From the newest adjuster to the chief claims officer in aninsurance organization's home office, every claims professional haslikely wondered at one point or another, “What is the ideal claimscaseload?”

|That question still yields no quantitative answer. Those posingthe question seek hard numbers. An adjuster's caseload shouldpose a constructive challenge, causing a claims professional tostretch his or her capabilities without snapping. It is a veryrare adjuster who has time to twiddle thumbs. I mean,have you ever known a claims person who resembled theMaytag Repairman? However, caseloads should not induce adjusterdespair. If adjusters are drowning in files, then theyare reduced to putting out fires. Mistakeshappen. Deadlines slip. Policyholders and claimants getupset. Disputes and claims litigation increases. Stresslevels and blood pressures rise. Complaints and turnoverspikes.

|You get the idea. Properly managing and monitoring adjustercaseloads are key duties of office claimsmanagement. So, on what does the ideal adjustercaseload depend? Here are six factors:

|1. Case complexity and “texture.”

|Not all files are created equal. A complex business interruption(BI), time-element loss is not the same as a first-partyhomeowner's kitchen fire. Claims files are not fungible goods,where there is equivalence in terms of the amount of time andeffort they consume. A serious boiler and machinery loss may takemore time than, say, thirty “medical only” workers compensationfiles. We must look beyond the numbers and consider casecomplexity.

|A multi-vehicle auto-truck fatality on I-40 may be more complexthan a straightforward case of wrong-site surgery or the classicsponge-left-in-the-body case of res ipsa medicalmalpractice. One must look beyond—or ratherbeneath—the type of claim in order to assess thecomplexity. This means the number of moving parts, the issuespresented, the number of people to interview and locate, andso on. The number of witnesses the adjuster must locate is anotherfactor that renders it folly to say that one claim is equal toanother.

|Larry Wahnsiedler, a retired adjuster from Owensboro, Kentucky,says a reasonable caseload depends on claims severity. He averagedbetween 100 and 125 new files each month; performed his own autoand property inspections; and handled his own litigation. As tocaseload size, he fears that nowadays, “staffing is the leastconcern of management.”

Barry Zalma, an insurance coverage attorney and contributorto PC360, believes the ideal caseload depends on thetype of case, the adjuster's experience, and the time needed toresolve the claim. “The ideal is a caseload sufficient to keep theadjuster busy and able to do a complete and thorough investigationon each claim,” Zalma maintains.

|2. Line of Coverage.

|While each type of coverage and claim has nuances and quirks, afirst-party glass breakage loss to the family mini-van is not onpar with the time demands of a product liability claim against afarm combine that overturned, killing its operator.

|Sherri Handke, a claims manager at Columbia, Missouri-basedColumbia Insurance Group says the type of claim determines thehandling capabilities. She cites various other factors,including experience level, the technology available,individual skill-sets, and management expectations. Any one (eitherlacking or superior) of these can also make a huge difference inthe “ideal” adjuster caseload, she says.

|According to Handke, most companies she hasworked for have not set approximate caseload ceilings but didnonetheless monitor the number of claimsreceived compared to those open/closed. By now it shouldbe clear that mere stick counts, by themselves, can be misleadingin deciding the ideal caseload.

|3. Adjusterseasoning.

|Typically, more experienced adjusters can shoulder highercaseloads than newbies. As is the case in nearly all fields ofbusiness, experience often makes one more efficient.This brings us to the nextpoint.

|4. Adjuster efficiency.

|Sometimes efficiency does not always correlate with joblongevity. Some adjusters “get it” and catch onquicker. All other things being equal, an efficient adjusterwith 200 files might be as effective as a plodding adjuster with150 open claims. Determining the efficiency of a claims personis, admittedly, subjective. However, it is a factor impactingone's ability to comfortably shoulder a caseload.

|5. The degree of administrativesupport.

|Claims adjusters trudging across the office to do their ownphotocopying, typing, and file retrieval may be constrained in theamount of files that they can reasonably shoulder. Bycontrast, adjusters who can delegate clerical and administrativetasks can rev at higher RPMs. Put differently, the moreancillary/administrative support, the more claims an adjuster cancompetently shoulder.

|6. Servicestandards.

|Ironically, “best practices” and mandatory service standards canexacerbate quality problems if caseloads do not adjustdownward. Steve Breard, a litigation specialist with AmericanClaims Service in Houston, Texas, observes that newassignments in the 100 to 125 files-per-month range are commonin multi-line environments. “Things like 24-hour contact on newclaims, returning calls same day, and writing estimates over thephone for small claims are great customer service tools,” he says.These components of claims handling, while crucial, can alsodilute a rep's ability to control and work the caseload, an oftenignored fact.

|James Moon of Fort Myers, Florida-based Quintairos, Prieto, Wood& Boyer views case loads through multiple lenses, having workedas an adjuster and now as an attorney. Adjusters want enoughfiles to stay busy and meet deadlines, analyze cases and claimsraised, and so on. However, Moon notes, “the difficultycomes from a cost perspective when you maximize workloads with theleast staff and still try to maintain the same output.”

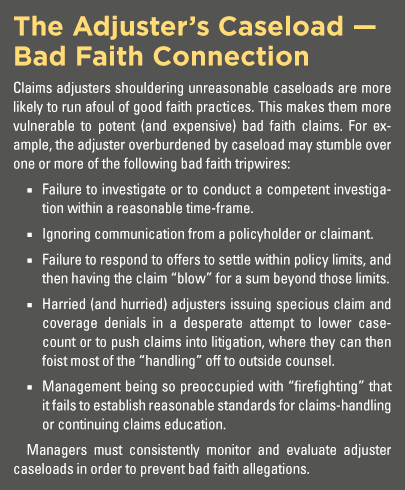

|Unfortunately, poor or penny-conscious management can causefatigue or adjuster burnout. Moreover, this management stylecan potentially cost insurance carriers millions in judgmentsbecause of poor decisions resulting from excessive workloads.

|Three Reasons for Realistic Caseloads

|Why is an adjuster's caseload important? There are atleast three reasons:

- File quality. The higherthe caseload, the greater chance that claims handling qualitydegrades. To stay atop caseloads, adjusters may cutcorners, omitting necessary steps to put out fires to avoidcrises.

- Staff morale. When adjustersfeel overburdened by unrealistic caseloads, they often havepoorer attitudes. This can impactwork performance and increase turnover. It exacts its owncosts in the form of lost productivity, the expense ofsearching for a replacement, the cost of training a successor, andso forth.

- Cost containment. When caseloads arehigh, so is the potential for “leakage.” The latter is a euphemismfor paying more (either in indemnity or expense) thanwarranted. Adjusters scrambling to stay on top of hugecaseloads and put out fires lack the time to thoughtfully run downleads, go the extra mile to locate the key witness or set upsurveillance.

Research and pursue subrogation opportunities? Who has timefor that? Simply put, overtaxed professionals are moreapt to take the path of least resistance, gloss over the“basics,” and throw money at claims just to whittle down thecaseload. Extrapolated over a large caseload times the numberof adjusters, this can produce sizable expense, hemorrhagingprofits and “opportunity costs” of economizing activitiesforegone.

|One mattress company advertises its ability to deliver a goodnight's sleep by asking, “What's your [sleep] number?” Claimsmanagers are unlikely to invite adjusters to name their number, butcalibrating the right size caseload to the right adjuster can yieldpeace of mind and better file outcomes.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.