NU Online News Service, May 8, 11:07 a.m.EDT

|A recent survey leads The Council of Insurance Agents &Brokers to declare that the commercial property and casualty markethas hardened.

|“We've been cautious up to now about declaring a market turn,but I think it's reasonable to say that the market has made a hardturn after two quarters of price increases and tighterunderwriting,” says Ken A. Crerar, president and chief executiveofficer of The Council, in a statement. “It's difficult to predictlength and severity, but the market has turned.”

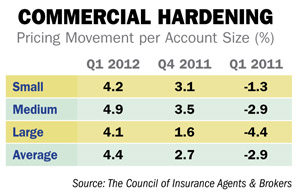

Pricing for small, medium and large commercial accounts was upan average of 4.4 percent during the first quarter, according TheCouncil's quarterly market survey.

|The increase continues a trend. Pricing was up an average of 2.7percent on all accounts during 2011's fourth quarter afterbeginning to edge up nearly 1 percent in the third quarter lastyear.

|Going back a year, pricing was down 2.9 percent on small, mediumand large accounts during the first quarter in 2011.

|Brokers who responded to the survey say losses from catastrophesdrove rate increases. Hard-to-find coverage such as earthquake andflood increased 25 percent, says another broker. A new version of ahurricane model from Risk Management Solutions also drove up rates,especially on the coast.

|The greatest increase from the fourth quarter last year to thefirst quarter this year was seen in large accounts. Rates here wereup an average of 4.1 percent this quarter compared to up 1.6percent during 2011's fourth quarter.

|By line, workers' compensation and commercial property appear tobe leading the rate-hardening charge. Workers' compensation priceswere up 7.4 percent in the 2012 first quarter after going up 7.5percent during the 2011 fourth quarter.

|Commercial property was up 6.5 percent for the first quarter.Pricing in the line was up 5.7 percent the last quarter of2011.

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.