From September 10-14, a group of young (ages 30-50) business andfinancial leaders gathered in Montreaux, Switzerland at the fifthannual meeting of the G-20Y summit. The mission? To discusssustainable prosperity in the face of a world increasingly atrisk.

|The summit covered ten issues specifically in a series ofstructured discussions from which attendees then developed sets ofrecommendations for the G-20 heads of state and leadinginternational financial organizations. The topics ranged fromenergy markets, to food security, to global financial reform andother topics.

|This year's summit was an especially important one, as itfeatured for the first time an insurance committee. This groupdiscussed the role insurance plays in the global economy and howbest to ensure that globally important insurance companies do notfail, endangering other sectors of the economy, as AIG's meltdownin 2008 did.

|Zurich North America CFO Dalynn Hoch co-chaired the insurancecommittee, and spoke with National Underwriter on how the groupdeveloped a compelling set of suggestions not just for how theinsurance industry can be better at what it does, but how it canbetter synch with the efforts of every industry that insurancetouches. The G-20Y Summit is nothing if not ambitious, but it'salready producing the kind of thought the insurance industry coulduse, and in so doing, has identified what might just be the fourmost important issues facing the insurance world now, and in thefuture.

|Let's take a look.

||

Better insurance regulation

|In the wake of the global financial crisis, kicked off in largepart by AIG's astonishing collapse, insurers across the board havebeen subject to additional regulatory scrutiny. Systemicallyimportant companies (whatever that means – the federal governmentis having a hard time deciding who is systemically significant andwho is not) are under even stricter oversight to ensure that theydon't fail, and if they do, they won't cause a domino effect acrossthe economy.

|The problem, of course, is that insurance is a global business,with lots of companies selling across multiple regulatoryjurisdictions. This gets even more complicated if they are activein the United States, which has a separate jurisdiction for everystate.

|What insurers and the public need, the committee suggested, isbetter regulation. It recommends global groupsupervisory colleges (regular meetings of regulators to discussissues that affect them all) with recognition of a lead supervisor.Zurich's Dalynn Hoch describes noted that layer cakes are greatwhen they're made from Swiss chocolate, but not so much whenthey're made from duplicative regulatory efforts. So the point hereis for regulators to harmonize their efforts – to make how they dothings work well in conjunction, while still preserving the localor regional nature of the regulations themselves. It is far easiersaid than done, but it is the kind of thing that, until it isachieved, will simply hold back insurers in terms of efficiency.Cumbersome regulation simply increases costs that get passedalong.

|[Related: GreaterFederal Regulation Role a Lingering, Not ImmediateIssue]

|When it comes to systemic risk, Hoch noted that regulators oftenfocus on the size of the insurer rather than the nature of theirbusiness. AIG was big, indeed, but its size isn't what made itproblematic. Its credit default swap business was. Systemic risk,then, should be determined by the level of participation in riskbehavior, nothing more. And systemic risk regulation should befocuses on systemic risk management, nothing more.

|One area where regulatory disharmony really gets in the way iscapital standards – how much money insurers need to keep on hand tocover their risks. The insurance committee suggested that insurancecapital standards apply at the group consolidated level andrecognize the specific risks in the insurer's business model andorganization. Regulators should be allowed to be flexible and toexercise sound judgment when it comes to evaluating capitalstandards, which should be risk-sensitive and comparable acrossjurisdictions.

||

Big data

|Last week's KPMG Insurance Conference mentioned big data and data analyticsmore than a few times as one of the most important developments inthe modern insurance industry, and that insurers had to takeadvantage of it immediately. But at the same time, it would help ifrules on data governance and privacy were optimized.

|To that end, Hoch said, the committee recommended thatgovernments support the digitization of records and of open dataplatforms. The more insurers can engage big data, the better it cananalyze that data and better understand the risks it is covering.This, in turn, can make it easier for insurers to develop newproducts to address emerging risks, and at a pace far faster thantoday's data environment will allow.

|[Related: Canthe P&C industry handle big data?]

|The communique also called for a global data governance andcontrol framework that would provide a swift regulatory approvalprocess across jurisdictions. Think a big data equivalent to theregulatory harmonization called for earlier.

|But what about privacy? What the committee calls for is a global“consumer Privacy Bill of Rights,” because right now, data privacystandards are all over the map, and there is just no consistency towhat can be used in one industry, in one part of the world, andwhat can't be used in other industries elsewhere. This really playsagainst the insurance industry, so the G-20Y communique calls for aprivacy blueprint that would apply across all industries and ensurea consistent, level playing field for everyone when it comes towhat is and what is not permissible use of consumer data.

