Despite growing concern about risks, private companies largelyreport wide gaps in coverage and lack of understanding aboutprofessional and management liability insurance, according toChubb's 2013 Private Company Risk Survey.

|The survey polled 450 decision makers for U.S. private companiesto ascertain concern about corporate risks, uncover risk-mitigationstrategies and identify the prevalence of insurance ownership.

|In the past three years since Chubb last conducted its survey,44% of private companies experienced at least one loss eventrelated to directors and officers (D&O) liability, employmentpractices liability (EPL), fiduciary liability, employee fraud,workplace violence or cyber liability.

|Large companies are especially susceptible to losses, withtwo-thirds of companies employing more than 250 staff membershaving experienced a loss since 2010, compared to a third ofcompanies with up to 50 employees. However, smaller companies areless likely to recover from a major loss event, Chubb says.

|Click next to see how effectively private companies recognizeand manage the biggest risks they face.

|(All graphics on the following pages are fromChubb)

||Private Company Misconception: GL Covers Everything

While private companies do express concerns regardingcorporate risk, many are not adequately protected by insurance. This may be due to misconceptions surrounding whatgeneral-liability insurance covers and what it does not.

While private companies do express concerns regardingcorporate risk, many are not adequately protected by insurance. This may be due to misconceptions surrounding whatgeneral-liability insurance covers and what it does not.

Over 50% of private-company decision makers responding toChubb's survey do not purchase directors & officers liabilitycoverage, EPLI, errors & omissions liability coverage andfiduciary liability insurance because they believe the associatedrisks are covered under a GL policy.

|Chubb explains that GL covers incidents such as legal liabilityfor claims involving bodily injury, property damage, advertisinginjury or personal injury; defense expenses for suits filed againstthe insured; cases of infringement upon another's copyrightedadvertisement or registered trademark; publication of materian thatviolates a person's privacy or libels or slanders a person ororganization; and personal injury.

|Chubb notes that GL, however, does not cover financial injuryfrom actual or alleged wrongdoings of a company's directors andofficers; employment-related discrimination, harassment orretaliation; breach of fiduciary duty imposed by ERISA for anemployee benefit fiduciary-liability claim; financial injury thatmay be insured by professional liability or product or serviceE&O liability policies; first-party expenses resulting from aprivacy-data breach.

||Employee Fraud Exposures

Smaller companies face a greater threat from employeefraud, Chubb says citing data from the Association of CertifiedFraud Examiners. But just 30% of executives at small companies(<$5 million in revenue) say they are concerned about this risk,compared to 56% of executives at large companies (>$25 millionin revenue).

Smaller companies face a greater threat from employeefraud, Chubb says citing data from the Association of CertifiedFraud Examiners. But just 30% of executives at small companies(<$5 million in revenue) say they are concerned about this risk,compared to 56% of executives at large companies (>$25 millionin revenue).

In total, only 23% of private companies purchase crimeinsurance, including 47% of large companies and 17% of smallcompanies.

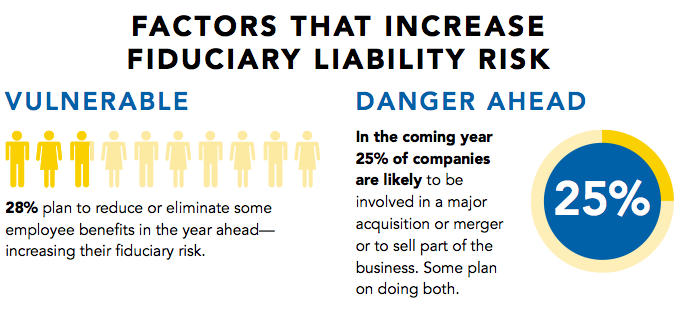

|Chubb says 25% of private companies are likely to be involved ina major acquisition or merger, or sell part of their business. Thiscan increase the risk of theft if employees fell their jobs arejeopardized.

|1. ACFE

|

D&O Lawsuits: They Can Impact Private Companies Too

Many private-company decision makers mistakenly believe they areinsulated from directors and officers lawsuits because theircompany is not publicly traded. But Chubb says private companiescarry nearly as much risk as public companies, and lawsuits cancome from sources such as vendors, competitors, regulators andemployees.

