In a new study analyzing the average annualpremiums for the 125 biggest cities in the U.S., financial advisorsite NerdWallet determined the least expensive cities for autoinsurance.

|Related: See the study'sanalysis on the Most Expensive Cities.

|To find the average annual premium in all these cities,NerdWallet found the average car insurance rates in thenation's largest cities using the profile of a 26-year-old malewith no history of accidents, insuring a 2012 Toyota Camrywith extended coverage.

|Favorable weather conditions, low road congestion, expansivepublic transportation systems and high employment rates were allcited as contributing factors to why the following 10 cities hadthe lowest average annual premiums for auto insurance.

|Click “next” to see the least expensive cities. Click here tosee the

|| 10. Montgomery, Ala.

10. Montgomery, Ala.

Average annual premium: $1,375.82

|Montgomery is the home of Maxwell Air Force Base and many othergovernment agencies. Many insurance companies offer militarydiscounts, the study says, which can affect the low averagepremiums in this capital city.

|| 9. Spokane, Wash.

9. Spokane, Wash.

Average annual premium: $1,307.68

|High-risk drivers in Washington are encouraged to enroll in theWashington Automobile Insurance Plan (WAIP), which allows insurancecompanies to share the risk of high-risk drivers, according to thestudy. Through WAIP, high-risk drivers can purchase insurance.

|(AP Photo/Luke Davis)

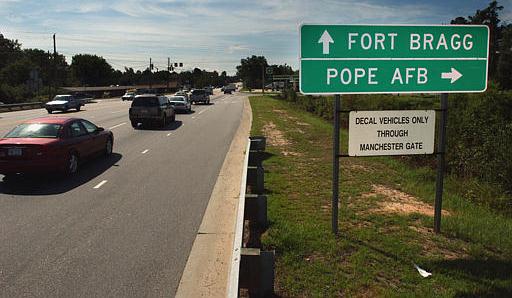

|| 8. Fayetteville, N.C.

8. Fayetteville, N.C.

Average annual premium: $1,294.80

|Like Montgomery, Fayetteville is home to a major militaryinstallation: Fort Bragg, which is the main economic driver in thecity, the study notes. In addition to many of its citizensreceiving military discounts, Fayetteville also benefits fromN.C.'s Safe Driver Incentive Plan, which promotes safe driving byincreasing insurance costs for unsafe drivers. As an example, amoving violation will increase a driver's premium by 30%.

|(AP Photo/Jeffrey A. Camarati)

|| 7. Rochester, N.Y.

7. Rochester, N.Y.

Average annual premium: $1,249.26

|Rochester is home to large companies such as Bausch and Lomb,which helps to keep employment levels at reasonable rates andallows drivers to afford insurance, says the study. Large numbersof uninsured drivers can increase a city's average car insurancepremium. However, N.Y. has the New York Automobile Insurance Planto help high-risk drivers find insurance.

|(AP Photo/David Duprey)

|| 6. Boise, Idaho

6. Boise, Idaho

Average annual premium: $1,221.65

|Boise has a low crime rate and lack of auto congestion, whichhelps keep its car insurance rates low, according to the study. Theaverage commute time is 20 minutes, which is lower than thenational average. The city has a 5.9% unemployment rate, thanks tocompanies such as Albertsons and Bodybuilding.com, which helps keepthe average premium low.

|A farmer's market in Boise. (AP Photo/Boise Parks &Recreation, Bill Grange)

|| 5. Charlotte, N.C.

5. Charlotte, N.C.

Average annual premium: $1,123.09

|Charlotte normally has good weather—averaging around just sixinches of snow per year—which contributes to the city's low carinsurance rates, the studay says.

|A Lynx train travels toward downtown in Charlotte, N.C. (APPhoto/Chuck Burton)

|| 4. Durham, N.C.

4. Durham, N.C.

Average annual premium: $1,100.50

|Durham is part of N.C.'s Research Triangle. Home to DukeUniversity and North Carolina Central University, many commuters inthe city can take Triangle Transit, a commuter bus that helpsalleviate the area's congestion, states the study.

|| 3. Raleigh, N.C.

3. Raleigh, N.C.

Average annual premium: $1,098.48

|Raleigh is also part of The Triangle, being home to NorthCarolina State University. The University runs its own bus line inaddition to the city's extensive public transportation system.

|(AP Photo/Allen G. Breed)

|| 2. Greensboro, N.C.

2. Greensboro, N.C.

Average annual premium: $1,089.58

|Greensboro is a city in the Piedmont Triad, an area known forits contributions to culture and education. Greensboro is atransportation hub. It is the home of the Piedmont TriadInternational Airport, and has Amtrak trains that connect to othermajor U.S. cities. The city also benefits from state policies aimedat curbing insurance fraud.

|| 1. Winston-Salem, N.C.

1. Winston-Salem, N.C.

Average annual premium: $969.10

|The least expensive city for auto insurance is also part of thePiedmont Triad. Winston-Salem is a hub for transportation andmanufacturing, being home to Wake Forest University and R.J.Reynolds Tobacco Company, which employs many residents. Largenumbers of uninsured drivers can increase car insurance rates forall drivers. North Carolina has one of the lowest rates ofuninsured motorists in the country, at just 8%.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.