Florida Insurance Commissioner Kevin McCarty has approvedanother round of take-outs from the state's bloated insurer of lastresort.

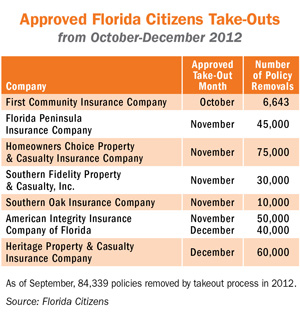

|McCarty's Office of Insurance Regulation says American IntegrityInsurance Co. has been given the go-ahead to take 40,000 policiesfrom Citizens Property Insurance Corp., and the recently-licensedHeritage Property & Casualty Insurance Co. is green-lighted toremove 60,000 policies.

|The latest round of take-outs is scheduled for Dec. 4, says theOIR.

|This latest announcement is in addition to a late September approval of 60,000 take-outs and an earlierapproval for companies to remove 150,000 Citizens policies next month. TheOIR also approved about 6,645 take-outs in October.

| McCarty's take-out approvals are not necessarily theamounts of policies that will be removed from Citizens' book ofbusiness due to a policyholders right to opt out of a take-out andstay with the state-run insurer.

McCarty's take-out approvals are not necessarily theamounts of policies that will be removed from Citizens' book ofbusiness due to a policyholders right to opt out of a take-out andstay with the state-run insurer.

As of September, about 84,340 policies have been removed throughthe take-out process, says the OIR. According to OIR records, thesepolicies went to Florida Peninsula Insurance Co., Southern FidelityP&C, and Southern Oak Insurance Co. The three companies wereapproved to remove a combined 125,000 policies this year as ofSeptember.

|Insurers may have stepped up to take policies because doing socould give them the first shot at Citizens' books. McCarty has senta letter to Citizens urging the it to give priority to insurersthat have already been approved to take out policies withoutfinancial incentives proposed by Citizens.

|Citizens has approved a controversial plan to loan its surplus toinsurers willing to assume its policies. The low-interest, 20-yearloans are meant as an enticement since insurers must provide thesame coverage, at the same rate, as Citizens once the policy isassumed—and it is widely known that, overall, Citizens' policiesare underpriced.

|Citizens canceled an Oct. 15 Depopulation Committee meeting "toallow additional time for outside advisors to review the proposedsurplus note program."

|The cancellation followed a letter to Citizens CEO Barry Gilwayfrom Carlos A. Lacasa, chairman of the Board of Directors. Lacasarequested an independent review.

|The chairman says he agrees in principle with the proposedsurplus note program, but "given the nature of Citizens and theneed for heightened transparency, further review is paramount."

|"An outside assessment will give the public added confidencethat, if we move forward with the [program], we are doing so withall available information and a firm understanding of its potentialimpact on our policyholders and Florida taxpayers," Lacasawrites.

|Citizens is also under fire in Florida after two newspapersreported that Citizens terminated employees working in itsOffice of Corporate Integrity, which handled complaints of employeefraud or misconduct. The move drew the ire of Gov. Rick Scott, whofired a letter to Lacasa.

|Citizens followed with a press release to clarify that it hadnot eliminated its corporate integrity functions, but realignedthem under other business units, including the Office of InternalAudit, the Ethics Officer and the Employee Relations Office.

|"We believe these changes strengthen our ability to ensureCitizens employees operate with the highest level of integrity,"says Gilway in the statement.

||

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.