On Sept. 22, David Villalobos, a25-year-old real estate agent from Mahopac, N.Y., visited the BronxZoo with a single intention: To “become one” with its tigers.

On Sept. 22, David Villalobos, a25-year-old real estate agent from Mahopac, N.Y., visited the BronxZoo with a single intention: To “become one” with its tigers.

Villalobos boarded the Wild Asia Monorail, an attraction thatglides past open-air enclosures of elephants, rhinos and a redpanda. Once he reached the tiger enclosure, Villalobos leapt fromthe elevated train over a 16-foot-high perimeter fence, landed onall fours and found himself face-to-face with a 400-pound Siberiantiger named Bashuta.

| Bashuta was not amused by theintrusion.

Bashuta was not amused by theintrusion.

Villalobos suffered bites and punctures on his arms, legs,shoulders and back; a broken right shoulder, right rib, right ankleand pelvis; and a collapsed lung, before he was rescued from theexhibit.

|On Christmas Day a few years ago, the San Francisco Zoo wassimilarly thrust into the national spotlight when three young menwere attacked by Tatiana, a tigress that scaled one of the walls ofher enclosure. Brothers Paul Dhaliwal, 19, and Kulbir Dhaliwal, 23,survived—but their friend, 17-year-old Carlos Sousa, was mauled todeath.

|A bitter legal battle followed, with actions brought against thezoo for personal injury and wrongful death. The San Francisco Zooeventually settled with the brothers for $900,000 before trial andalso settled with Sousa's parents for an undisclosed sum.

|Both incidents fall under the category of Premises Liability, inwhich a property's owner or operator could, under certaincircumstances, be held responsible for any injuries that occur onsite. And while such fatal or even near-fatal incidents are in factquite rare, they do serve to highlight the liability concerns forzoos across the U.S.

|SPECIFIC POLICIES FOR SPECIAL NEEDS

|For each zoo, the coverage provided under a typical GeneralLiability policy is tailored to the exposures of that facility. Azoo's GL policy can include coverage for volunteers, fundraisers,day camps, supervised overnight stays, amusement rides, pettingzoos, zoo employees' off-site visits to schools and museums, andVIP tours, to name just a few. However, there are no blanketpolicies for the safety of the animals and visitors.

| “There are no national standardswith regard to coverages required from a Property and Casualtystandpoint,” says David Mello, vice president of client servicesfor American Specialty Insurance & Risk Services Inc., one ofthe biggest insurers of zoos in the U.S.

“There are no national standardswith regard to coverages required from a Property and Casualtystandpoint,” says David Mello, vice president of client servicesfor American Specialty Insurance & Risk Services Inc., one ofthe biggest insurers of zoos in the U.S.

“Each zoo is unique, and thus its coverage needs vary,” saysMello. Some insurers may provide glass coverage that would extendto damages caused by animals scratching or cracking theirsee-through enclosures, for example, while other carriers maynot.

|Typically, zoos will purchase no less than $1 million inCommercial General Liability limits. Quite often, these facilitieswill purchase additional Excess Liability limits at their owndiscretion.

|AZA: THE ZOO WATCHDOG REVIEWS RISK-MANAGEMENTPLANS

|One factor that comes into play when zoos shop for insurance isaccreditation by the Association of Zoos and Aquariums (AZA), awatchdog group whose seal of approval holds extremely high valueamong zoos, animal parks—and underwriters.

| An inspection team of threepeople—including one veterinarian, one expert in operations of thetype of facility being reviewed and an expert on animalhusbandry—spends three days “going through every aspect of theinstitution,” says AZA Spokesman Steve Feldman. “At the heart oftheir inspection, of course, is looking for great animal care:making sure the zoo has the best facilities, best diets and thatthe staff is well trained to meet animal needs.”

An inspection team of threepeople—including one veterinarian, one expert in operations of thetype of facility being reviewed and an expert on animalhusbandry—spends three days “going through every aspect of theinstitution,” says AZA Spokesman Steve Feldman. “At the heart oftheir inspection, of course, is looking for great animal care:making sure the zoo has the best facilities, best diets and thatthe staff is well trained to meet animal needs.”