|D&O lawsuits, says Chubb, can be costly as well, with theaverage coast reported to the Private Company Risk Survey beingnearly $700,000.

|As noted earlier, decision makers also mistakenly believe thatD&O risks are covered under a GL policy. Tony Galban, globalD&O product manager at Chubb, explains, “Let's say you make adrug which causes harm to people and that has to be recalled andtaken off the shelf. The coverage that pays for the harm to thepeople would be GL insurance. The loss of monetary and reputationalvalue of the company because of the recall would be addressed by aD&O liability policy.”

|

Fiduciary Liability: The Unseen Risk

Three quarters of private companies use outside serviceproviders for employee benefit plans, but only a quarter purchasefiduciary liability insurance to insure managers who select andhire these service providers.

|Just 26% of respondents purchased fiduciary-liability insurance;72% of the non-buyers either believe the exposure is covered undertheir GL policy (51%) or don't know if it is covered under their GLpolicy (21%).

|Chubb says companies may also not realize the potential exposurefor their fiduciaries, or may be “confusing fiduciary-liabilityinsurance with fiduciary-bond insurance—required by law—thatprotects the plan assets but not the fiduciaries.” Chubb saysfiduciary liability “appears to be one of the most poorlyunderstood of private-company risks.

|

Employment-Related Risks

All companies, even the best-run ones, are vulnerable to EPLcharges because they engage in normal employment-related activitiessuch as hiring, firing and promotions, Chubb says. Charges such asdiscrimination, sexual harassment, retaliation (the most commoncharge) and bullying may be brought by past, present or prospectiveemployees.

|Michael Schraer, global EPL product manager at Chubb, points outan emerging factor in EPL events: “We're seeing social media becomemore of an issue in employment during the hiring process, where theclaimant comes in with emails, Facebook postings and all kinds ofsocial-media-related evidence that can prove that [discriminationby the company] actually happened.”

|Despite the risks, Chubb says only 30% of respondents purchaseEPLI. Part of the reason, again, is that 60% believe their GLpolicy covers the risks.

|

E&O Risks: Even the Best Professionals Can Be Sued

The good news is that executives are more concerned aboutpotential E&O lawsuits than in the past, according to Chubb.Still, most do not purchase E&O insurance, and, in fact, only55% of companies that said they are contractually required to carrythe coverage actually purchased it.

The good news is that executives are more concerned aboutpotential E&O lawsuits than in the past, according to Chubb.Still, most do not purchase E&O insurance, and, in fact, only55% of companies that said they are contractually required to carrythe coverage actually purchased it.

Chubb notes that any company that performs a professionalservice for others can be held accountable for its actions. Chubbsays 49% of survey respondents fell into this category. Of thosecompanies, 37% reported being concerned about an E&O lawsuit,compared to only 12% in Chubb's 2010 survey.

|

Cyber Risk: High Concern; Low Insurance Takeup

| Former FBI Director Robert Mueller said in 2012, “Thereare only two types of companies: those that have been hacked, andthose that will be. Even that is merging into one category: thosethat have been hacked and will be again.”

Former FBI Director Robert Mueller said in 2012, “Thereare only two types of companies: those that have been hacked, andthose that will be. Even that is merging into one category: thosethat have been hacked and will be again.”

But hacking isn't the only cyber risk. Chubb notes that 59% ofbreaches involve human error or system problems. In fact, Chubbnotes that a breach might be as simple as a lost laptop.

|The Ponemon Institute in a 2013 study pointed out that theaverage cost of a cyber attack is $188 per compromised record.Despite the risks and the costs though, the vast majority ofcompanies surveyed by Chubb did not purchase cyber insurance, and57% say they do not have an incident-response plan. Chubb says anincident-response plan can reduce notification costs by up to $42per record.

|

Workplace Violence: No Employer Is Immune

There were 13,827 workplace homicides from 1992 to 2010, Chubbsays, and in 2009, 1,527 nonfatal violent crimes occurred every dayagainst persons 16 or older while at work.

|Chubb says concern among private-company decision makers isrising—29% of respondents versus 8% in 2010.

|The average total reported losses associated with workplaceviolence was $65,664, says Chubb.

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.