NU Online News Service, April 10, 3:12 p.m.EST

|While the general consensus for global property-insurance rateshas been that rates in catastrophe-exposed areas are rising whilerates in areas without such exposures are remaining flat, pricingduring the 2012 first quarter is showing property rates climbingacross the board, according to Marsh.

|In its latest Global Insurance Market Quarterly Briefing, Marshsays property-insurance rates are rising in most geographies, withnon-catastrophe-exposed property risks in the U.S. climbing by upto 10 percent. Catastrophe-exposed risks in the U.S., meanwhile,increased between 10 percent and 20 percent, Marsh says.

| Around the globe, Marsh says it expects rates to continuerising moderately for both catastrophe- and non-catastrophe-exposedrisks.

Around the globe, Marsh says it expects rates to continuerising moderately for both catastrophe- and non-catastrophe-exposedrisks.

Rate increases are largely being driven by insurers attemptingto recoup losses incurred from extensive catastrophes in 2011, thebriefing states. Marsh says that 2011 “was the second-most-costlyyear for overall insured losses, had the highest ever level ofinsured earthquake losses, and, in Thailand, saw the most costlysingle flood event in history.”

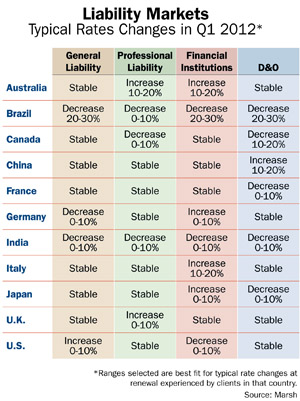

|For liability markets, Marsh says pricing around the globe has“generally remained stable, with most classes either flat orexperiencing slight decreases at renewal as capacity remainedplentiful.

|Marsh notes that the U.S. primary-casualty market “continued toshow signs of stress. Overall, rates are expected to increase,although in a tight range—typically flat-to-5-percent increase atrenewal—for all lines of casualty business.”

|The workers' compensation market in the U.S. saw combined ratiosat their highest levels in more than a decade in 2011, Marsh says,as claims frequency and severity continued to grow.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.