There were still positive signs for the U.S. property andcasualty industry during Q1 2014, but financial performance was notas robust as the same period in 2013 as weather losses mounted andthe pace of rate increases slowed.

| The good news for carriers: the industry managed anunderwriting profit for the fifth consecutive quarter (Q4 2012,when Superstorm Sandy struck, remains the last time the industryreported an underwriting loss), and rate increases, whilemoderating, remained in place for most lines, according to an A.M.Best Q1 Financial Review.

The good news for carriers: the industry managed anunderwriting profit for the fifth consecutive quarter (Q4 2012,when Superstorm Sandy struck, remains the last time the industryreported an underwriting loss), and rate increases, whilemoderating, remained in place for most lines, according to an A.M.Best Q1 Financial Review.

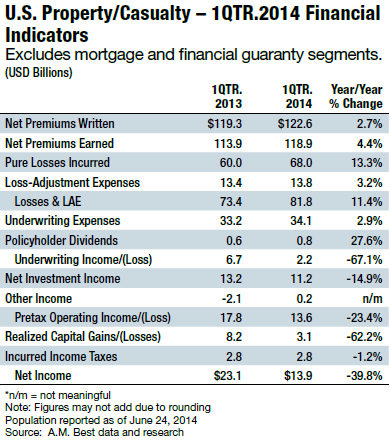

The industry posted Q1 net income of $13.9 billion, down 39.8%from Q1 2013. Underwriting income was $2.2 billion, a 67.1% dropcompared to Q1 2013.

|Catastrophe losses, which A.M. Best defines as an industry eventthat causes $25 million or more in insured property losses, climbedto $1.8 billion compared to $772 million in Q1 2013. The reportcites the impact of the Polar Vortex this past winter as a primarydriver of the losses.

|All told, cat losses added 3.4 points to the industry’s Q1combined ratio, compared to 2.1 points the year before. The 2014 Q1combined ratio was 96.4, up from 92.7, A.M. Best says.

|Net premiums written grew, but more slowly in Q1 2014 (2.7%)than in the same period the year before (4.6%). Direct premiumswritten grew 3.8%, compared to 5.3% a year ago. A.M. Best says,“Growth rates have declined across the board, with premiumreductions accelerating sharply in the accident and health line.”In workers’ comp, A.M. Best says DPW grew 5.4%, compared to 11.1%in Q1 2013.

|Explaining the slower premium growth, A.M. says it believes“market conditions are becoming more competitive, driven byreinsurance capacity, capital availability and customer resistanceto price increases, particularly in more desirable classes and formore desirable insureds.”

|Next pages -- breakdown of personal lines,commercial lines and policyholder surplus

||Personal lines

Personal lines Q1 net income was $4.7 billion, down slightlyfrom $4.9 billion a year ago. Higher realized capital gains andlower income taxes partially offset lower pretax operating income($4.7 billion compared to $5.6 billion), says A.M. Best.

|Top-line growth continues as insurers were still able to getrate increases, mainly on the homeowners side, but also in autoliability to a lesser extent, the report says (justified by ahigher rate of incurred claims due to more frequent and severeweather losses in recent years for homeowners, and by higher claimseverity due to medical-cost inflation for auto liability).

|A.M. Best notes that decreases in net-premiums written,net-premiums earned and net loss and LAE “were attributed primarilyto the impact of Geico’s execution of a 50% loss-portfolioagreement and the implementation of a 50% quota-share reinsuranceagreement with its affiliate, National Indemnity Co."

| The calendar-year combined ratio through the first threemonths of 2014 was a profitable 98.9, compared to 96 at the samepoint last year. The accident-year combined ratio, though, whichdoes not include $9.1 billion in favorable prior-year reservedevelopment, was 115.5.

The calendar-year combined ratio through the first threemonths of 2014 was a profitable 98.9, compared to 96 at the samepoint last year. The accident-year combined ratio, though, whichdoes not include $9.1 billion in favorable prior-year reservedevelopment, was 115.5.

“However,” says A.M. Best, “when the Geico transaction isexcluded, the ratio is 101.5 and is comparable to the accident-yearcombined ratio of 101.6 through the first quarter of 2013.”

|In general, A.M. Best says while the personal-lines segmentremains competitive, it “continues to exhibit strong capitalizationand generally positive operating performance. In addition, actionsthe industry continues to take to strengthen enterprise riskmanagement practices and tighten underwriting standards havebenefitted the personal-lines segment.”

||Commercial lines

While the commercial-lines segment saw profitable Q1underwriting results, performance deteriorated, A.M. Best says.

|The combined ratio was 97.8, compared to 90.6 in Q1 2013, withthe increase attributable to less favorable prior-year reservedevelopment, higher catastrophe-related charges, higher relativeexpense ratios and less-favorable core accident-year lossperformance.

| In fact, with respect to reserves, A.M. Best says thatdespite the continued trend of favorable development, it viewsreserve levels as deficient, in total. “Additionally,” A.M. Bestcontends, “the estimated deficiency continues to be compounded bythe concern that the more recent accident years’ reserves wereestablished by some commercial-lines companies at levels that mightnot account for a change in macroeconomic conditions or thepotential for an increase in claims costs associated with medicaland other inflationary pressures.”

In fact, with respect to reserves, A.M. Best says thatdespite the continued trend of favorable development, it viewsreserve levels as deficient, in total. “Additionally,” A.M. Bestcontends, “the estimated deficiency continues to be compounded bythe concern that the more recent accident years’ reserves wereestablished by some commercial-lines companies at levels that mightnot account for a change in macroeconomic conditions or thepotential for an increase in claims costs associated with medicaland other inflationary pressures.”

Rate increases moderated, and A.M. best notes that growth forthe segment is “generally impacted significantly” by workers’ comp,which accounts for about 20% of commercial-lines DPW. A.M. Bestexplains that workers’ comp rates had begun rising earlier thanmost other lines – as early as 2011. “As a third consecutive roundof rate increases begins, it is not surprising that the pace ofincreases has slowed,” the ratings agency says.

||Policyholder surplus

The industry’s surplus was up 1.4% in Q1 2014, says A.M. Best,down from Q1 2013’s pace of 3.3%. Still, surplus stands at a record$671.8 billion.

|A.M. Best says, “The industry’s overall capital position remainsstrong. However, the potential re-emergence of catastrophes as asignificant driver of losses, the slowing of rate increases andreports of increasingly competitive conditions could presentsignificant challenges to sustained underwriting profitability asthe year progresses.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.