Disasters represent a moment of truth for P&C insurers tomake good on their promise to policyholders while fostering goodwill. Successful fulfillment of this obligation is contingent uponthe performance of claims organizations, which must in turn rely onimpeccable disaster response protocols, as well as the proficiencyand self-possession of individuals comprising catastrophe adjustingteams.

|A mastery of logistics, appropriate vendor partnerships, andstaffing—hiring and nurturing the right talent—is only half thebattle. To emerge from a large-scale loss such as Sandy with bothreputation and policyholder loyalty intact, insurers must commit tomodern, flexible claims technology.

|Arrested Development

However, agiletechnologies obviously require an earnest managerial commitment aswell as a monetary one, and if the findings of a late-yearAccenture survey of 50 P&C insurance companies serve as anyindication, this is a difficult proposition. When asked whethertheir companies lack the flexibility to address consumers' evolvingneeds, by and large, claims execs said "yes." In fact, 85 percentof survey respondents admitted to this organizational deficit.

Many respondents admitted to lacking sufficient data analysiscapabilities because of antiquated claims technology. One couldeasily infer this is diminishing the quality and speed of insurerresponse in the wake of catastrophic events.

|Technological lags that compromise claims capabilities and, byextension catastrophe response, must be addressed now toavert disaster later. The first step is discerning betweenthe hype and the reality of upgrading systems. Lingeringaspirations to modernizing claims technology "one day" is notserving policyholders today.

|Swirling Contradictions

Admittedly someclaims organizations have been talking upgrades for years but haveyet to implement new solutions. Similarly, talk about advances inanalytics related to social media, telematics and geo-locationtechnology is at a fever pitch. However, Michael Costonis, managingdirector in Accenture's P&C insurance services, points out that75 percent of survey respondents are still using offline datastored in Excel spreadsheets or Access databases.

"Flexibility has been the byword of core systems modernization,but claims systems remain inflexible, requiring the intervention ofIT," Costonis says.

|Prudent technology decision-making starts with a core systemmust be flexible enough to meet an insurance carrier's currentneeds while providing an environment suited for data analytics,Costonis says.

|"Predictive models are only as good as the data that feeds them,so a [carrier needs] a system that [will allow] core capabilitiesand data analysis to work hand-in-hand," he says.

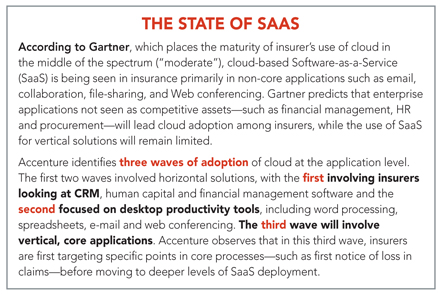

|Buying versus building a system is a separate discussionaltogether. But what is clear is that the only way for insurers tosurvive and thrive is to employ systems that can be upgraded andconfigured, all while supporting the data environment. In thatregard, Accenture shares some encouraging findings, one being that48 percent of respondents have either already begun migrating theirclaims systems to the cloud or on a Software as a Service (SaaS)model; are planning to do so in the next two years; or arecurrently discussing the option.

|"The cloud" typically sparks discussion of reducing costs whileenhancing overall efficiency. As talks progress beyond the macrolevel and insurers grow more comfortable with the cloud, they willin turn be able to realize more of the technology's potentialbeyond that of off-site storage and so on. In this journey,insurers will find valuable ways to employ the cloud in the claimsprocess, just as they learned lessons in catastrophe preparednessand response from Sandy.

|Claims organizations will continue to seek cloud-based solutionsto enhance their performance in the aftermath of hurricanes,tornadoes, fires, acts of terrorism and violence, and otherdisasters. Aside from meeting customer expectations, the ability totake swift, decisive action will not only mitigate further damagebut also potentially save lives.

|Behind the Numbers

Cost is one of many factors driving insurers' increased use ofcloud at the platform, infrastructure, and software levels.

