MarketScout CEO sees some struggling companies in themarketplace, which could spell additional rate increases forcommercial lines.

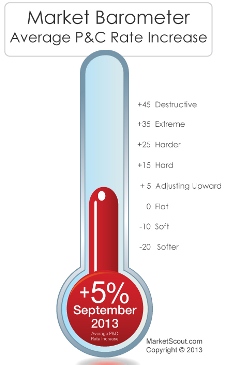

|The Dallas-based insurance exchange reports the composite ratewas up 5 percent in September compared to plus-4 percent inAugust—with commercial property and general liability up 6 percentduring September.

|“There are several medium-sized, publicly-traded insurancecompanies who are encountering challenges in their ongoing businessoperation,” says Kerr in a statement on market conditions. “Thesecompanies may be sold, restructured or placed into run-off unlessthey structure creative solutions to get them past their currentfinancial crisis.

|“Very capable, smart insurance executive lead each of thesefirm. It just goes to show how quickly things can go wrong if aninsurer experiences adverse loss development,” he continues, addingmore rate increases could be seen if additional insurers facedifficulties.

|No insurer was mentioned by name. An attempt to reach Kerr foradditional comment was no immediately successful.

|MarketScout's Market Barometer continues to show small accountsare paying slightly more than larger accounts. Accounts of up to$25,000 saw rates up 6 percent in September, but the increasetrickled downward with each larger account—5 percent for mediumaccounts, 3 percent for large accounts and 2 percent for jumboaccounts.

|By industry class, contracting saw rate increases of 6 percentlast month while habitational, transportation and service paid 5percent more.

|Personal Lines

|Personal lines rates were also up slightly in September comparedto August's 3 percent increase. MarketScout says the 4 percentcomposite increase in September was due to increases in 4 percentincreases in homeowners account under and over $1 million in value.Auto was also up 4 percent.

|Kerr says buyers of low-limit coverage can benefit from shoppingonline. “There are many options because this product isaggressively pursued by direct and agency markets,” he says.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.