Commercial property and Workers'Compensation continue to lead rate increases in MarketScout'slatest survey on market conditions.

Commercial property and Workers'Compensation continue to lead rate increases in MarketScout'slatest survey on market conditions.

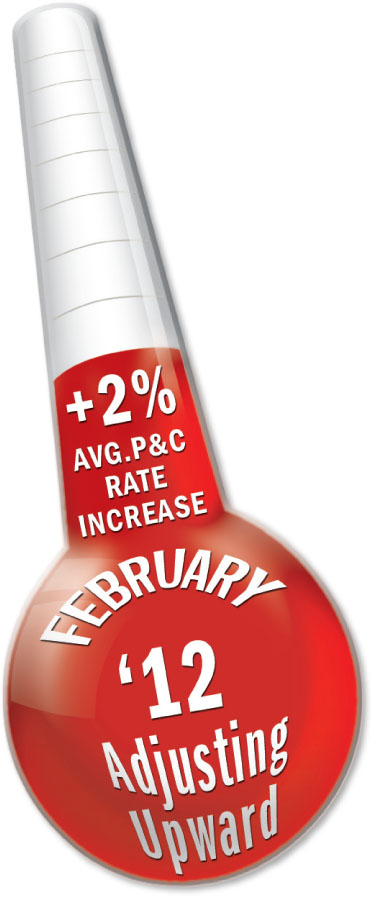

The Dallas-based insurance-distribution and underwriting companyreports a 2 percent increase in the U.S. composite commercial-rateindex for February.

|All coverage classes the survey tracks were up, except forFiduciary and Surety, which were flat. Commercial Property andWorkers' Comp led the way with rate increases of 3 percent each forthe month.

|The results follow 1 percent increases in the composite-rateindex during November, December and January.

|Until the recent uptick, rates had been down since March 2005.During this time, rates fell to an all-time low of minus-16 percentin December 2007—the biggest drop since MarketScout began thepricing survey to analyze market conditions in July 2001.

|The company “continues to see evidence of a slowly turningmarket,” MarketScout CEO Richard Kerr says in a statement.

|By coverage, Businessowners', General Liability, and Umbrellaand Excess were each up 2 percent. Business Interruption, InlandMarine, Commercial Auto, Professional Liability, Directors andOfficers Liability, and Employment Practices Liability were each up1 percent.

|Rates were up 2 percent on a month-to-month basis formedium-size accounts, the same increase as last month. Small andlarge accounts were up 2 percent from 1 percent in January; andjumbo accounts were up 1 percent from being flat the priormonth.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.