||

Retire wisely

|The growing Boomer and senior populations, worldwide, arecreating an unprecedented retirement crisis. In huge numbers,people do not have enough saved, in large part because they do notrealize how much they need to save, or that they need to save atall. In a world where people are living longer lives, and will facehigher medical bills during the final quarter of their years, someretirement savvy is a survival skill.

|The G-20Y communique suggests a “retire wisely” summit wheregovernments, educators and the private sector (e.g., insurers andfinancial advisors) can propose solutions and incentives to narrowthe retirement savings gap. This would drive awareness of the needand propose alternatives to public pensions that eventually shiftthe financial burden back to the individual. We already see thisquite a bit in the United States. It is the way of the future.

|And finally, accounting regimes worldwide need to take thelong-term nature of pension products (and products such asannuities) into account when valuating these liabilities. Theirrisk progresses over the duration of the product, and that needs tobe recognized.

||

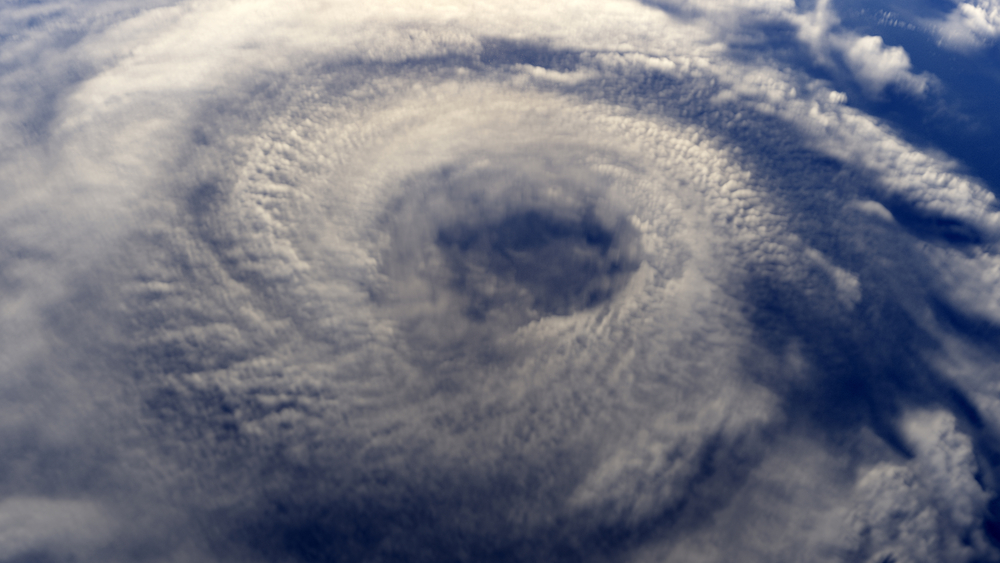

Mother Nature will, in fact, turn this cararound

|Right now, Hoch said, we spend some $100 billion a year copingwith natural catastrophes. In the 1990s, that number was more like$20 billion. And of the money we spend, maybe 10% is onpre-mitigation; the rest is largely unbudgeted post-recovery. Thisobviously plays havoc with how insurers do their business, butreally, this impacts everything. The global impact of naturaldisasters, the G-20Y communique said, could be greatly reducedsimply by shifting a lot of the money we are already spending onrecovery over to mitigation and risk management. It requires asignificant re-think on the part of governments, private partiesand not-for-profit organizations to come together so thatcommunities are safer, and that when natural disasters do happen,they cause less damage and have shorter recovery times.

|[Related: I.I.I. President Bob Hartwig, on Post-Disaster Regulation: GoodIntentions, Unintended Consequences]

|To that end, the communique called on the G20 governments tocoordinate decision-making authority for pre-disaster managementand post-management response, commit to long-term funding ofpre-disaster mitigation investments (such as floodgates inflood-prone areas) and collaborate with business and communities tooptimize pre-disaster mitigation. It all sounds fairlycommon-sense, right? But as we all know, it's not being done in ahuge swath of the world's insured and uninsured areas exposed toloss.

|The communique also called for a public/private partnership withprominent not-for-profit groups such as the Rockefeller Foundationand the 100 Resilient Cities Organization to adopt a robust naturaldisaster preparedness too to gauge risk exposure, mitigationalready in place, adequacy of building codes and standards,community awareness of natural disasters, and how best to financeit all.

|The truth is, populations are concentrating in areas mostexposed to natural disaster risk, especially along coasts and waterways. Hoch noted that historically, that is where economies are thestrongest, and where wealth builds the fastest, but note everybodyliving in the red zone can build wealth fast enough to protect whatthey build there.

|For more on this, please visit the G-20Y Summit web page.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.