Black boxes for cars and now in homes?

|Smart devices—and their associated telematics applications—aretechnologically advancing at breakneck speed, and their use helpsinsurers create statistically accurate risk profiles.

|Event data recorders (EDRs), also known as "black boxes," recorddriver behavior information including speed, seat belt use, andsteering and braking factors. After Sept. 1, EDRs will be mandatoryin all new vehicles.

|Instead of carriers pricing risk purely on probability, smartdevices allow insurers to access actual client data to personalizerisk. J. Robert Hunter, director of insurance for the ConsumerFederation of America, says that telematics usage defies trends"toward using risk factors in pricing that are not risk-related,like credit score and other factors that drive up prices on poorpeople, not risky people."

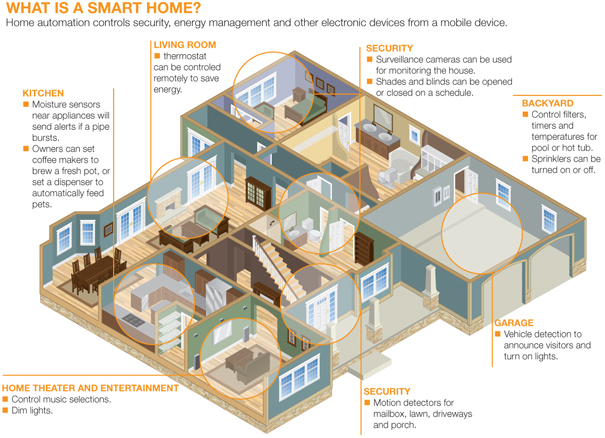

|The result has been personalized policies including usage-based,pay-as-you-drive and pay-how-you-drive—and now, telematics ispenetrating the home insurance market.

|Some insurers already have entered this arena, decreasingpremiums for so-called "smart homes." At the end of 2013, StateFarm and ADT partnered to provide the home security company'shome-monitoring technology, ADT Pulse, to State Farm policyholders.Signing up for the service provides discounted installation, lowermonthly service fees and more competitive insurance premiums.

|"Houses are getting smarter every day," says Rebecca Galovich,assistant vice president of reinsurance underwriting at HartfordSteam Boiler (HSB), "and tech is becoming more interconnected. Thatenables homeowners to have control over the environment of theirhomes, adjusting thermostats from outside of the home andcontrolling security systems."

|HSB, a division of Munich Re, partnered with EnergySavvy toprovide energy-use monitoring technology. HSB HomeWorks combineshome equipment breakdown coverage with online tools atmyhomeworks.com. Tools include home inventory catalogues, specificmaintenance tips, energy calculators and home management tips.

|Smart home technology is typically found in higher-end homes(with replacement values above $300,000) in which many of theelectrical systems are interconnected.

|The next generation of smart homes will serve a specific need:As the population ages, technology will allow more baby boomers tocontinue to live in their homes rather than moving to assisted-carefacilities. "We are seeing a lot of medical devices beinginstalled," Galovich says, that better connect providers topatients.

|Robert Large, VP of product development for Pacific SpecialtyInsurance, forsees a reduction in losses with smart homes. "Yourpolicyholder is becoming a better risk manager," he says. If anearthquake occurs, an evacuated smart-home owner can shut off gaslines remotely.

|Going further, the United Services Automobile Association (USAA)has a patent for a data device that records conditions that "haveled to damage or destruction of the building," or to "forecast thepossibility of future damage or destruction."

|The patent says data including temperature, wind speed andhumidity will be recorded. It stipulates that decisions regardinginsurance claims, underwriting, reinsurance and alerts may be madebased on data analysis.

|Although Hunter supports telematics usage, he is suspiciousabout its use. "Why is a home's temperature a measure of risk? Willrates go up if a person keeps the heat low in winter and high insummer to save money? If so, that factor is not measuring risk butwould be a way to, once again, raise prices on the poor," hesays.

|"Full transparency on everything a device measures and how thatinformation is used should be required by regulators beforeallowing use of these devices," Hunter continues. "People shoulddemand the same prior to agreeing to have the devices put intotheir cars or homes."

|HSB's myhomeworks.com collects all information the homeowneradds in the registration process. "We capture information about thehouse such as age and type of roof as well as data used tocalculate energy efficiency score. The data we collect is availableto our client companies and may be helpful in identifying trendsimpacting underwriting profitability," Galovich says.

|Insurance companies are subject to specific state privacy lawsregarding what information can be collected and its use.

|Intensified Competition Ahead

|Home insurance and property insurance will become morecompetitive in the coming years, Large says. What's driving thistrend are large auto carriers who also write home insurance: Ifthey write two policies with the same customer, their retentionrates remain high.

|And the homeowners' market is profitable—even more so than auto,according to Aon Benfield Analytics' annual review of homeowners' ratechanges. The report states that homeowners' insurancecumulative growth over the last three years has been 15%, comparedto 6.5% for auto.

|Large identifies two reasons why: low catastrophes last year andan increase in customer shopping. "You will see some of the bignational brands that are primarily auto companies start to focus onhomeowners because their customers are starting to switchcarriers," he says.

|Price reductions will not happen in the homeowners market thisyear, Large predicts. Homeowner insurers have had to steadilyincrease rates to maintain profitability, but rates increases areheld in check by customer retention.

|Agents and brokers who want to enter the homeowners' marketshould build upon an existing sophisticated auto insurance market,Large says. And for independent agents, those markets don't have tobe tied to the same carrier: "A lot of customers feel like theyhave to package home and auto with the same company—but theircompany is their agent."

|

Renters' Insurance: More than Condos

|More and more Americans are forgoing home ownership, andtherefore, more customers requiring renters' insurance are thosewho rent houses—as opposed to renting apartments or condos. Theseclients have larger amounts of personal property and greaterliability, says Renee Scott, product manager for American Modern inCincinnati.

|"We have seen lease agreements that specifically staterequirements for how much liability insurance someone has to carryto rent the home," she notes. Liability for home renters istypically in the $100,000 to $200,000 range.

|Rental homes are found in areas where there are a lot offoreclosures, specifically around Las Vegas, major metropolitanareas and in some parts of California. When these homes foreclose,investment companies and large LLCs can purchase up to hundreds ofthem and rent them out. The investment companies use these leaseagreements to mitigate their commercial liability deductibles.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.