Back in 1879, Gilbert and Sullivan created an amusing characternamed Major-General Stanley in the light opera "The Pirates ofPenzance." He enters singing a song satirizing the idea of the"modern" educated British Army officer of the latter 19thcentury:

|"I am the very model of a modernmajor-general, I've information vegetable, animal, and mineral… I'mvery well acquainted, too, with matters mathematical; I understandequations, both the simple and quadratical; about binomial theoremI'm teeming with a lot o' news; with many cheerful facts about thesquare of the hypotenuse."

|Today, near the start of the 21st century (and without tongueplanted in cheek), insurers seek the qualities of themodel modern major-general to develop predictive modelingexpertise. With access to "information vegetable, animal andmineral" and ever-advancing knowledge of "matters mathematical,"carriers have available the tools to become business leaders.

|Yet some companies have advanced farther than others, which begsseveral questions:

- Who successfully uses predictiveanalytics?

- What resources enable their efforts?

- Where do carriers use predictive modeling in pricing, marketingand claims?

- When is it time to deploy or rebuild models?

- Why do carriers use predictive analytics?

- How do carriers build models?

To assess the current state of predictive analytics at insurancecompanies, Earnix, a provider of integrated pricing and customeranalytics solutions for banking and insurance, and ISO, a source ofinformation about property/casualty insurance risk, completed ajoint industry survey titled, "2013Insurance Predictive Modeling Survey."

|With the objective of helping insurers learn from the experienceof their counterparts, Earnix and ISO conducted the survey touncover how predictive modeling and analytics are used throughoutthe industry. Responses were collected online from 269 insuranceprofessionals representing companies that sell personal andcommercial coverage in Canada and the United States.

|Responses confirm that the industry recognizes thevalue of predictive analytics but still faces challenges. Datainefficiencies, scarcity of analytic talent and the cost of thattalent can hold companies back from completing as many initiativesas they would like. And smaller carriers often have significantlyfewer resources to dedicate to modeling. However, carrierscan adopt innovative predictive modeling analytics toolsto make better business decisions.

|The survey responses also serve to answer the six questionsraised previously with statistics derived from the experience ofcarriers in the predictive analytics trenches.

|Who successfully uses predictiveanalytics?

The survey results reveal widespread useof predictive analytics in the insurance industry, with as many as82% of respondents currently using predictive modeling in one ormore lines of business, including personal auto (49%), homeowners(37%), commercial auto (32%), and commercial property (30%).According to survey respondents, predictive analytics enablesinsurance companies to drive profitability (85%), reduce risk(55%), grow revenue (52%), and improve operational efficiency(39%).

While the use of predictive analytics is pervasive throughoutthe insurance industry, larger insurance companies are more likelyto make use of predictive modeling than smaller ones. In fact, allthe respondents from companies that write more than $1 billion inpersonal insurance use predictive modeling, compared with 69% ofthe smaller companies that took part in the survey (writing lessthan $1 billion in personal insurance).

|Put in perspective: The high usage rates implythat insurers recognize predictive analytics as a critical tool forimproving their top line growth and profitability and managingrisk. In short, predictive analytics is important tocreating competitive advantage and increasing market share.

|The difference in usage rates between smaller and largercarriers is due to at least a couple of reasons. First, manysmaller insurers compete on serving specialized markets better thanthe large carriers, and that strategy may require a minimalreliance on advanced analytics. And more important, there's adefinite advantage to scale in developing and implementingpredictive analytic solutions. Larger insurers have large stores ofhistorical data that can make predictive analytics more effective,and they can spread the cost of an in-house predictive analyticseffort over a larger book of business.

||

Next page: What resources enable theirefforts?

|What resources enable their efforts?

Allthe large companies have resources dedicated to predictivemodeling. In companies with more than $1 billion GWP, 63% have ateam of more than 10 people, and 22% have a team of 5 to 10 people.Sixty-five percent of the companies with less than $1 billion GWPhave one to four people dedicated to predictive modeling, and 9%have no resources dedicated to predictive modeling.

Ninety-one percent of survey respondents use external data tosupplement their company's data. Of the companies that use externaldata, the vast majority (80%) use insurance score or raw creditattributes. Sixty-seven percent use geo-demographical data, and 53%use competitive pricing data. Catastrophe models data and weatherdata were also mentioned by 46% and 42% of the respondentsrespectively.

|Put in perspective: Again, theresponses to this question are reflective of the advantages ofscale when developing an in-house analytic capability. A modelingteam of more than ten people would represent a multimillion-dollarinvestment in analytics annually for an insurer. Larger companiescan spread the cost over a greater number of policies and also reapthe rewards of applying analytics to a greater number of policies,making this a high ROI proposition.

|However, even large insurers are not self-sufficient when itcomes to predictive data. The survey indicates that nearly allcompanies using predictive analytics must go outside the company toacquire additional data elements for their predictive analyticsprograms.

||

Next page: Where do carriers use predictive modelingin pricing, marketing and claims?

|Where do carriers use predictivemodeling in pricing, marketing and claims?

