The modest 2013 increases in employer-sponsored health-insurancepremiums have struck a favorable balance for both insurers andbuyers, as insurers enjoy some premium growth, but not at thedestructive levels seen in years past.

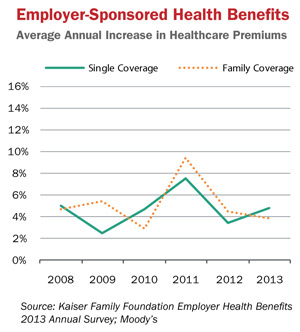

|Rates were up by about 5 percent for single coverage and 4percent for family coverage in 2013, according to the Kaiser FamilyFoundation/Health Research & Educational Trust (HRET) 2013Employer Health Benefits Survey.

|A Moody's analysis of the survey, written by Moody's Senior VicePresident Steve Zaharuk, cites three typical factors that influencehealth insurance premium growth: medical inflation, growth inmedical utilization and benefit inflation.

| In recent years, Moody's notes that lower medicalutilization and a trend toward reduced benefits offered byemployers have countered the impact of inflation and suppressedrate increases.

In recent years, Moody's notes that lower medicalutilization and a trend toward reduced benefits offered byemployers have countered the impact of inflation and suppressedrate increases.

In 2002, rates had increased by nearly 15 percent for singlecoverage and 13 percent for family coverage 2002. Since then,increases have generally moderated, a Kaiser chart shows.

|Since the Affordable Care Act was signed in 2010, Zaharuk notesin an interview that rates “bounced around a little bit,” butlately have moderated. Increases in 2012 were just under 4 percentfor single coverage and just over 4 percent for familycoverage.

|Zaharuk says it is a “very unsettled time” for gauginghealthcare costs. He says the recent reduced premium growth is apositive for buyers and the industry, but part of the cause behindthe trend is the economy. For example, he notes that businessesparing down plans lowers premiums, but also transfers moreout-of-pocket costs to consumers. This, in turn, helps lead tolower utilization, which also lowers premiums, but could mean thatpeople are simply putting off care as their share of costsclimb.

|The Moody's analysis states, “There is no clear data to explainthe reason for lower utilization, but it appears to be acombination of the poor economy, resulting in individuals foregoingor delaying healthcare, and lower benefits, which result in higherout-of-pocket costs to individuals.”

|But for now, the trends keeping premium growth in check havealso contributed to health insurers' positive earnings resultsthrough the first six months of the year, Moody's says in itsanalysis, adding that it expects continued strong earnings for theremainder of 2013.

|Beyond this year, though, Moody's says, “Unfortunately, wecannot expect similar premium, utilization and earnings results for2014 because of the uncertainty regarding major provisions of theAffordable Care Act (ACA) that will take effect next year, as wellas the prospects for an improved economy, which has historicallyled to increased medical care and costs.”

|Zaharuk says there is not enough data available yet to determinehow ACA provisions such as mandates for people to buy coverage willimpact rates.

|The Moody's analysis notes, “The Congressional Budget Officeprojects that of the 7 million it expects will obtain healthinsurance on the exchanges, approximately 4 million will come fromthe ranks of those currently uninsured. These individuals arelikely to have higher medical utilization in the first year ofcoverage. Similarly, the 9 million individuals the CBO projectswill obtain insurance coverage through the expansion of Medicaidare also likely to incur higher medical costs.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.