By Ben Page, principal, PageInsurance

|Agency producers talk about gaps in coverage–gaps thatmight cost clients a fortune if not properly handled. Butthere are also major gaps in technology found in most small tomid-sized agencies. Unfortunately, with these gaps,there's no chance for scooting by without a loss; there areguaranteed losses every year until they'refixed.

|It's no surprise that these gaps exist. A hundred yearsago, if a farmer traded in a horse for a tractor, everyone couldsee the progress and could work to keep up. Many of today'stechnologies are less visible–especially to many of the baby boomergeneration who comprise most agency management. Also, the sheervolume of technological tools makes it difficult to identify andemploy the right tools for the job.

|Read related: "3 TechTips to Eliminate Agency Time-Wasters."

|Here, in ascending order, are 10 of the most common andefficient fixes to agency technology gaps:

|

|

10. Online passwordmanagers. These are a huge timesaver. My favorite is LastPass (LastPass.com),which is very secure and eliminates the need for your staffers towaste time looking for passwords. It also gives you total controlover who has access to what.

|

9. Dual monitors. Use of dual monitorsis said to increase productivity by 10 percent, but from myexperience, I'd say it's more like 20 percent. Anyone whouses a computer to process, quote or work in multiple programsshould have dual monitors–and perhaps even three or four.

|Read related: "Agents ShareTheir 'Must-Have' Tech Tools ."

|

8. Webcams. These allow you and yourteam to meet with prospects, clients and coworkers in a way thateliminates the costs associated with in-person meetings whileretaining the face-to-face interaction that is proven to deepenhuman connections. They also allow for live and recordedcommunications.

||

7. Virtual meetings. Combining a service likeAnymeeting.com and webcamsenables agencies to facilitate meetings between remote locations. Afew years ago, we began holding our own agency meetings this way,allowing us to manage and facilitate them from anywhere in theworld. Depending on the circumstances, staff memberson vacation or sick leave could easily jump intothe meeting. It's also a great way to meet with clients andprospects.

|

6. VoIP phone systems. They're less expensivethan hard lines and more powerful. Of all the uniquefeatures you'll enjoy, having all of your agency's phone callsrecorded and stored is one of the best. This protects your agencyfrom E&O problems and is also is a wonderful tool for auditingand coaching your staff in their phone interactions–one of theprimary tools for improving sales and service.

|Read related: "Agency Technology- VoIP: Canyou see me now?"

|

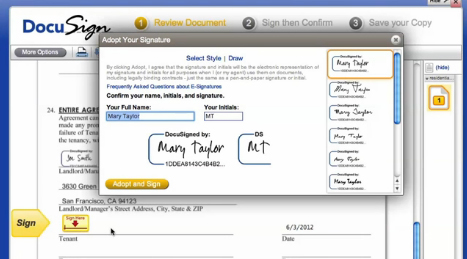

5. E-signature services. Weuse DocuSign to save time andhassle in collecting signatures. Check with your state andcarriers to see if this is allowable. You can convert any form intoa document that is then emailed and digitally signed with the useof any computer or smart phone. Clients will love it because itmakes everything easy. Many of our agents use this service to avoidprinting, signing and scanning their own signatures. It's a hugetime saver that also cuts down on the cost of paper and ink.

||

4. Personality profiles. Ifyou're Walmart, one bad hire is just a small percentage of youroverall workforce so you can easily absorb the loss. It's anotherstory for one bad hire at the average independent agency. One ofthe best tools I've found to avoid bad hires (and I've tried aboutall of them) is the personality profile. I was veryskeptical in the beginning but have learned the hard way over theyears that they are extremely useful. Omnia (OmniaGroup.net) offers freeprofiles to get an idea of how it works. They have also developedinsurance industry specific profiles to simplify the process.

|Read related: "The Art of theInterview."

|

3. Intranet. This is one ofthe more powerful tools an agency can use–a secure website forinternal purposes only, primarily informationmanagement.

|Although dozens of features can be built in, one of the mostuseful in our agency's intranet is the editable policies andprocedures system. Instead of paper manuals that are hard to keepupdated, our P&P (including detailed how-to instructions on allof the systems and tasks in the agency) can be edited by anyonewith access.

|Changes are forwarded to an administrator for review and finalapproval (in our case, the COO). This allows our P&Pto grow organically–similar to how Wikipedia works—while stillretaining final say from administration.

|Other features can include training materials, common forms,carrier information, internal message boards and links to commonlyused resources.

|The least expensive way we've found to create an intranet isthrough Google Sites, which does take a moderate amount of tech savvyto create, implement and manage. However, no programmingskills are necessary; you just need someone to can sit throughGoogle's training videos and put the time in to get it done.

|Read related: "HowInsurance Agencies Are Outsmarting the Economy."

||

2. Google Apps. This is a powerfulsuite of communication tools designed forbusinesses. About 5 years ago we switched from Microsoftto Google Apps, a move that saves us about $10,000 a year and hasmade everything easier. Google Apps can handle email, calendar,document storage, embeddable forms, online applications similar toMicrosoft Office, document collaboration, online meeting apps, andmore. Go to https://www.google.com/enterprise/apps/businessto learn more.

|Read related: "Top10 "Shadow IT" Apps Downloaded by Employees—and the RisksInvolved."

||

1. Sales system management. This isby far the most costly tech gap in small to mid-sizedagencies. Sales is a direct result of your sales system:improve your sales system and your sales improve. Everyproducer has a system, even if it's just sticky notes and a poormemory. Small improvements to your current systems canresult in immediate and big improvements inresults.

|A good system keeps all tasks and processes organized andprioritized automatically for every person in yourteam. Leads are not forgotten ormismanaged. Tasks and processes designed to increase leads(like referrals), increase conversion, and increase closings happenlike clockwork.

|CRMs are not comprehensive sales managementsystems. They are best at servicing existingpolicies. Use the CRM reports and other features as partof your sales system, but don't be afraid to use othertechnologies, such as Google forms, spreadsheets and other salespipeline managers to design, implement and manage everything inyour agency's pipeline.

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.