Michael P. Voelker is a contributing editor toPropertyCasualty360.com and TechDecisions Magazine, a sister publicationof Claims. This article also appears in TechDecisions' Nov/Dec 2012 issue.

|Smart businesses are always looking for ways to cut costswithout impacting the service they provide to customers andstakeholders. Cloud computing offers a compelling cost-savingargument, particularly as the churn of technology has madetraditional capital budgeting a challenge for ITorganizations.

|"What you buy today [in IT] will be obsolete before you evenhave the capital expense depreciated," observes Michael Hugos,consultant and author of the book Business in the Cloud. "You needa flexible cost structure where you're not saddled with a massiveinfrastructure expense. Using cloud computing and Software as aService (SaaS) are cost-effective, pay-as-you-go mechanisms forIT."

|"There's no advantage to me to have a data center and to pay forelectricity, cooling, real estate, and other costs. It's moreefficient to use a co-location site or cloud-based infrastructureoptions," says Waleed Sharaf, vice president of informationtechnology at ICW Group Insurance Companies in SanDiego.

|ICW Group uses cloud extensively throughout its operations. Thecompany's FirstBest front office solution, providing online quotingand binding for workers' compensation, is run on cloudinfrastructure at RackSpace. On the application level, ICW Groupcurrently uses the SaaS-based UltiPro from Ultimate Software for HRand CounselLink from LexisNexis for legal matter management. Theinsurer also uses cloud-based services from ServiceNow formanagement of auto and commercial property claims as well as ITincident, problem, asset and change management.

|"Particularly because we are a mid-sized company, cloud workswell for us. It is a quick, inexpensive way to get high value,"Sharaf says. But while financial factors may lure insurers to thebuffet of cloud-based platform, infrastructure, and softwareoptions, carriers stick with cloud for the business value it isproving to deliver.

|"Expense reduction [with cloud] is important, but being able tohave control of our abilities to migrate new products quicker,satisfy regulatory requirements faster, and provide a betteroverall level of service to our clients in an on-demand fashion arethe critical business benefits that we see from cloud," says DanColarusso, senior vice president and chief information officer atCypress Insurance Group in Jacksonville.

|"Clearly, we see the benefits of converting from fixed cost tovariable cost environment, but for us, cloud is as much about thestrategy of how we look at technology in IT," says Mark Berthiaume,senior vice president and CIO of commercial insurance at Chubb,which uses cloud on both the infrastructure and application levels."We don't want to spend on things that are not core to thebusiness, and we want to shift from building applications toassembling, configuring, and integrating them."

|AgilityDefined

Cloud is enablingagility by allowing insurers to consume services without buildingor buying a new business system, and that translates to speed tomarket. "With cloud, you don't have to spend nine months studyingsolutions and invest millions of dollars to deploy them. You canthink big, but start small and deliver quickly. You can spend justa few weeks studying things, and roll out something that solves aspecific problem in 30-, 60-, 90-day cycles," Hugos says.

"I don' think we went out to the market saying 'we want cloud.'We wanted the best way to get something up quickly," saysBerthiaume.

|Chubb leverages cloud-based fax services from Easylink toeliminate the need to maintain fax infrastructure. On theapplication side, Chubb uses salesforce.com for CRM andImaginatik's Innovation Central to support the insurer's innovationprogram. The company is exploring a cloud-based print solution andis investigating ways to move policy administration components tocloud-based providers.

|"We were able to deploy the cloud-based innovation system in 90days. We considered some in-house development of platforms, but itwould have been a much longer timeframe," Berthiaumesays.

|"Cloud is a way for us to move from platform to platform as thetechnology advances. Just unplug from one and move to another. Itkeeps us ahead of the curve," says David Hoppen, chief operatingofficer, ICW Group.

|In its cloud-based IT strategy, ICW Group made it a top priorityto avoid vendor lock-in. "This has been a big problem forcompanies—creating a Gordian Knot of systems that you couldn'textract yourself from. Cloud gives us easier access to newer,extensible systems that are available via a portal and that areenriched by the experience of multiple users, in contrast toproprietary systems," Hoppen says.

|Size and Scale

In addition to enablingfaster speed to market, cloud levels the playing field. "It [cloud]gives smaller companies the ability to look bigger by giving themaccess to technology on par with bigger players," says Bob Hirsch,director at Deloitte Consulting.

