Editor's Note: Kevin Quinley, CPCU, ARM, AIC, is theprincipal of Quinley Risk Associates LLC and the author of thefollowing article.

Editor's Note: Kevin Quinley, CPCU, ARM, AIC, is theprincipal of Quinley Risk Associates LLC and the author of thefollowing article.

Sooner or later, all adjusters will find themselves examiningclaims that pose coverage issues. These controversies may pertainto the date of loss, additional insureds, applicability ofexclusions, intentional acts, breach of policy conditions, latenotice, non-coverage for certain counts, or punitive damages.

|It is considered a best practice for adjusters to assesscoverage as one of the first steps or the first step inhandling any claim. If there is no coverage, then liability anddamages may be moot. If coverage is lacking, then that is game,set, and match. “Game over!” Do not pass GO. Do not collect $200—orrather anything from the policy proceeds. Supervisors and textsurge fledgling adjusters to first verify coverage as a thresholdissue. This is sound advice.

|Having decided that a claim poses a coverage issue, however, newdecision points loom. Claims adjusters may deny coverage outright.Alternatively, the adjuster may ask the policyholder to sign anon-waiver agreement. More typically, he or she will send theinsured a reservation of rights letter. At this stage, there is agenuine coverage issue involving the claims file.

|A corollary decision point is this: Should the claims departmentnow split the staffing so that one adjuster handles the liabilityclaim while a separate staffer handles coverage? This is the“screen,” or bifurcation of the claim file. Failure to adroitlymanage this process can mire adjusters, insurers, or independentproviders of claims services in bad-faith quicksand.

|Challenges in Setting Screens

Inbasketball, setting a screen often means risking a collision, andthe same applies to claims handling. Here are some potentialchallenges:

- When should the adjuster or the claims unit bifurcate—that is,split coverage—from liability?

- Once a screen is in place, what communications are legitbetween the liability and coverage adjusters? Is the screenostensibly an airtight, hermetically sealed chamber with no passagebetween the two areas?

- Do all coverage questions merit a screen between the liabilityadjuster and the coverage adjuster?

- Is there a need to create a “vertical” screen within the claimdepartment? How high up the organizational chart must an insurerbuild a screen to insulate itself from bad-faith claims?

- When does the obligation to maintain a screen between claimshandling and coverage handling end? When does a screen comedown?

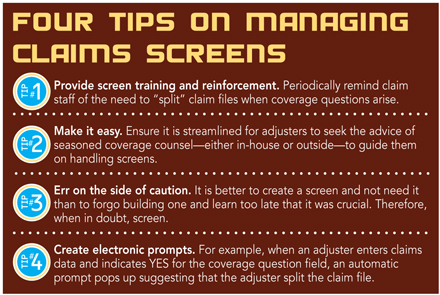

Here we pose more questions than we can definitively answer inthe space confines of this article. A sound starting point is forthe adjuster to seek the advice of seasoned insurance-coveragecounsel at the first whiff of a coverage question that mightinvolve the need for a screen.

|Avoiding Conflicts of Interest

Let'sreview the purpose of the so-called screen. Many also call thescreen a “Chinese Wall” or a firewall. Screens address the problemof insurer conflict of interest that may disadvantage apolicyholder. Without a screen, a liability adjuster could “feed”investigative tidbits to the coverage adjuster that would boost thelatter's ability to contest or deny coverage.

Conversely, without a screen, the coverage adjuster could shareinformation with the claim-handling adjuster that would help thelatter “steer” claim defense toward defeating only the coveredcounts or allegations. The net effect might be to leave the onlyremaining counts as ones outside of the policy's coverage orbit,enhancing the carrier's ability to say, “Sayonara.” Either way, theinsured suffers.

|Thus, to avoid either scenario, screens insulate the two aspectsof claim-handling, so that never the twain shall meet betweenhandling the liability claim and handling the coverage aspect ofthe file.

|Here are the thorny issues for adjusters. What follows is notlegal advice, as I am not an attorney. The following suggestions donot necessarily represent the standard of care. Deviating from themmay not equate to bad faith. These are bend-over-backwards steps toavoid any taint of conflict of interest and to bulletproof theclaim file from bad-faith allegations. View these as rhetoricalquestions with accompanying practice tips:

|How soon should a screen be erected? If this isdone too soon, then it wastes time and resources. If you do it toolate, then an attorney could say you acted in bad faith by allowinga conflict of interest in handling the claims file.

Suggestion: Err on the side ofcaution and do it sooner rather than later; better late than never,though.

What kind of communication does a screenprohibit? Does a screen bar all communications or justthose which could inure to a policyholder's disadvantage? Does a“gag order” prevent Joe (who handles the liability file) and Bonnie(who handles the coverage file) from talking at all? Can theydiscuss any aspect of the file? If the two adjusters discuss thecase status or the progress of, say, settlement negotiations, thendoes that breach the screen? Screens are porous; they allow air—andsound waves—to pass through. Even the Great Wall of China extendsonly so high up into the air.

Suggestion: Consider discussionsabout that specific claim file off-limits to avoid any whiff ofcollusion.

Do all coverage questions require ascreen?

|Perhaps not. Let's say, for instance, a naïve or cluelessinsured files an auto claim with the homeowner's carrier. Orsuppose a retailer submits what is clearly a workers' compensationloss to its general liability insurer. In both cases, the adjustersview coverage (or no coverage) as a slam dunk. Is theadjuster—under penalty of a bad-faith lawsuit—to split the file intwo? Do these scenarios differ from one where, say, a questionarises as to whether the insured's late notice materially breachedthe policy conditions?

Suggestion: Unless the coverage issueis a black-and-white no-brainer, split the file.

How high up the org chart does a screen go?

|Let's say Suzie handles a fire loss claim and there is acoverage question. The company splits or bifurcates the claim file,with Suzie handling the claim and Brad handling the coverage, butboth Suzie and Brad report to the same claims manager. Is thatlegit? Is there still a conflict-of-interest risk by having bothadjusters report to the same boss? Does this taint or compromisethe screen? Must Brad and Suzie report to different bosses now?What if there is only one overriding claim “boss” left? How high upthe org chart—vertically—must a screen extend?

Suggestion: Have the two adjustersreport to different supervisors for that claim file only. Noneed to turn the org chart upside down.

|When does the screen come down? If you take acase to trial and it results in a verdict, then can theclaims-handling adjuster compare notes with the coverage adjuster,or is it folly to do so? Must you wait until the claim settles tolower the screen?

Suggestion: Keep the screen inplace until the claim file is closed.

|Exercising care in creating and maintaining screens will paydividends. Painstaking efforts here protect the insured. Moreover,a strong and well-thought-out claims screen can become an effectiveshield against bad-faith claims.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.