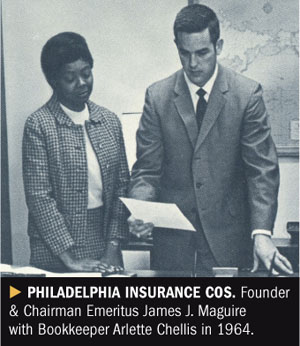

Celebrating its 50th birthdaythis year, Philadelphia Insurance Cos. has found five decades ofsuccess by hewing closely to the strategic vision of its founder,James Maguire Sr., who entered the industry as an agent sellinglife insurance to deaf people during the early 1960s.

Celebrating its 50th birthdaythis year, Philadelphia Insurance Cos. has found five decades ofsuccess by hewing closely to the strategic vision of its founder,James Maguire Sr., who entered the industry as an agent sellinglife insurance to deaf people during the early 1960s.

“My dad identified that market as an underserved niche where hecould differentiate himself,” says his son Jamie Maguire Jr., whonow serves as chairman & CEO. “So he set up his own insuranceagency and instead of being a generalist, he [focused on] certainareas where he had competitive advantages and developed creativeproducts that set him apart.”

|Today, Philadelphia pursues the same specialty strategy,providing P&C coverage to more than 100 niche markets spreadamong eight commercial sectors including health care, child-carefacilities, nonprofits, security-guard services and automobilerentals.

| Dedication to understanding itsniches thoroughly is the hallmark of Philadelphia’s strategy—andthis intimate, hands-on knowledge of the businesses it underwritesextends up into the executive suite.

Dedication to understanding itsniches thoroughly is the hallmark of Philadelphia’s strategy—andthis intimate, hands-on knowledge of the businesses it underwritesextends up into the executive suite.

The company’s second-biggest niche, for example, is sportsprograms, with Philadelphia offering dozens of products that covereverything from whitewater-rafting guides and martial-arts programsto recreation facilities such as archery ranges.

|And its leaders are accomplished athletes themselves: BothMaguire Jr. and President & COO Sean Sweeney regularly competein triathlons.

| “If we’re going to be inthat niche, it might as well be a passion,” Sweeney says. “We don’twant to be posers.”

“If we’re going to be inthat niche, it might as well be a passion,” Sweeney says. “We don’twant to be posers.”

This level of expertise exists across all the lines itunderwrites and helps Philadelphia stand out in the minds of itsclients.

|“They really understand the nature of child care,” says T.J.Comeau, risk manager for day-care provider Bright Horizons FamilySolutions. “They’ve established themselves as the playerin this business.”

|GROWTH STRATEGIES

|To fuel its growth, the carrier seeks to expand into three newniches a year, most recently adding sleep-disorder researchcenters, gun stores and surety bonds to its lineup.

|“Everything we do is a stair step off an existing product andniche where we have experience,” says Sweeney.

| Philadelphia’sfamiliarity working with day-care centers and nonprofits, forinstance, led it to expand into outpatient mental-health andaddiction-treatment facilities.

Philadelphia’sfamiliarity working with day-care centers and nonprofits, forinstance, led it to expand into outpatient mental-health andaddiction-treatment facilities.

In finding new niches, Philadelphia also relies heavily on itsnetwork of preferred agents—in keeping with the company’s agencyorigins. “It’s in our DNA,” Sweeney adds.

|Internal committees then vet all new products and underwritingand help decide when exiting a market is necessary.

|ONE-STOP SHOPPING & QUICK REACTIONS

|Philadelphia bundles different products under one umbrella togive its niche clients a one-stop-shop—such as providing automobilepolicies for day-care operators—while also providing coverage forperils particular to a class of business that some other carrierstypically avoid, such as sexual abuse and molestation.

|“In the old days you had to go to an excess-and-surplus [player]with those kinds of exposures,” observes Doug Borden, co-founderand managing director of Borden Perlman Insurance, a member ofPhiladelphia’s preferred-agent network. “Philadelphia can be verycreative.”

|This bundling of products, analysts say, helpsengender customer loyalty. “It keeps policyholders with the companylonger,” notes Robert Farnam, senior vice president of equityresearch with Keefe, Bruyette & Woods. “They’re pleased thatthere’s something designed specifically for them rather than astandard package.”

|Key to Philadelphia’s niche-based strategy is not only stayingaway from lines of coverage outside its comfort zone—it avoidsWorkers’ Compensation insurance, for instance—but also reactingquickly when a new niche fails to perform or an exposure becomestoo great.

| In the mid-2000s, for example,citing increased hurricane activity, it sold a division based inFlorida that provided homeowners’ insurance; it also brieflyentered the nursing-home arena but soon exited after deciding thatsector offered more exposures than anticipated.

In the mid-2000s, for example,citing increased hurricane activity, it sold a division based inFlorida that provided homeowners’ insurance; it also brieflyentered the nursing-home arena but soon exited after deciding thatsector offered more exposures than anticipated.

“They cut bait and ran,” says one agent in Philadelphia’spreferred network, requesting anonymity in order to speak frankly.“Some brokers might not see that as a positive, but I think itshows the management team is flexible, smart and can movequickly.”

|“They’re reactive in a good way,” adds Paul Smith, executivevice president of carrier relations for Willis. “They have alaser-focused approach and they don’t want to be all things to allpeople.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.