NU Online News Service, March 26, 12:31 p.m.EDT

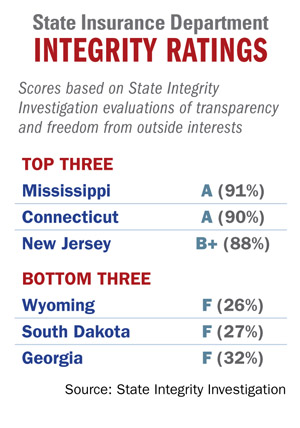

|Sixteen state insurance agencies failed a nationalstate-evaluation test, but Mississippi came out on top of the50-state review.

|The State Integrity Investigation, a researchproject sponsored by The Center for Public Integrity, GlobalIntegrity and Public Radio International, had reporters in all 50states evaluate the corruption risk, covering issues oftransparency, accountability and ethics enforcement in individualstates.

| The report gives an overall evaluation of individualstates and breaks the results down into several categories thatinclude state insurance commissions.

The report gives an overall evaluation of individualstates and breaks the results down into several categories thatinclude state insurance commissions.

Wyoming's insurance department was at the bottom of the listwith a score of 26, earning it a grade of F. Fifteen otherdepartments received the same letter grade, despite posting highernumber grades.

|On a scale of 0-100, the Wyoming insurance department received 0for citizen access to the asset-disclosure record of the insurancecommission and disclosure of documents filed by insurancecompanies. It received a score of 33 for the department avoidingconflicts of interest and a 37 for both protection fromoutside influence and effectiveness of conflict-of-interestregulations.

|Its highest score of the six evaluation questions was 50 for:“Does the commission have sufficient capacity to carry out itsmandate?”

|By contrast, Mississippi's insurance department scored an “A”for its 91 percent evaluation. The state received 100 percentscores for four questions and 81 percent for disclosure ofdocuments filed by insurers. Its lowest score, 66 percent, was forcitizen access to records of the department.

|In a statement, Mississippi Commissioner of Insurance MikeChaney says, “I am proud and honored that this report recognizesthe outstanding effort the department makes in enforcing the lawsand regulations in the state while providing our citizens with themaximum amount of consumer protection.”

|He went on to say, “Every day our dedicated staff works hard tofulfill the goals of the Mississippi insurance department increating the highest degree of economic security, quality of life,public safety and fire protection for the state's citizens at thelowest possible cost. We are committed to providing assistance toconsumers in a timely, caring and ethical fashion.”

|Mississippi's insurance department was followed by Connecticut,which was also graded “A” and earned a score of 90.

|Next came New Jersey, graded “B+” with a score of 88percent. The state of Washington's department also earned a “B+”with a score of 87.

|In overall state rankings, New Jersey was the highest with agrade of “B+” and score of 87 percent, while Connecticut rankedsecond with a grade of “B” and score of 86 percent. Washington wasranked third with a grade of “B-” and score of 83.

|Georgia earned the lowest overall state score of “F” and 49percent.

|The 15 other state insurance departments receiving failinggrades were:

- South Dakota—Score 27 percent

- Georgia—Score 32 percent

- New Mexico—Score 41 percent

- Nevada—Score 43 percent

- Idaho—Score 47 percent

- Michigan—Score 50 percent

- Maine—Score 51 percent

- Maryland—Score 52 percent

- Arizona—Score 53 percent

- Kansas—Score 55 percent

- South Carolina—Score 55 percent

- North Dakota—Score 57 percent

- Hawaii—Score 57 percent

- Colorado—Score 58 percent

- Texas—Score 58 percent

A spokesman for the National Association of InsuranceCommissioners says the leadership declined to comment on theevaluation.

|A request for comment from the Wyoming Insurance Department wasnot immediately returned.

|Updated: 4:30 p.m. EDT concerning comment from the WyomingInsurance Department.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.