Seeking a CRM solution but with limited time and IT resources,Alabama-headquartered Alfa Insurance turned to the cloud-basedRightNow solution (since acquired by Oracle), deploying theplatform in 2009. Alfa was able to go live within six months ofinitial research into a CRM platform.

|

"It would have taken us at least 24 months in a traditionalinstallation, and I am not sure if that would have even been enoughtime," says Susan Adcock, vice president of marketing resources."We wouldn't have been able to commit to a new system at all if itwasn't a cloud-based system."

|A cloud deployment also keeps Alfa current with the latestplatform upgrades. "It's nice to get technology improvements andenhanced features without having to purchase new equipment,software, or upgrades. No IT staff is required; the systemadministrator works with the RNT [Oracle] staff to set up aproduction test environment and, after testing is complete, we rollthe upgrade into production," Adcock says.

|Insurers are also looking to cloud for scalability needs.Companies can manage business fluctuations and growth through apay-as-you-go structure.

|"In terms of IT control and efficiency, we have affordable andpredictable fixed-rate costs [with cloud]," says Colarusso. "I cansay exactly what my costs will be and don't have to add additionalhardware and software."

|One area where Cypress uses cloud is office productivity viaMicrosoft Office 365. "It [Office 365] provides us withenterprise-grade security, reliability, and on-demand scalabilityand storage with no up-front infrastructure investments," Colarussosays.

|"We also seized on its built-in message archival and legal holdcapabilities," he adds. "Being cloud-based, it provides redundantdisaster recovery and automatic failover that we didn't have tobuild ourselves. We're guaranteed 99.7 percent uptime, and mynetwork engineers have a single administration point that reducesour support time and costs."

|Cypress has been using CSC's outsourcing services for policyadministration, billing, customer service, and commissionprocessing to date, but is in the latter stages of bringing thosefunctions in-house. Supporting those processes will beMajescoMastek's STG suite, provided to Cypress through a SaaSdelivery model.

|"Being able to have control of our abilities to migrate newproducts quicker, satisfy regulatory requirements faster, andprovide a better overall level of service to our clients in anon-demand situation" are the key benefits Cypress targets from thecloud model, Colarusso says.

|Cypress isn't the only insurer looking to thecloud for core processing. ICW Group believes core in the cloud isa viable model and is testing CodeObjects' subscription-basedInsuranceEnterprise platform.

|"Data integration and analytics are the only two areas we couldsee needing to stay in-house, although even there we could bedealing with servers and data storage in the cloud," Sharafsays.

|Yet many carriers remain cautious of moving core in the cloud."We're seeing a lot more adoption of cloud in the front office. Theback office is being handled by more traditional solutions,"observes Hirsch.

|"There is definitely interest of carriers wanting to do theircore transaction processing within the cloud, although no doubtthere's more talk than use, particularly when we get into the'secret sauce' of how carriers differentiate themselves byunderwriting their products or handling customers and claims," saysMike Jackowski, global managing director of P&C Software,Accenture.

|Chubb is among the carriers who believe that cloud-based coreinsurance systems are not ready for prime time. "The [core] vendorsout there are not as established. They're still in the process ofbuilding capability and scale," says Berthiaume. "I'm convincedwe'll see policy admin in the cloud, but it's an area that needs tomature before we'll consider it."

|Jackowski says that the configurability of modern admin systemsto reflect a carrier's unique business processes has gone hand inhand with the growth of interest in cloud-based delivery. "In thepast, a lot of the product rules were instantiated inside thesystems themselves, and as a result they weren't very configurableover the cloud. The day that cloud-based products becomeconfigurable in the cloud is the day they become more popular, andthat is happening, with rule definitions sitting outside the coresoftware," explains Jackowski.

|He believes that while companies of all sizes will eventuallylook at the cloud for core processing, only small and mid-sizedcarriers will trust the cloud to provide their entire suite of corefunctionality. "With large carriers, you will see them taking onlypart of a core solution to the cloud. For instance, they may bewilling to do first notice of loss processing in the cloud, but notthe entire claim process," says Jackowski.

|Collaboration andAlignment

In an increasingly social businessenvironment, web-based cloud platforms are enabling easiercollaboration. "Because we have a large number of remote users, itwas important to allow anywhere access and collaboration. With thethree pieces of the Microsoft solution—Office 365, SharePoint, andLync Online services, we have real-time file sharing and editing,"says Colarusso.

