Editor's Note: The following article has been contributed byChristoph Meili, CEO, The Innovation Society, St.Gallen(Switzerland), an international consulting firm that advisesinsurers and regulators in risk-management and governance ofnanotechnology.

Nanomaterials are commonly used in manyindustrial and consumer products. Aside from their beneficialproperties, certain nanomaterials can also pose substantial risksto human health and the environment. Nanomaterials are implicitlycovered in insurance policies. Liability insurers should thereforecheck their portfolios and investigate whether and what kind ofnano-related risks are covered in their policies.

|At the same time, insurers must stay abreast of new scientificdata about potential risks of specific nanomaterials and regulatorydevelopments, which must be followed continuously. Unexpectedlosses in liability lines of business could be avoided, ifappropriate underwriting options are developed timely.

|Increasing Nano Product Sales

|From self-cleaning windows and scratch-resistant colors andlacquers, to transparent sunscreens, antimicrobial plastering,packaging materials and textiles, an array of nano products areavailable. There are a fast-growing number of industry and consumerproducts which contain nanomaterials (NM). According to theEuropean Commission, “nanomaterial” refers to a natural, incidentalor manufactured material containing particles, in an unbound stateor as an aggregate or as an agglomerate and where, for 50 percentor more of the particles in the number size distribution, one ormore external dimensions is in the size range of 1-100 nm (1 nm =10-9 m).” Compared to corresponding bulk materials, nanomaterialsoften show new physical and chemical properties. Therefore they areoften used in nanotechnologically improved products andapplications.

| For example, in Germany there are approximately 2,000companies and research organizations related to nanotechnology.Forty-four percent are small- and medium-sized enterprises (SME),while 41 percent are research organizations and university labs,and 15 percent are major companies. In 2011, there were 64,000workers involved in nanotechnologies and a turnover of 14.3 billioneuro was generated by German nano companies. Because of thecross-sectional character of nanotechnologies, the sales volumes ofnanomaterials and nanoproducts are increasing in all industries. Inthe color and lacquer industry, it is projected that by 2020already 20 percent of the total business sales are generated bynano-components—for example, smart coatings—as the above mentionedantimicrobial and scratch-resistant ingredients.

For example, in Germany there are approximately 2,000companies and research organizations related to nanotechnology.Forty-four percent are small- and medium-sized enterprises (SME),while 41 percent are research organizations and university labs,and 15 percent are major companies. In 2011, there were 64,000workers involved in nanotechnologies and a turnover of 14.3 billioneuro was generated by German nano companies. Because of thecross-sectional character of nanotechnologies, the sales volumes ofnanomaterials and nanoproducts are increasing in all industries. Inthe color and lacquer industry, it is projected that by 2020already 20 percent of the total business sales are generated bynano-components—for example, smart coatings—as the above mentionedantimicrobial and scratch-resistant ingredients.

The situation in other industries is similar. According tointernational forecasts, nanotechnologies will be a key factor inthe value creation of goods, with a market value of up to $3trillion by 2015. Their market potential in 2015 could correspondto approximately 15 percent of the whole industrial goods market. Alarge part of the global goods production, for example in the areasof health, information and communication technology, energy andenvironmental technology would be based on the application ofnanotechnology knowledge.

|An Unclear Risk Profile

|Nanomaterials have often been critically discussed in the pastfew years with regard to their potential adverse effects on humanhealth and the environment. Even though scientific risk research onnanomaterials has been undertaken for over 10 years, it is stillpremature to determine potential adverse effects on human healthand the environment in the mid- and longterm perspective. Inaddition to physical and chemical data, especially related toexposure, data is needed to address human and eco-toxicologicaleffects. Nanomaterials that are bound or embedded in a solid matrixpose a low or even negligible risk, according to many experts. Bycontrast, unbound, powdered or airborne particles could be inhaledand enter the bloodstream through the lungs. In the bloodstreamparticles can enter cells. Some particles have actually been foundin the nucleus and interacting with cellular structures.