Safety and emergency procedures are reviewed, as well as thefacility's risk-management plans, which AZA defines as thefacility's identification and assessment of the potential forinjury or harm to the visiting public and to employees.

|Exposures faced by zoo guests include human-animal contact, wetfloors, poor lighting, insufficient barrier fencing and cracksand/or holes in walkways.

| For employees, the risks entailpoorly constructed or planned exhibit-service areas, cluttered workspaces, inadequate training, and potential contact with narcoticdrugs and used hypodermic needles. Plus, of course, some zooworkers are in regular, up-close-and-personal contact with the mainattractions.

For employees, the risks entailpoorly constructed or planned exhibit-service areas, cluttered workspaces, inadequate training, and potential contact with narcoticdrugs and used hypodermic needles. Plus, of course, some zooworkers are in regular, up-close-and-personal contact with the mainattractions.

“AZA provides a seal of approval that the public can count onand that other members of the association can count on,” Feldmansays. “Insurers should look to accreditation for assurance they'redealing with a top-notch facility.”

|NEW ATTRACTIONS BOOST ATTENDANCE,EXPOSURES

| Despite the fangs and clawspossessed by the inhabitants, zoos at their most basic aren'tevaluated by insurers in a way much different from other venueswith a mission to educate and entertain the public.

Despite the fangs and clawspossessed by the inhabitants, zoos at their most basic aren'tevaluated by insurers in a way much different from other venueswith a mission to educate and entertain the public.

“As an underwriter, when it comes to most facilities and itsanimals, you tend to look at a zoo as a living museum,” says Mello.“It's when a facility has additional exposures, such as amusementrides, overnight stays or animal contact, that additionalunderwriting concerns come into play.”

|Those additional exposures are becoming more common as zoos,looking to get more visitors through the gate, are adding newattractions like rides and such features as rock walls,rope-climbing courses and even zip lines (see accompanying videobelow).

|“The challenge for zoos is attendance; they have to step outsidewhat they're used to and offer more challenging features to attractvisitors,” says Shirl Hedges, commercial-lines manager atPhiladelphia Insurance Cos., which underwrites several zoo clients.“That ends up costing them more for insurance.”

| Zip-lining has becomeparticularly popular among zoos, helping to lure a demographicwhose attention they've been after for years: the 30-and-undercrowd, which is excited by the thrill of speedily soaring among thetreetops along stainless-steel cables.

Zip-lining has becomeparticularly popular among zoos, helping to lure a demographicwhose attention they've been after for years: the 30-and-undercrowd, which is excited by the thrill of speedily soaring among thetreetops along stainless-steel cables.

At the San Diego Zoo's Safari Park, for example, visitors 12 andolder can zip as high as 160 feet above rhinos, deer and othercreatures. The Columbus Zoo in Ohio offers the Wild Zipline Safari,a series of 10 zip lines that promises visitors an aerialexpedition above giraffes and herds of other animals.

|In Florida, the St. Augustine Alligator Farm and ZoologicalPark, which was founded in 1893 and boasts all 23 species ofcrocodiles, last year installed a “Crocodile Crossing” zip-linecourse in the treetops above much of the park that has proven to bea hit with visitors looking for a more adventuresomeexperience.

| Tommy Martin, senior vicepresident at Brown & Brown Inc. in Daytona Beach, has managedthe zoo's insurance needs for more than 20 years. He discoveredthat zip lines aren't the easiest risk to place, as they have onlybecome popular in the U.S. in the last several years. Without muchloss data to go on, many E&S carriers would rather pass oninsuring them, he found.

Tommy Martin, senior vicepresident at Brown & Brown Inc. in Daytona Beach, has managedthe zoo's insurance needs for more than 20 years. He discoveredthat zip lines aren't the easiest risk to place, as they have onlybecome popular in the U.S. in the last several years. Without muchloss data to go on, many E&S carriers would rather pass oninsuring them, he found.

