Tower Group expects an after-tax net loss ofbetween $55 million and $68 million next quarter due to SuperstormSandy, while Fitch Ratings says insurers can easily handle thelosses—and then some.

Tower Group expects an after-tax net loss ofbetween $55 million and $68 million next quarter due to SuperstormSandy, while Fitch Ratings says insurers can easily handle thelosses—and then some.

During a Nov. 8 conference call to discuss the company'sthird-quarter earnings, CEO Michael L. Lee said he expects Sandy to“easily cause the largest catastrophic event [in Tower's]history.”

|Lee said Sandy will be an earnings event for Tower, not acapital event—which could mean improved personal-lines marketconditions since “many companies face substantial losses from thisevent.”

|Tower's reciprocal-company subsidiaries will look to expand inthe Northeast, he said, while the carrier's stock companies“continue to diversify away from the Northeast to minimize ourearnings volatility from our concentration [there].”

|Claims are expected primarily from New York, New Jersey andConnecticut, added CFO William Hitselberger, with most lossescoming from Tower's direct-insurance business.

|Sandy affected Tower directly, as its Jersey City, N.J. and NewYork City offices were closed for a week following the storm.

|Hitselberger outlined Tower's risk-transfer mechanisms, notingthe company retains the first $75 million of losses beforereinsurance kicks in up to a layer of $150 million.

|“We currently expect the loss for our direct-insurance businessto be contained in our first layer of reinsurance,” he said. Thecompany will pay reinstatement premiums of up to $20 million on thefirst layer of reinsurance for additional protection through June30, 2013, he added.

|Fitch Ratings, meanwhile, says in a report that even if lossescaused by Sandy were to reach Katrina-like proportions, theinsurance industry would still be able to handle it and post astatutory profit.

|Analyst Jim Auden notes that “tremendous uncertainty” remainsabout what the ultimate amount of Sandy's insured loss will be,acknowledging that catastrophe modelers have thus far put atop-figure estimate of $20 billion on the event.

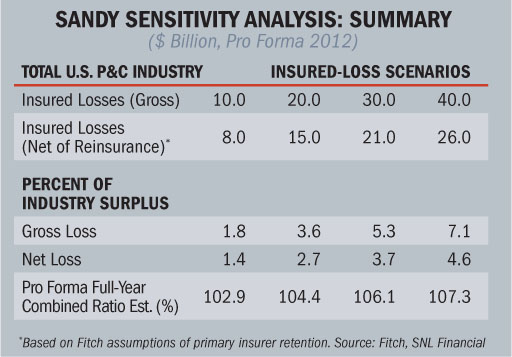

|Fitch performed a sensitivity exam of the U.S. insuranceindustry and individual insurers with hypothetical loss scenariosup to $40 billion, equal to losses from Hurricane Katrina in2005.

| Under the ratings agency's hypotheticalscenario, the losses are not expected to change any ratings for theindustry or the five companies expected to be most impacted bySandy.

Under the ratings agency's hypotheticalscenario, the losses are not expected to change any ratings for theindustry or the five companies expected to be most impacted bySandy.

Analyst Brian Schneider says in Fitch's analysis that theratings service did make some “broad assumptions” that could differfrom what the ultimate loss might be. He says losses were spreadthrough eight states in the Mid-Atlantic and Northeast, with NewYork, New Jersey and Pennsylvania most heavily impacted. Sixtypercent of those losses were assumed to be in personal lines and 40percent in commercial.

|The five companies expected to be most heavily impacted by Sandyclaims are State Farm, Allstate, Liberty Mutual, Travelers andChubb. On the commercial side, the large commercial insurers, suchas FM Global and Ace, should also be impacted.

|As to how the storm will affect regional insurers, Auden saysthose carriers are sufficiently reinsured for an event such asSandy.

|Both Auden and Schneider emphasized that their analysis is not aforecast of insured loss but a hypothetical analysis.

|Auden says some companies are releasing their loss estimates,but that process could be slowed as the industry grapples with theissue of wind-vs.-flood loss.

|In the Fitch report, a $10 billion insured industry loss isexpected to produce an industry combined ratio of 102.9. Thatnumber rises to 107.3 under a $40 billion loss scenario.

|The report also says Sandy is not likely to change marketunderwriting capacity and “tip the balance to a hard Propertymarket,” but the recent general uptick in pricing trends isexpected to continue into 2013.

|Impact Forecasting, Aon Benfield's catastrophe modeler, saysSandy will become “one of the costliest natural disasters in U.S.history,” with extensive damage and at latest count 113 dead.

|Impact Forecasting says economic losses will approach or exceed$30 billion and total insured losses are likely to approach orexceed $10 billion, based on preliminary state-released governmentand industry estimates.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.