|Carbon nanotubes (CNT), which are long,fiber-shaped nano molecules have been found to cause inflammationand asbestos-cancer-like malignant tumors in mice. Nanoparticlescan also enter the body through digestion. However, there arecomparatively few data on the behavior of nanomaterials in theintestinal tract that demonstrate that titaniumdioxidenanoparticles (commonly used in food) cause inflammatory reactionsand have genotoxic effects in cells of in the intestine. In theenvironment there are persistent and bioactive nanomaterials thatare critically examined. Today no final judgment of the potentialrisks of specific nanomaterials in the middle or longtermperspective is possible. A “long-tail” risk potential for certainnanomaterials, however, cannot be excluded.

|Potential Loss Exposure

|A recent study published by Gen Re demonstrates thatnanotechnologies pose potential risks to liability insurances dueto the enormous global use of nanomaterials in industry andconsumer products. According to Gen Re this could affect liabilityinsurances in the following liability lines of business:

- Comprehensive general liability (CGL)

- Product liability insurance

- Environmental liability insurance

- Product recall

- Workers' compensation

The increasing number of compensation claims, the complexity ofnanotechnologies and the unlimited passive legal protection forconsumers offered by liability insurance policies could easilycause tremendous costs to elaborate defense.

|In a position paper the Chief Risk-Officers Forum describesboth: the opportunities and the challenges which the insuranceindustry faces with nanotechnologies. Given the enormous economicpotential it seems vital for insurance companies not to bannanotechnologies from insurance policies. Exclusion ofnanotechnologies is no option. In fact, understanding the potentialrisks of nanomaterials and promoting risk awareness and riskmanagement among the insured companies seems to be crucial. Thus,long-term damages, as happened in the case of asbestos, could beavoided.

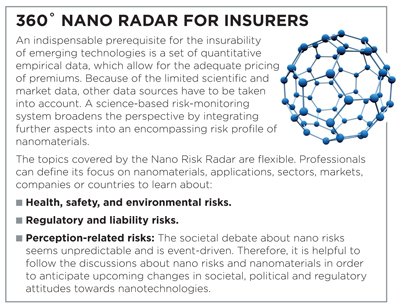

|Nevertheless, the Gen Re study states thattoday most insurance companies do not look into the matter of nanorisks at all. Furthermore, the current situation could be called a“waiting period” in the insurance industry. It is recommended thatthe insurance companies should rather anticipate the potentialdevelopments, monitor the ongoing risk research and internationalregulation with a systematic “Risk-Radar” (refer to the boxabove).

| No Nano Registry In Sight

No Nano Registry In Sight

Nanomaterials are regulated on national and internationallevels. In the European Union, for example, there are severalregulations applicable to nanomaterials. Most of the presentregulations on EU level and above do not refer explicitly tonanomaterials or nano-specific properties of the chemicals orproducts. Many critics and even authorities argue thatnanomaterials are not treated adequately in currentregulations.

|Today there is only one country in the world (France) which hasstarted a mandatory registry for nanomaterials. On the European andalso at the global level there is no official registry ofnanomaterials and nanoproducts available. A registry ofnanomaterials in the European Union has been discussed since 2008but has never been started. Therefore there is a growing lack ofinformation concerning the use and application of nanomaterials onthe market. There is a systematic shortage of data concerningnanomaterials along the value-chain. Downstream users often lackdata about nanomaterials which are used in their processes orproducts. Therefore it seems very difficult for insurance companiesto get nano-specific information and data from their insuredcustomers. Thus, liability insurers have to determine the riskprofiles in their portfolio with external data and expertise.

|In conclusion, liability insurers have to meet the challenges ofnanotechnologies. The uncertainties in the risk profile of certainnanomaterials can be handled by:

- Checking new and existing liability policies in the portfoliosfor hidden nano risks.

- Raising customer (external) and underwriter (internal)awareness of potential nano risks.

- Developing appropriate underwriting strategies withrisk-specific signing policies

- Continuous monitoring, based on the state-of-the-art of scienceand technology.

Thus, insurers can profit from booming nanotechnologies. Theycan price their nano policies adequately. On the other hand theycan avoid unforeseen late damages and losses through “long-tail”risks of nanomaterials.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.