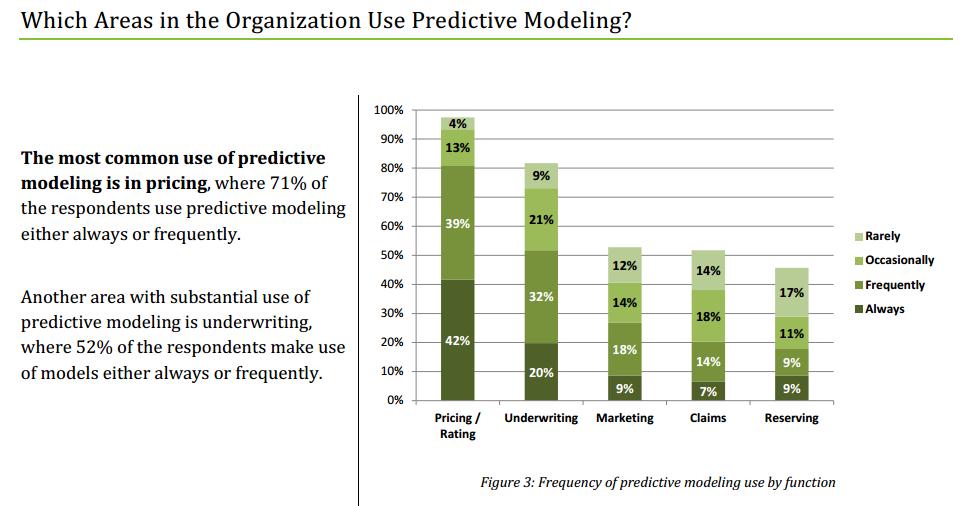

The mostcommon use of predictive modeling is in pricing, where 81% of therespondents use predictive modeling either always or frequently.Another area with substantial use is underwriting, with 52% ofrespondents using models either always or frequently.

(Source: Earnix Inc. and ISO, 2013)

|The two areas that make predominant use of predictive analyticsin pricing are loss cost modeling (75% of those that use modelingin pricing) and tiering (70%). Twenty-seven percent of therespondents use predictive analytics for demand modeling.

|Risk selection is the primary use of predictive modeling inunderwriting, mentioned by over three-quarters (78%) of those thatuse predictive modeling in underwriting. Fifty-two percent of theserespondents use predictive modeling to trigger for additionalunderwriting information, 33% for company selection, and 16% forproduct selection.

|Close to two-thirds (64%) of the companies that use predictivemodeling in marketing use it for target marketing. Other fields ofmarketing where predictive models are applied include customerretention (44%), cross-sell (32%), agent performance (28%) and leadgeneration (26%).

|Fraud investigation is how half of the companies surveyed usepredictive modeling in claims. Forty-four percent of therespondents use predictive modeling in claim loss forecasting and36 percent in claims triaging.

|Put in perspective: Pricing andmarketing of personal auto policies is where predictive analyticsgot its initial foothold in the P&C industry, and the surveyindicates that is still where much of the emphasis remains. Thatmakes sense because personal lines auto is where a large share ofP&C money is, and it's a very price competitive marketplace, soeven minute gains in pricing accuracy can yield big advantages.

|But the survey also reflects the trend of applying successfulanalytic programs to other lines of business and even otherfunctions. While the dollars may be smaller than in personal auto,other lines of business may offer more opportunity to create acompetitive advantage.

||

Next page: When is it time to deploy orrebuild models?

|When is it time to deploy or rebuildmodels?

While some respondents take two to threemonths (22 percent) or less (10 percent) to deploy new predictivemodels, as many as 55 percent take more than four months to deploynew models.

Companies that are quicker to deploy new models take advantageof these capabilities with higher frequency of re-estimating andbuilding new models. For example, 53 percent of the companies thattake less than one month to deploy new models update their modelsonce a quarter or more frequently, while the majority of companiesthat take longer only update their models once a year or lessfrequently.

|Put in perspective: The survey responses painta picture of a surprising level of inefficiency in some carriers'predictive analytics operations, with most requiring more than fourmonths to deploy a model. Decreasing the cycle time ofnew data to new insights to new competitive advantage is criticalto realizing the potential of a predictive analytics program. Thatcould be an opportunity for smaller carriers, which are presumablyless bureaucratic and more nimble, to outclass their largercompetitors.

||

Next page: Why do carriers use predictiveanalytics?

|Why do carriers use predictiveanalytics?

