Professional athletes are the ultimate high-net-worth customers.In 2010, average minimum wage for NFL rookies was $325,000, goingup to $395,000 in a player's second year and $470,000 in theirthird year. Average player salary, with both stars and rookiestaken into consideration, was $1.1 million in 2010–for careers thattypically last less than 10 years. Expensive houses, powerful cars,jewelry and high-end collectibles are all part of the picture.

|But what happens when things go wrong? “Broke,” a recentepisode of ESPN's “30 for 30” series, examined bankruptcy amongprofessional athletes. According to Sports Illustrated, 78 percentof former NFL players go bankrupt after 2 years of retirement; 60percent of former NBA players are broke within 5 years ofretirement. Reasons include bad investments, excessive lifestyles,trusting family, friends or unscrupulous financial advisors, andsimply failing to plan for life after retirement.

|The average agent and broker may not have sports superstars ascustomers, but you can still learn a lot about how to advisehigh-net-worth clients by studying the lifestyles of the rich–orbroke–and famous.

|Read related: “Educatethe High Net Worth Customer.”

|Donnie Nickey, former Tennessee Titans safety and 8-year NFLveteran, is now a financial advisor with Stonebridge Advisors inBrentwood, Tenn. His clients include players from the NFL, NBA,PGA and NHL.

|His story is a cautionary tale. After his rookie season in 2003when he saw how “taxes, lifestyle and family pressure” affected hisnet worth, Nickey asked his agent to find him a CPA and financialadvisor. Believing he was in good hands, he touched base with theadvisor about once a month. Three years later, he noticed excessivecommissions for seemingly meaningless trades in his brokerageaccount. Investigating further, Nickey found he was being “churned”by his financial advisor.

|“Unscrupulous agents and financial advisers have taken millionsand will continue to do so as long as there is professionalathletics,” he said. “I feel like I have been called to educateother current and former athletes on how to make the money theyearned through sweat, blood and tears last a lifetime–or at thevery least, springboard them into a successful second career.”

|The rags to riches phenomenon—taking a college student tomillionaire in the case of first- and second-round draftpicks—skips much of the learning experience and knowledge that atypical high-net-worth client attains over the course of hiscareer, Nickey said. Once a rookie makes the team, the playerdevelopment director puts together a curriculum for financial andlife skills training. But many of these advisors are trying toclimb the ladder into a front office or full-time coaching positionand don't have the player's best interests in mind.

|Read related: “TheGreat Underserved Niche: High Net WorthClients.”

|“Wealthy families spend time and effort grooming their youngergenerations on some of the skills necessary to preserve thefamily's assets,” he said. “Professional athletes get a crashcourse in wealth management over a 3-day period at the annual NFLRookie Symposium. “ Ultimately, “the responsibility of protectingthe athletes' assets relies squarely on the athlete himself.”

|Expensive homes, collectibles and cars are a huge temptation forprofessional athletes, Nickey said. When he was picked in the fifthround of the NFL draft in 2003, Nickey believed he had earned theright to buy a new car. Luckily, the scale of expense is oftendictated by the signing bonus, and he ended up with a $40,000 truckinstead of a $150,000 Lamborghini. “While it's not a bad thingto reward one's hard work, it is the place of the athlete'sfinancial team to step in and make sure he is getting a good dealand that he understands how quickly automobiles depreciate in valueand how that affects his net worth overall,” he said. “Real estateshould be a decision made with the athlete's budget, salary,health, draft status and the prospective real estate market all inmind. This is where a trusted advisor can make a huge impacton a player's future. It is all about taking the time toadvise the player and teach them, starting at a very basic level,about finance and the time value of money.”

|Read related: “The Value is in the Service.”

|The biggest difference between counseling typical high-net-worthclients and a professional athlete is “taking an educational roleand understanding the pressures on the athlete resulting from thefamily and friends' perception that he has a money tree that an NFLteam just planted in his back yard,” Nickey said.

|Although your client roster may not include any professionalathlete superstars, the average insurance agent should apply thesame skills to educate his or her customers.

|“Earning anyone's trust is something that takes time,”Nickey said. “Athletes have been overloaded with caution and horrorstories of athletes who have been taken advantage of and lostmillions of dollars. This makes athletes very unwilling totrust anyone in a suit and very skeptical of financialprofessionals…Total transparency of fees and performance, educationand most importantly communication are the keys to earning theplayer's trust and developing a lifetime relationship. This isno different than an average insurance agent gaining the trust of anew client, other than the fact that they are in their early 20swhen they are coming into a lot of money. Respect, like money,takes lots of time to accumulate and just seconds to lose

|Click through to view 5 horror stories of athletes who went fromhaving it all to having nothing at all.

|

Michael Vick

|Vick's salary from the Atlanta Falcons was $11.4 million in2006. In August 2007, he pled guilty to federal charges offinancing a dogfighting operation. He reported to a federalpenitentiary, where he worked for 12 cents an hour after beingconvicted of running a dogfighting ring.