Alfa provides an agent portal to the RightNow system for itsemployed and independent exclusive sales agents. "The portal allowsour field agents to access leads, view services we've provided totheir customers, and see notification of claims that were filed. Italso allows us to deploy our knowledge-bases information to thefield agents and to capture VOC [voice of the customer] informationfrom the agents," which includes compliments, concerns, andsuggestions, Adcock says.

|Collaboration is central to Chubb's innovation platform. "It'san environment where people can comment on, rate, and score ideas,"Berthiaume says.

|Headed by a chief innovation officer, Chubb's innovation programfeatures regular events that focus on specific targets, such ascost reduction or operational efficiency. The Imaginatik platformprovides cloud-based collaborative spaces that help teams collect,build, and share ideas, and analytics that let Chubb evaluate theeffectiveness of ideas that the program generates.

|"When a program is over, the platform has a variety of ways toscore the results and to slice and dice the information. It's theguts of our innovation process," Berthiaume says.

|Chubb has also seen improved alignment between business and ITas a result of cloud-based technology deployment. "Besides greaterflexibility, faster speed to market, and increased innovation, onething that gets overlooked is how close [cloud] puts business andIT folks together," says Berthiaume.

|"With traditional platform implementation, the business sidedoes business requirements, and IT designs and codes. If you're notfollowing an agile methodology that pushes small increments of codeout in an iterative way, IT can go off, design and build systemsand rarely talk to business," he elaborates. "In configurable cloudenvironments, you don't have long periods when IT and business arenot as close. Development happens quickly, and business is oftendirectly responsible for doing a good part of the configuration ofcloud-based systems."

|Cloud Cautions

The top concerns insurerscite about cloud typically deal with the technical issues ofsecurity. Hugos dismisses those worries.

"The security issues are not the important ones," he claims."People go on and on about security and I appreciate the need to besecure, but those issues have essentially been solved as well asanyone can. This is not experimental technology anymore—every majorvendor has invested millions of dollars in creating cloud services,and their reputations depend on those services beingsecure."

|"In some cases it's better [security withcloud] than with their internal systems," Hirsch observes. "Infact, where insurers feel comfortable putting data into the cloud,they tend to have a better understanding of data security becausethey make a point to audit the vendor."

|Hugos says the biggest challenge for insurers presented by cloudis the cultural change it can bring to the ITorganization.

|"It's provoking a major cultural backlash because for the last30 years, 70 percent of your IT operations were in-houseadministration and staff dealing with maintenance. When you can ineffect outsource your data center operations [with cloud], thatstaff needs to be repurposed," he says. "Job security issues arebig concerns."

|IT may also see the technical part of its role shift fromsystems development to integration. "Although at times my team canget frustrated because they want to do the cool, 'sexy' work usingthe latest development technology, our strategy is to buy, notbuild applications," Sharaf says. "We build our integration layerand we build our analytic layer—those are the only two areas wherethe work has to be ours, using our own people."

|Additionally, the affordability of cloud can also create its ownproblems for IT. "The cost of entry is so low that cloud oftenbecomes "shadow IT" across the organization, and it's hard tomanage as a result," Hirsch observes. "That's something IT reallyneeds to get in front of."

|"We realized early on that cloud solutions could really beimplemented without IT, so we put management controls around it—notto strangle the process, but to ensure consistency and avoidSarbanes Oxley, privacy, and other issues," Berthiaume says. Thosecontrols include rules for provisioning and de-provisioning usersof cloud systems, implementing new features and functionality, andgoverning environments and data.

|"Even though you're not running the systems in the company, youwant to have governance oversight so that the environments don'treplicate into too many diverse and different environments," hesays.

|Capitalizing on Cloud

Jackowski says thatalthough insurers have been slower than some other industries inthe adoption of cloud, they are well positioned to capitalize onit.

"It's not new for carriers to outsource key capabilities orfunctions. For decades they've been outsourcing estimatingpackages, medical bill processing, damage appraisal andsubrogation, call center capabilities, and so on. That outsourcingmentality is the basis of cloud adoption," he says.

|"IT has a lot to gain by partnering with the business andprovisioning cloud-based applications to support new businesscapabilities, which will make the IT organization more flexible andvaluable," Hugos says. "[Cloud] is going to happen, and those whoget out in front are going to look like heroes."

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.