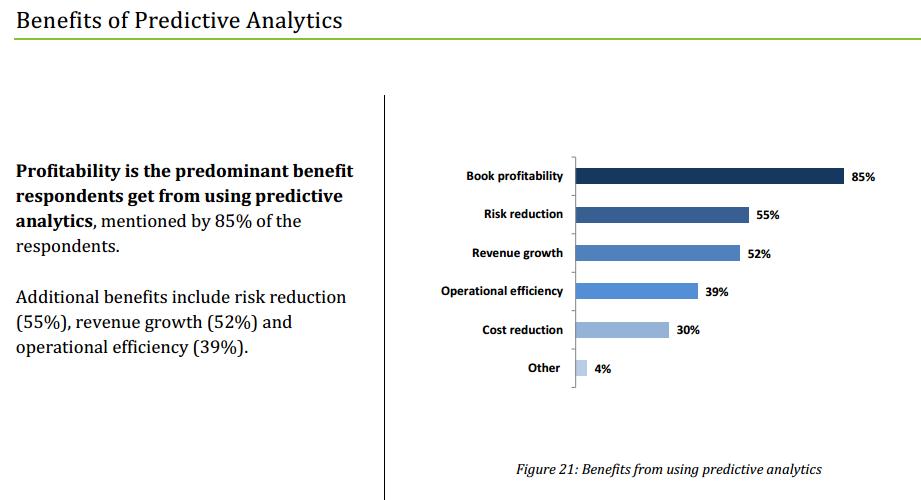

Profitability is the predominant benefitrespondents get from using predictive analytics, mentioned by 85%of the respondents. Additional benefits include risk reduction(55%), revenue growth (52%) and operational efficiency (39%)

(Source: Earnix Inc. and ISO, 2013)

|When asked to rate the top three changes in their workingenvironment in the past three to five years, respondents pointedout to the following changes (in order of frequency): Do more withfewer resources; more pressure for speed to market; new modelingtechniques. Obviously such changes drive the need for predictiveanalytics expertise.

|Put in perspective: Speed, efficiency,effectiveness, profitability, growth–those desirable qualitiesoften contradict each other and create a management challenge forinsurers trying to institute an effective predictive modelingprogram. Again, there would appear to be an opportunity for smallerinsurers to maximize their advantages (for example, agility) whileleveraging industry models to make up for some of theirdisadvantages due to lack of scale.

||

Next page: How do carriers buildmodels?

|How do carriers buildmodels?

Close to half of the respondents use eitherSAS (47%) or Excel (44%) to build models. Other statisticalsoftware used to build models include: R (25%), domain-specificmodeling software (12%) and SPSS (6%).

Close to three quarters of the respondents (74%) use GLM/GAM intheir model building process. Other algorithms used in the modelbuilding process include: regression/classification trees (47%),clustering (34%), principal component analysis / Factor analysis(25%) and text mining (16%).

|Thirty-six percent of the respondents find using additional dataattributes as the most promising avenue to increase the power andquality of the models they built today. Better modelingalgorithms/approaches (19%), additional skilled modelers (18%),more efficient modeling software tools (13%) and more efficientextraction tools (10%) are also seen as ways to increase the powerand quality of models.

|On the flip side, more than half (53%) of therespondents mentioned lack of sufficient data as theirorganization's top modeling challenge. Other challenges include notenough skilled modelers (47%), need for additional computingresources (31%), and need for better modeling tools (23%).

|Lack of know-how/technical expertise and cost are the biggestobstacles mentioned by 42% of the survey respondents. Culture andmanaging change were mentioned by 16% and 15% of the respondents,respectively.

|Put in perspective: Although this survey is asnapshot in time, it supports trends shown in other studies thatshow use of the open-source software R gaining momentum andchallenging the dominance of the large commercial softwarepackages. It seems that the segment of domain-specific modelingsoftware, such as pricing software, is also growing.

|As for the algorithms used, their popularity is reflective ofthe types of analysis being done. For example, GLM/GAM aretypically used in pricing models, clustering and principalcomponents are common methods used in marketing analysis, and textmining is often used to analyze claims and underwriting notes.

|And the respondents are expressing the historic concerns of datamodelers everywhere—the need for more and better data and thepeople to analyze it.

|Looking ahead, according to the survey respondents, personalauto and homeowners will be the focus of new predictive modelinginitiatives the in next two to three years (49% each). Commercialauto (37%), commercial property (37%) and businessowners (24%) werealso mentioned.

|The two functional areas at the focus of predictive modelinginitiatives in the next two to three years are pricing andunderwriting, cited by 79% and 71% of the respondentsrespectively.

|With these results in mind, the overriding lesson learned fromthe survey—and, for that matter, from the world of opera as well—isperhaps the following: The major-general song from the19th century operetta is one of the most difficultpatter songs to perform, due to the fast pace and tongue-twistingnature of the lyrics. Similarly, successful predictive modelingtakes skill and agility due to its fast-paced evolution and oftenmind-bending scientific approach. Nevertheless, as shown by thesurvey, carriers that are "model" modelers can become models ofexcellence.

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.