“It's still too new for insurers—and their reinsurers—to feelcomfortable with taking on the risk,” Martin says. Crum &Forster, a Morristown, N.J.-based standard and specialty insurer,had held the zoo's Excess policy for 15 years, says Martin, “butthey couldn't handle the zip line.”

|Richmond, Va.-based E&S insurer Kinsale now serves as thezoo's Excess carrier; its policy was placed by Brown & Brownthrough Peachtree Special Risk Brokers, a wholesaler that Martinuses frequently.

|“Given the uniqueness of the risk, we were very pleased to placeit through Kinsale with very little premium increase,” Martinadds—just a few thousand dollars extra per year for the significantadditional exposure.

|And while zip-lining above creatures with long rows of sharpteeth sounds like an insurer's nightmare, “zip-lining over animalsisn't the most dangerous thing we do,” says John Brueggen, the St.Augustine Alligator Farm's director and general manager. “We workwith king cobras and some of the biggest crocodiles in the UnitedStates. We work with a 15-foot, three-inch saltwater crocodile.That's not an easy thing to find insurance for.

|“That's what we depend on [Martin] to do for us,” adds Brueggen.“He helps us locate the insurance—and helps the insurance peopleunderstand what we do and how well we do it.”

|The proof is in the zoo's loss history, which has been minimal,says Martin—a fact not altogether surprising considering the park'ssubstantial safety precautions, particularly those for the ziplines.

|Before being allowed to cruise around some 30 feet above thezoo, participants undergo a thorough training session. Visitors whodon't use their equipment properly or fail to follow the detailedsafety instructions of no-nonsense Crocodile Crossing Manager ScottBrown are given just one warning before being pulled from thecourse.

| BIG-CATCOVERAGE: INSURING ZOO ANIMALS

BIG-CATCOVERAGE: INSURING ZOO ANIMALS

Beyond the risks to human visitors and employees that zoos mustinsure against, what about the insurance considerations for theanimals themselves?

|In some instances, zoos may purchase Mortality coverage ifthey're transporting a rare or temperamental animal or for veryrare animals on loan from another facility or country.

|Pandas, for example, are an endangered species loaned to zoos bythe Chinese government for a fee of up to $1 million per year;American zoos do not own them. Some zoos might buy Mortalitycoverage simply to be protected against loss of revenue if theanimal dies and can't be exhibited.

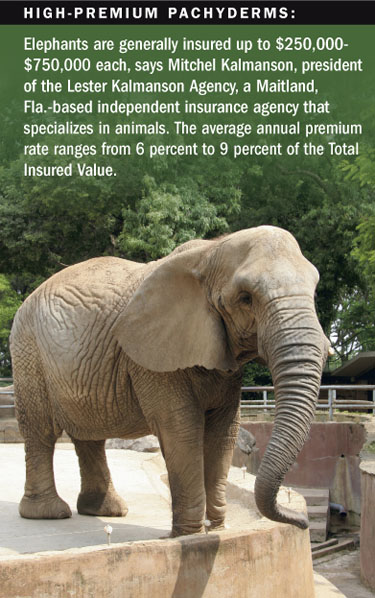

|The factors in underwriting Mortality coverage include suchconsiderations as the animal's age, sex and species, as well aswhere the creature will be exhibited and for what use (personal vs.commercial), according to Mitchel Kalmanson, president of theLester Kalmanson Agency, a specialized independent insurance agencythat provides insurance, risk-management and related services forzoos.

|The animal's enclosure is a major factor, including overallacreage of the habitat and the materials and construction qualityof the walls and fences, he says: “How high are the fences? Is it a10-foot wall? A 20-foot wall? Are there electric fences the publicdoesn't see? How are those elements secured to the ground? Are theybuilt with wood, steel or a polycarbonate plastic?” All thesefactors go into the determination of rates.

| Colin Dean, managing director atMcGowan Program Administrators, a managing general underwriter andprogram manager, has decades of experience in insuring zoos' mostvaluable asset. Zoo-animal mortality is his business, and many suchpolicies are written through E&S carriers like Ace Westchesterand Lloyd's.

Colin Dean, managing director atMcGowan Program Administrators, a managing general underwriter andprogram manager, has decades of experience in insuring zoos' mostvaluable asset. Zoo-animal mortality is his business, and many suchpolicies are written through E&S carriers like Ace Westchesterand Lloyd's.

“We write them on a livestock form: Inland Marine with abloodstock attachment,” he explains. Prized specimens get a fullMortality policy that includes disease or death by any cause asidefrom intentional slaughter.

|“As a book of business, [insuring zoo animals] is not immense,but we've got a core book of zoos for which we insure their wholestock,” he says. “As long as there's a flow of business, you canpeg rate to cover loss, and that's the way it's done.

|“By and large, zoos are very good risks,” Dean adds. “The ratesare pretty stable, and you know your losses immediately—there'sreally no long-tail exposure, excuse the pun.”

//

//

//

//

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.