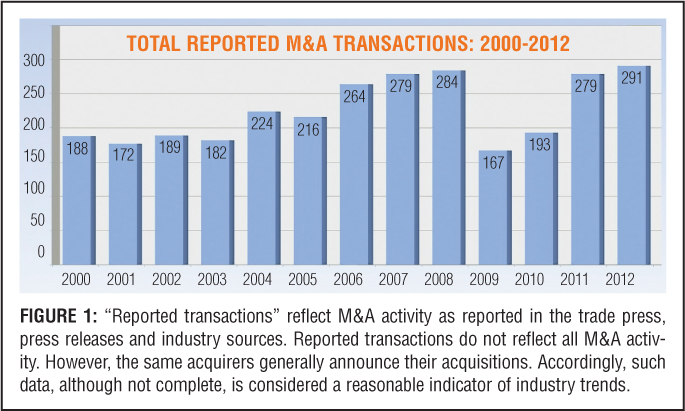

Agency and brokerage mergers & acquisitions have been on a steady upward climb since 2000, except for a blip in 2009 and 2010 due to the collapse of the economy. Those 2 down years were followed by a near blockbuster year in 2011, and the most active year since 2000 with 291 announced transactions in 2012 (see Figure 1).

A number of factors influenced the historical trend, some of which will influence M&A activity in the future.

The 2009 and 2010 down years were the direct result of the collapse of the economy and a prolonged soft property-casualty insurance market, which created a “perfect storm” event. Most buyers and sellers simply sat on the sidelines due to great uncertainty regarding the future.

The uptick in 2011 was due not only to a clearer, if still tentative future, but also to a buildup of sellers' inventory and a similar pent-up demand, particularly of the most active acquirers to get back into the M&A arena. The momentum of 2011 carried forward into 2012, which was largely influenced by the impending expiration of the Bush tax cuts and a new tax due to the Patient Protection and Affordable Care Act (ACA).

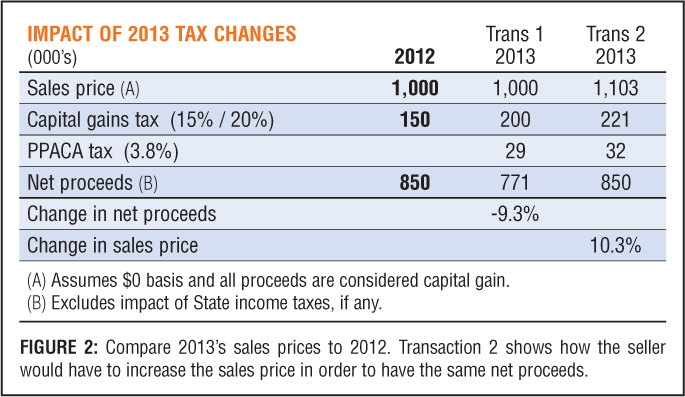

On Jan. 1, tax rates for capital gains transactions increased to 20 percent from 15 percent. In addition, the new surtax on non-wage income, including capital gains, of 3.8 percent for certain “high-income” taxpayers ($250,000 and higher for joint filers) as mandated by the ACA came into effect. Combined, these two create nearly a 60 percent increase in taxes that will be due on most agency sales (see Figure 2).

For sellers, the additional tax burden will reduce their take-home proceeds by more than 10 percent. From the buyer's perspective, the purchase price would need to be increased by approximately 11.5 percent for the seller to yield the same net proceeds. While the year is still young, we expect a temporary lull in acquisition activities as sellers digest the impact of these new taxes and try to grow through it. With the market continuing to firm and the economy still picking up steam, prospective sellers may be able to make up the difference in a year or two of solid growth.

Growing Gray

Another factor affecting both historical and future M&A activity is the aging agency principal population and the need to sell outside the agency to affect an exit. Numerous studies indicate that one-third of agency principals are age 55 and older—no surprise as the baby boomer generation continues to age. But the insurance industry has not been diligent in attracting young talent, which is creating an impending, if subtle, perpetuation crisis. One of the key underlying problems for many firms is simply the cost of recruiting, hiring and training new producer talent that will logically segue into future principals.

Many larger brokers have the capital and resources to recruit new talent with a structured development program to help them learn the trade and be mentored by experienced people in a sales-oriented culture. But even here, the number of successful hires often lag the aging of the firms' rainmakers. The situation is more difficult in the small- to mid-sized privately held firms, where relative costs are higher and support systems less structured. This can result in fewer successful hires, if the hires are even made.

Hiring a new producer who turns successful is one of the biggest challenges most agency principals face today. Hiring someone to become a potential perpetuation candidate is even more difficult. Principals certainly don't want to leave their agencies in the hands of a marginal producer, and it can be difficult to know if you have hired “the real deal” within the first year or two. With rare exceptions, agency principals should allow for a minimum of 10 years before someone might be ready to step into the role of principal and future leader.

Capitalize Organic Growth

Without viable candidates for an internal perpetuation sale, agency principals limit their options on how they can exit the business and capitalize their value. For many years into the foreseeable future, a steady stream of agencies will be in need of a sale. The unknown is the extent, if any; an oversupply of sell-side candidates may have in creating a buyer's market with a resultant downward pressure on value and pricing.

Generally speaking, publicly traded companies are expected to grow to increase their values or market capitalizations and provide positive returns for their shareholders. The same is true for the firms with significant private equity ownership. Growth can only come from two sources: organic or acquired. Growth also can come from rate or economic expansion, but more typically, contraction, as experienced a few years ago, leading to that great oxymoron, “negative organic growth.”

Broadly speaking, in periods of low organic growth or contraction, the need to acquire growth becomes more important. The “perfect storm” climate in 2009 and 2010 was so dramatic and uncertain that it created a major M&A retrenchment, contrary to the conventional wisdom of the push to acquire when organic growth is low.

The publicly traded brokers disclose their financial results, including organic growth, each quarter in the SEC public filings; this data is a reliable indicator of certain industry trends. Organic growth started to trend downward in 2007 due to the collapse of the economy and prolonged soft property-casualty market.

Figure 3 illustrates anecdotal data reported by the Council of Insurance Agents and Brokers (CIAB) and MarketScout showing property-casualty premium rates, and by parallel correlation commission revenue, declined 5 to 15 percent between 2007 and 2010. Accordingly, there is negative growth for three of the four referenced brokers in that time frame.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.