|Throughout his early career, Vick helped friends and family buycars and homes and gave them spending money. He got wrapped up inabout 20 different business ventures, had various real-estateholdings spanning across multiple states and owed child support.Vick ultimately filed for bankruptcy. After his release from prisonhe got a big break in 2011 when he signed a $100 million contractwith the Philadelphia Eagles.

|Vick is now paying off debt and back taxes through acourt-approved restructuring plan. He pays an estimated two-thirdsof every dollar he earns to creditors and the government. So far hehas paid more than $11 million in taxes, $9.2 million to creditorsand $2.7 million to lawyers and accountants. Whatever is left goesto child support and living expenses, limited to $300,000 a year.

Lenny Dykstra

|Dykstra enjoyed a 12-year career with both the Mets and thePhillies until 1996. At one point, he owned an $18.5 millionmansion in California. He did a short stint as a stock-pickerwith CNBC's “Mad Money”program and in 2008 had a net worth of $58 million.

|Everything changed after he was caught up in a steroid useinvestigation in 2007. Although Dykstra denied using drugs, hisbrother came out as his supplier. His entire family disowned himbecause of alleged debts and his wife filed for divorce. Anextensive article about an ESPN.com investigation in April 2009went into greater detail, asserting that Dykstra has been thesubject of at least two dozen legal actions since 2007. He filedfor bankruptcy in 2009.

|In March 2012, Dykstra was sentenced to 3 years in prisonfollowing a no-contest plea to charges of grand theft auto andfiling a false financial statement. According to court records andpress reports, Dykstra and confederates obtained automobiles fromvarious car dealerships using falsified bank statements and stolenidentities. He was unable to post $500,000 for bail and wasappointed a public defender for the trial. Former teammates say thetransition from being a professional player to a normal life washard on his high-energy, competitive personality.

|

André Rison

|A former NFL wide receiver for the Colts, Falcons, Browns,Jaguars, Packers, Chiefs and Raiders, Rison's career spanned from1989 to 2005. In “Broke,” Rison recounts the confusion he felt onseeing a large amount of his first paycheck set aside for taxes. Hehad strings of bad luck and poor planning, including when the teamhe was playing for moved to a different city after he had alreadypurchased a $2 million house.

|Rison wasn't a discerning investor. He once spent $29,000 onrecording equipment. In the documentary, Rison tells stories aboutplayers attempting to outdo each other by having the mostexpensive, newest car in the lot. “How much is this one?” Risonsaid. “It doesn't matter, just get it.”

|Poor planning and paternity suit debts eventually led him todeclare bankruptcy. Afterward, Rison wised up and returned toMichigan State University to complete his degree. He now works as astudent assistant football coach for the MSU Spartans.

|

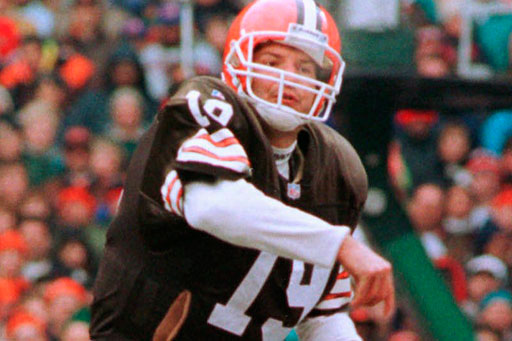

Bernie Kosar

|Kosar was once considered the smartest player in the NFL. Whathe lacked in physical prowess, he made up for in mental acuity. Toplay with the Cleveland Browns, he avoided signing league paperworkand ended up with a contract for $5.2 million, earning an estimated$19 million throughout his career.

|But family troubles, a divorce settlement and real estateinvestments put a strain on his finances. He spent more than $4million in court costs and a divorce settlement. He alleges hisfather used a lot of his earnings to pay off debts and a mortgageand believes that he supported anywhere from 25 to 50 familiesbefore retiring in 1997 after 12 seasons. He filed for bankruptcyin 2009.

Antoine Walker

|A three-time NBA All-Star, Antoine Walker earned $110 millionwith the Celtics, Mavericks, Hawks, Heat and Timberwolves. Heinvested in real estate during the 1990s bubble and was living alavish lifestyle that allowed him to bankroll a posse of friendsand gamble away as much as $800,000.

|But it all ended when the housing crisis hit and banks camelooking for Walker, the personal guarantor of several holdings. Oneof his advisors, Fred Billings, was convicted of running a mortgagescam. Walker himself was charged with three felony counts ofwriting bad checks to cover gambling debts. He filed for bankruptcyin 2010.

|Today, Walker blames himself for most of his money problems. Hecautions younger players to wait until they have retired beforeinvesting, because he found it too difficult to keep track of hismoney while focusing on the game.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.