By Ben Page, principal, PageInsurance

|Agency producers talk about gaps in coverage–gaps thatmight cost clients a fortune if not properly handled. Butthere are also major gaps in technology found in most small tomid-sized agencies. Unfortunately, with these gaps, there's nochance for scooting by without a loss; there areguaranteed losses every year until they'refixed.

|It's no surprise that these gaps exist. A hundred yearsago, if a farmer traded in a horse for a tractor, everyone couldsee the progress and could work to keep up. Many of today'stechnologies are less visible–especially to many of the baby boomergeneration who comprise most agency management. Also, the sheervolume of technological tools makes it difficult to identify andemploy the right tools for the job.

|Read related: “3 TechTips to Eliminate Agency Time-Wasters.”

|Here, in ascending order, are 10 of the most common andefficient fixes to agency technology gaps:

|

10. Online password managers. Theseare a huge time saver. My favorite is LastPass (LastPass.com),which is very secure and eliminates the need for your staffers towaste time looking for passwords. It also gives you total controlover who has access to what.

|

9. Dual monitors. Use of dual monitors issaid to increase productivity by 10 percent, but from myexperience, I'd say it's more like 20 percent. Anyone who usesa computer to process, quote or work in multiple programs shouldhave dual monitors–and perhaps even three or four.

|Read related: “Agents ShareTheir 'Must-Have' Tech Tools .”

|

8. Webcams. These allow you and your teamto meet with prospects, clients and coworkers in a way thateliminates the costs associated with in-person meetings whileretaining the face-to-face interaction that is proven to deepenhuman connections. They also allow for live and recordedcommunications.

||

7. Virtual meetings. Combining a service likeAnymeeting.com and webcamsenables agencies to facilitate meetings between remote locations. Afew years ago, we began holding our own agency meetings this way,allowing us to manage and facilitate them from anywhere in theworld. Depending on the circumstances, staff memberson vacation or sick leave could easily jump into themeeting. It's also a great way to meet with clients and prospects.

|

6. VoIP phone systems. They're less expensivethan hard lines and more powerful. Of all the unique featuresyou'll enjoy, having all of your agency's phone calls recorded andstored is one of the best. This protects your agency from E&Oproblems and is also is a wonderful tool for auditing and coachingyour staff in their phone interactions–one of the primary tools forimproving sales and service.

|Read related: “Agency Technology- VoIP: Canyou see me now?“

|

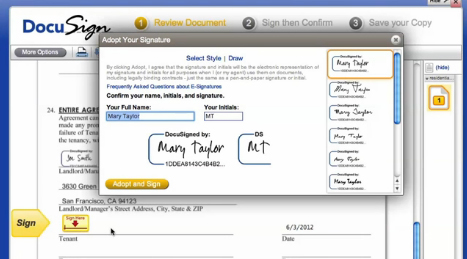

5. E-signature services. Weuse DocuSign tosave time and hassle in collecting signatures. Check with yourstate and carriers to see if this is allowable. You can convert anyform into a document that is then emailed and digitally signed withthe use of any computer or smart phone. Clients will love itbecause it makes everything easy. Many of our agents use thisservice to avoid printing, signing and scanning their ownsignatures. It's a huge time saver that also cuts down on the costof paper and ink.

||

4. Personality profiles. If you'reWalmart, one bad hire is just a small percentage of your overallworkforce so you can easily absorb the loss. It's another story forone bad hire at the average independent agency. One of the besttools I've found to avoid bad hires (and I've tried about all ofthem) is the personality profile. I was very skeptical in thebeginning but have learned the hard way over the years that theyare extremely useful. Omnia (OmniaGroup.net) offers freeprofiles to get an idea of how it works. They have also developedinsurance industry specific profiles to simplify the process.

|Read related: “The Art of theInterview.”

|

3. Intranet. This is one of themore powerful tools an agency can use–a secure website for internalpurposes only, primarily information management.

|Although dozens of features can be built in, one of the mostuseful in our agency's intranet is the editable policies andprocedures system. Instead of paper manuals that are hard to keepupdated, our P&P (including detailed how-to instructions on allof the systems and tasks in the agency) can be edited by anyonewith access.

|Changes are forwarded to an administrator for review and finalapproval (in our case, the COO). This allows our P&P togrow organically–similar to how Wikipedia works—while stillretaining final say from administration.

|Other features can include training materials, common forms,carrier information, internal message boards and links to commonlyused resources.

|The least expensive way we've found to create an intranet isthrough Google Sites, which does take a moderate amount of tech savvyto create, implement and manage. However, no programmingskills are necessary; you just need someone to can sit throughGoogle's training videos and put the time in to get it done.

|Read related: “HowInsurance Agencies Are Outsmarting the Economy.”

||

2. Google Apps. This is a powerful suiteof communication tools designed for businesses. About 5 yearsago we switched from Microsoft to Google Apps, a move that saves usabout $10,000 a year and has made everything easier. Google Appscan handle email, calendar, document storage, embeddable forms,online applications similar to Microsoft Office, documentcollaboration, online meeting apps, and more. Go to https://www.google.com/enterprise/apps/businessto learn more.

|Read related: “Top10 “Shadow IT” Apps Downloaded by Employees—and the RisksInvolved.”

||

1. Sales system management. This is byfar the most costly tech gap in small to mid-sizedagencies. Sales is a direct result of your sales system:improve your sales system and your sales improve. Everyproducer has a system, even if it's just sticky notes and a poormemory. Small improvements to your current systems can resultin immediate and big improvements in results.

|A good system keeps all tasks and processes organized andprioritized automatically for every person in your team. Leadsare not forgotten or mismanaged. Tasks and processes designedto increase leads (like referrals), increase conversion, andincrease closings happen like clockwork.

|CRMs are not comprehensive sales management systems. Theyare best at servicing existing policies. Use the CRM reportsand other features as part of your sales system, but don't beafraid to use other technologies, such as Google forms,spreadsheets and other sales pipeline managers to design, implementand manage everything in your agency's pipeline.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.