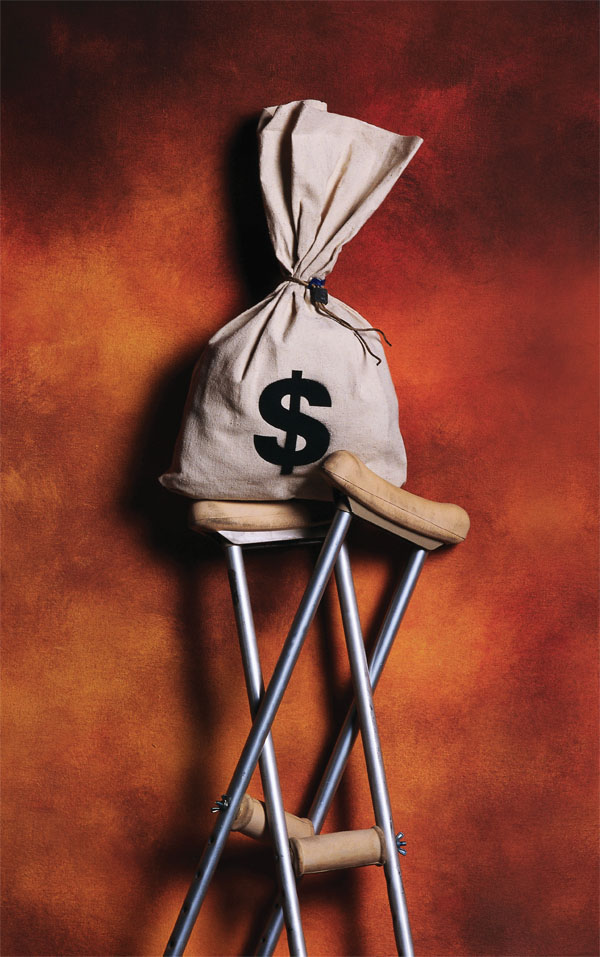

The U.S. workforce is getting older; peopleare retiring later in life than ever before. And this trend hasbeen a major concern for those in the health & safety field, astraditional wisdom holds that older workers are more prone tosuffer more expensive on-the-job injuries.

The U.S. workforce is getting older; peopleare retiring later in life than ever before. And this trend hasbeen a major concern for those in the health & safety field, astraditional wisdom holds that older workers are more prone tosuffer more expensive on-the-job injuries.

However, new research from the National Council on CompensationInsurance (NCCI) calls into question this accepted notion—or at thevery least, potentially changes how we think about “olderworkers.”

|In a recent study in which NCCI studied different age groups andthe rate at which they become injured, it was found that youngerworkers (under the age of 35) had substantially more cuts on theirfingers and slightly more lumbar-region sprains than older workers(those aged 35 and up).

|While those facts alone are surprising, consider that age split:A major analyzer of Workers' Comp data now defines an “olderworker” as someone who grew up listening to Pearl Jam instead ofElvis. And because a great many employees in ths country now fallinto this category, it should prompt agents to help businessesrenew their focus on strategies that can reduce injury costs foremployees of all ages.

|Prevention from the Get-Go

|Injury prevention for employees should begin before they evenbecome employees—during the hiring process. Agents can help theirclients develop a written functional description for the positionthat is open. Once that is complete, it is critical that thecandidate whom the employer selects be given a conditional offer ofemployment: This document is a bona-fide job offer with the caveatthat the employer can withdraw the offer if they are physically ormentally unable to do the job with reasonableaccommodation.

|Once this is complete, the client should have the candidatevisit a physician and complete a post-offer, pre-placement medicalquestionnaire. Having this completed allows a medical professionalto ask questions relevant to the job and to let the employer knowwhether or not the candidate is fit for the job. If they are,proceed; if not, they will have to find another suitablecandidate.

|Once a worker is on the job, it is critical that he orshe is always mindful of how the job is being executed.Far more injuries are caused by unsafe acts by employees than anyunsafe conditions in their workplace. Employees that feel rushedare more likely to set safety aside in the name of meeting adeadline—and those decisions result in accidents that could havebeen prevented.

|When your client takes all of these steps and has aworkforce that is fit for work and doing their jobs safely, thenthe focus turns to what happens when an accident does happen and anemployee is injured.

|Employees must know before they get hurt who they should talk toif they suffer an injury; immediate incident reporting is a key tokeeping injury costs as low as possible. Studies have shown thatthe costs of an injury go up when there is a delay in reporting.Make it your policy that any employee injury is to be reportedbefore the end of the shift.

|Once the injury is reported, getting the proper treatment iskey. Agents should help employers build a relationshipwith an occupational medical provider in your area. You can findboard-certified occupational doctors on the Web at the officialsite for the American College of Occupational and EnvironmentalMedicine, acoem.org. Even if there isn't an occupational medicinespecialist in your town, you can develop a relationship with awell-rated local physician and send your injured employees to thatdoctor.

|The goal of forging a relationship with a top-rated physician isto ensure that the doctor knows the client's business and thephysical demands of employees. The physician should also beinformed of transitional work the employer makes available toinjured employees. When a doctor knows that you will accept anemployee back to work on transitional duty, they are far morelikely to send them back to work rather than send themhome.

|If agents help employers follow those steps, then having older,experienced workers on the payroll can be a great asset rather thana potential liability. It can also create clients forlife.

|

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.