Retail businesses are in the crosshairs ofhackers, according to a recent report from Trustwave, a provider ofon-demand data-security and payment-card compliance solutions tobusinesses.

Retail businesses are in the crosshairs ofhackers, according to a recent report from Trustwave, a provider ofon-demand data-security and payment-card compliance solutions tobusinesses.

Indeed, retail businesses—specifically the cardholderdata they possess—were the primary target of cybercriminals in2012, says Trustwave. About 45 percent of the company'sinvestigations were in the retail sector, followed by food andbeverage (24 percent), and hospitality (9 percent).

|“Cyber could very well be the largest part of the exposurepicture for these retail businesses,” says John O'Connor, vicepresident of strategic product & platform development forTravelers Small Commercial.

|What makes the retail industry so appealing to cyber thieves?The sheer volume of payment cards used in these industries makesthem obvious targets, says the Trustwave study. Stores also tend tobe relatively easy targets: The main focus of the organizationsoperating in these spaces is customer service, not datasecurity.

|Awareness among retailers of the exposures they face whenstoring customers' data and swiping their credit cards hasincreased significantly—and this, in turn, has led to a “tremendousuptick” in interest in Cyber Liability coverage, says DavidDerigiotis, assistant vice president of the special risk divisionat Burns & Wilcox.

|Frequent reports of costly and embarrassing breaches in themainstream media have helped fuel these inquiries frominsureds.

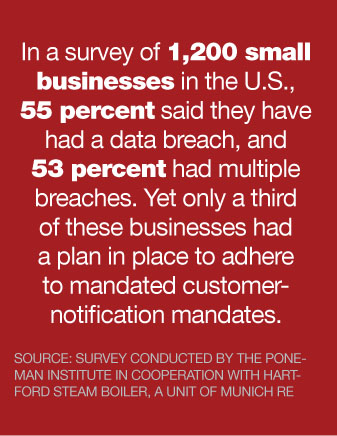

|“And many of these reported breaches are tied toretail,” Derigiotis notes. These retail businesses, big and small,are being targeted, “and many of the smaller business can't affordthe reputational damage or the massive costs related to customernotifications.”

|So the chance for carriers to provide insurance solutions andadd premium dollars—and for agents and brokers to aid their clientsand add to their own coffers—is enormous andundeniable.

|“There is a big opportunity here, with new business popping upeverywhere,” says Tim Streck, assistant vice president ofcommercial product at Nationwide Insurance. “Agents have the chancehere to forge some great relationships.”

|Lew Dryfoos is one of those producers on the front line, helpinghis clients evaluate and insure against their Cyber risks.

|“These are people I know; I frequent their businesses in town,”says Dryfoos, president of the Dryfoos Group of insurance agenciesin eastern Pennsylvania. “A data breach is one of those things theymight not think about—but it can shutter the doors if ithappens.

|“It is so expensive [without insurance coverage] to do the rightthing, and a lot of these businesses aren't the types that canabsorb these costs,” he adds.

|Luckily for business owners, the industry'sCyber Liability and Data Breach insurance offerings areextensive—and not expensive.

|Carriers are constantly innovating new Cyber products, andcompetition for business is fierce. Both of these facts are to thebenefit of buyers.

|“There are so many different carriers, with different tweaks incoverage—there are unbelievable deals to be had,” Derigiotissays.

|Small retail-business owners can obtain coverage for everythingfrom the costs of investigating a suspected data breach, to thecosts of recovering data, to payouts for customer notifications,attorney fees and liabilities from potentiallawsuits.

|Endorsements for additional services, such as public relationscosts, can be obtained as well.

|BIGGER BETTERBOP

|Another key trend in retail: The standard business owners'policy (BOP) isn't what it used to be: It's a lot better forinsureds.

|For years, a BOP was a highly generic form for low-hazardProperty and General Liability risks.

|But it has become a lot more robust in scope, driven by carriercompetition for small-business premiums and by a betterunderstanding of certain risks that were once limited to specialendorsements.

| “What we have found over the years is the BOPhas included more and more coverages,” says Dryfoos, athird-generation insurance agent.

“What we have found over the years is the BOPhas included more and more coverages,” says Dryfoos, athird-generation insurance agent.

Coverage for plate glass, for example, is now included. Otherrisks, such as Cyber and Business Interruption, once considered toocomplex for inclusion, are now wrapped up in the BOP—at least withmodest limit levels.

|Crime and theft, employee dishonesty, and equipment breakdowncan be found in the BOP as well. Look around and buyers can find aBOP product with some Inland Marine coverage for products intransit.

|And the ability to customize an account with the use ofendorsements—which are many times used now to increase limits ofcoverage currently available in the BOP (buying extra BusinessInterruption coverage to extend to dependent properties, forinstance)—has improved “quite a bit,” says Dryfoos.

|“There are so many ways to tailor the BOP product,”agrees Sandy Mullins, underwriting consultant for StateFarm.

|“This is no longer a one-size-fits-all venture,” adds BenediktSander, senior vice president of commercial insurance at LibertyMutual. “There are good products, more tailoring, with a lot offlexibility—and good deals.”

|In terms of Business Interruption protection in BOP, Mullinssays the industry has recognized its importance to the retailbusiness segment and has “come up with some amazing coverage toallow them to get back in business quickly.”

|Insurers have additionally recognized the seasonality of manyretail businesses. A bike shop is busiest in the spring. An icecream parlor does most of its business in the summer.

|To respond, the BOP has evolved to automatically increase limits(the percentage varies per carrier and can be increased viaendorsement) based on a business' peak season.

|“It makes sense to adjust the policy for these historicalpatterns,” says O'Connor of Travelers. “It gives these businesses abetter chance to withstand an event or accident.”

|Another example of a bigger, better BOP: Employment PracticesLiability insurance.

|“It used to not even exist [in the BOP],” says Dryfoos. “Now[carriers] put it right in automatically. Low levels, but it'ssomething.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.