Risk Management Solutions says storm Sandy's impact on the EastCoast is “much more severe” than last year's Hurricane Irene, andthe catastrophe modeler expects insured losses from Sandy toeclipse the $4.5 billion in losses from Irene.

|Modeler Eqecat said yesterday that it expected damage from Sandyto be comparable to Irene, and released an initial insured-lossestimate of $5 billion.

| And as emergency personnel, modelers and insurers move toassess the ultimate damage from Sandy, some interests haveconnected the storm to hot topics such as federal risk-managementstrategies, insurers' disaster responses, and climatechange.

And as emergency personnel, modelers and insurers move toassess the ultimate damage from Sandy, some interests haveconnected the storm to hot topics such as federal risk-managementstrategies, insurers' disaster responses, and climatechange.

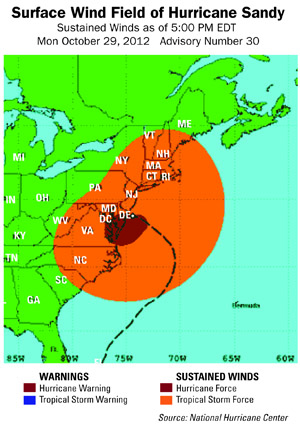

Sandy came ashore along the coast of southern New Jersey as anextra-tropical cyclone, although maximum sustained winds atlandfall were 80 miles per hour, in the lower Category-1 range. TheNational Hurricane Center (NHC) says the center of Sandy trackedabout five miles southwest of Atlantic City, New Jersey and around40 miles northeast of Cape May, New Jersey.

|As of 11 a.m. EDT, the storm was further inland, about 145 mileswest of Philadelphia, according to the NHC, but maximum sustainedwinds are down to 45 miles per hour. The storm has slowed, says theNHC, and it is expected to continue west throughout the day beforeturning toward Western New York tonight and moving into Canada onWednesday.

|“The effects are very far reaching due to the size of thestorm,” says RMS in a statement. “Expect to see a lot of buildingdamage and auto damage due to tree fall over a wide area. Businessinterruption, fire-following damage, coastal-surge damage, andinland flooding will all contribute to the total losses.”

|The catastrophe modeler says over 7 million people across 15states are without power.

|RMS adds that inland damage typically seen during winter stormsis also expected. The Associated Press reports that, in WestVirginia, winds spinning off of Sandy produced blizzard conditionsover parts of the state, causing snow accumulations of over a footin lower elevations and more than two feet in higherelevations.

|Meanwhile, the more traditional tropical-cyclone risks of wind,water and storm surge wreaked havoc on coastal areas. CBS Newsreported last night that areas in New York City endured recordstorm surge, including surge measurements of 13.88 feet at BatteryPark in southern Manhattan. Elsewhere, RMS says surge measurementswere 14.6 feet at Bergen Point West, N.Y., and 13.31 feet at SandyHook, N.J. Images on TV throughout the night on Oct. 29 showedregions from southern New Jersey to the Hudson Valley in New Yorkinundated with floodwaters from the combined forces of storm surgeand tidal forces driven by the full moon.

|RMS says, “The event is fairly unusual due to the size of windfield and the track path, i.e. making direct hit on coast andtraveling far inland rather than skirting coastline.”

|RMS notes that Sandy impacted “a very densely populated regionwhich has very high insured-exposure values.” In New York Cityalone, where damage consists of blown-out windows and flooding,there is $2.1 trillion worth of insured property, RMSsays.

|INSURANCE INDUSTRY PREPARES

|As for insurers, it remains too early to give estimates on claimcounts or losses. Laura Strykowski, senior corporate relationsmanager for Allstate, says the insurer has approximately 1,100claim personnel staged for deployment, and in its catastrophecenters. “Once authorities give clearance to enter the affectedareas, agents and the catastrophe team will be available to helpAllstate policyholders start the claim process, Strykowski says viaemail.

|Credit Suisse analysts say in a research report that the stormis likely to wipe out the fourth-quarter earnings of Chubb,Allstate and Arch Capital Group.

|Officials of the Property Casualty Insurers Association ofAmerican and the National Association of Mutual Insurance Companiessay the severity of the storm appears to vary greatly, withthe greatest impact in New York, New Jersey and Connecticut.

|Frank O'Brien, PCI vice president, state government relations,says the industry stands ready to pay all claims. “Theinsurance industry is well-capitalized and well positioned, andwill be able to handle the financial impact,” he states. “There areno solvency concerns here.”

|Neil Alldredge, NAMIC's senior vice president, state &policy affairs, says there may be fewer losses from coveragesprovided under the National Flood Insurance Program and more lossesfrom commercial coverages such as business interruption, althoughhe notes small businesses are provided coverage through theNFIP.

|Fitch Ratings said before landfall that losses from Sandy wouldlikely be “largely borne by primary insurers,” but noted that itsearly assessment was uncertain.

|“We expect the brunt of losses to be borne by primary writers,including State Farm, Allstate, Liberty Mutual Group, andTravelers, based on market share positions in the Mid-Atlantic andNew England regions,” Fitch said.

|NEXT PAGE: KATRINA-RESPONSE CRITICISMS, CLIMATE CHANGE, ANDFEDERAL POLICY

||The Consumer Federation of America, meanwhile, criticizedinsurers' response to 2005's Hurricane Katrina and warned against asimilar response to Sandy. “Insurers treated many people poorly whofiled claims for damages caused by Hurricane Katrina,” CFA says ina statement. “For example, after Hurricane Katrina, insurers pulledback from offering coverage along the coasts, dumping people intohigher priced, state run insurance pools. They also cutcoverage and raised rates substantially.”

|Regarding a response to Sandy, CFA says, “There is no reason,actuarially, for insurers to raise rates or cut back coverage dueto Hurricane Sandy, which is a storm well within the projections ofinsurers' current rate schedules. Insurers have already raisedprices and cut back coverage along the East Coast of America and nofurther price or coverage action is called for.”

|INTERESTS TAKE ON THE 'WHY?'

|As insurers wait to get into affected areas to assess damage,some are beginning to point to the event as evidence in support oflarger issues. Ceres, an environmental group made up of investorsthat was instrumental in getting the National Association ofInsurance Commissioners' Climate Change Risk Disclosure Survey offthe ground in 2009, says the storm is a sign of changing weatherpatterns driven by climate change. In a statement, Ceres says,“Hurricane Sandy's impact on a region that is not typical forhurricanes begs the question: are extreme weather trends andanticipated future impacts due to climate change creatingsignificant challenges across the country for the insuranceindustry?”

|The R Street Institute pointed to the damage from the storm as areason against developing in risky areas. In a statement, R Street“suggested the storm should heighten awareness about the dangers offederal policies that encourage development in risk-proneareas.”

|R Street Senior Fellow R.J. Lehmann speaks to the potentialimpact on the National Flood Insurance Program: “It appears likelythat Sandy will exhaust the NFIP's remaining $3 billion ofstatutory borrowing authority, meaning it will need to request moremoney from Congress to pay its claims.”

|He adds, “In the short term, we would insist the NFIP use itsexisting authority to raise rates, buy reinsurance and issuecatastrophe bonds, so that the private market, rather thantaxpayers, assume the risk of these sorts of catastrophes in thefuture. Over the longer term, further NFIP reform must includephasing in actuarial rates for all policies, and possibly sellingsome of the NFIP's 5.6 million policies to private insurers.”

|Additional reporting by Arthur D. Postal

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.