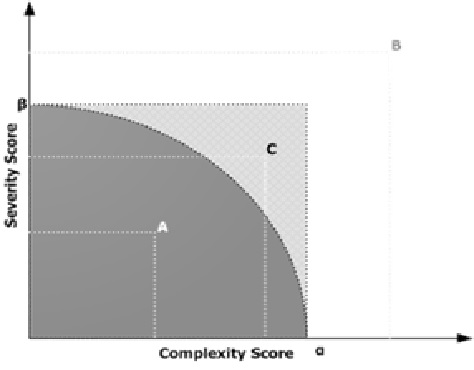

|Multi-variable models for decision support

|Multi-variable statistical models are helping insurance carriersmake more objective decisions. A simple linear model underestimatesthe risk of severe claims. In fact, claims that simple models treatas non-litigation cases (ones they evaluate against only onevariable, such as complexity), actually often end up in litigation.If insurers evaluate the same case against more than one variable,such as complexity and severity, then they are able to moreaccurately determine their potential litigation exposure. Suchcases contribute as much as 60 percent of the totals legal spend,based on PwC's analysis.

||

Accordingly, carriers should conduct an initial assessment thathelp them understand the current environment, potential challenges,and a strategic vision of what could be by involving claims, legaland IT stakeholders, and the CFO. Then they should define a legalperformance management strategy with clearly identified milestones,deliverables, and a timeline for achieving results. With thisinformation, carriers can more easily identify the return oninvestment and improve the claims legal spend and performance.

|Throughout this process, carriers should make sure they areequipped with the process and analytical tools that will help themeliminate potential pitfalls, and expedite results, as well asenable them to focus on innovating and building business value. Viathis approach, many carriers have identified quick "wins" that havetotalled between 5-10% of legal spend (approximately $2 to 3million) and an additional 5-10% reduction as part of a longer termimprovement strategy.

|Claims organizations must evaluate their legal spend and assesstheir strategies to manage that spend. A well-defined legalperformance management strategy with analytics-based decisionsupport has a track record of providing a significant reduction inlegal costs.

|Sajid Kadri is a manager in PwC's Insurance Advisorypractice with more than 11 years of experience in the P&Cinsurance sector across areas such as claims management, policyadministration, reinsurance, litigation management, focused ontransformational initiatives at carriers.

|Also contributing to this article were: Richard Pankhurst,director, PwC Advisory Services, who has more than 18 years ofexperience serving and consulting to the insurance sector in theU.S. and Asia Pacific. Scott Busse, director inPwC's Insurance Advisory practice with more than 12 years ofconsulting experience helping clients undergo change and realizevalue through the strategic use oftechnology. Suman Katragadda, manager in PwC'sAdvanced Analytics practice, who has over seven years of experienceleading numerous analytical engagements within the insurance andhealthcare sectors. Doug Bond, director in PwC'sInsurance Advisory practice with a focus on delivering dataanalytics as a means of driving competitive gain and attainingstrategic goals.

||

|

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.