NU Online News Service, March 7, 1:41 p.m.EST

|Larger companies benefited from carrier competition on theiremployment practices liability risk receiving more rate decreasesthan small and midsize businesses, according to a report frominsurance broker Marsh.

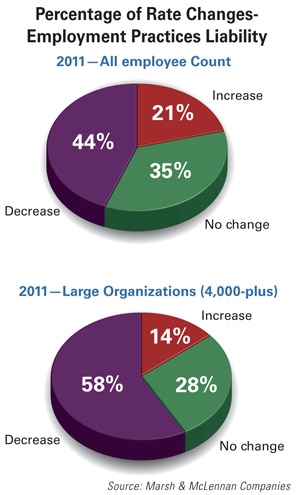

|In Marsh's latest benchmarking trends report on EPLI, 58 percent of largeorganizations (4,000 or more employees) received rate decreases intheir coverage in 2011. That translated into close to 4 percentaverage rate decrease for the year. While the majority of largeorganizations enjoyed decreases, 14 percent saw rate increaseswhile 28 percent saw no change.

|For all businesses, decreases still outweighed increases with 44percent seeing their EPLI insurance decrease by an average of closeto 2 percent. Twenty-one percent saw their rates increase while 35percent saw no change.

|

Marsh says in response to the soft market conditions insurersplaced upward pressure on rates, notably for small and midsizecompanies.

|Companies purchased on average more than $10 million in limitsin 2011, with the larger companies purchasing higher limits thataveraged in excess of $28 million.

|The highest limits were purchased by financial institutions,health care and the retail and wholesale sector “commensurate withthe higher exposures in those industries.”

|Financial institutions with more than 4,000 employees purchasedthe highest total of EPLI limits at average of close to $48million.

|Marsh went on to say that increased enforcement action by theEqual Employment Opportunity Commission (EEOC) and increased claimsand exposure on EPL, contributed to the purchasing trends.

|Increased staffing at EEOC and commitment of more resourceshelped the agency reduce its pending files by 10 percent. Thatactivity pushed recovery on behalf of employees to more than $365million.

|Adeola Adele, Marsh's senior vice president, national EPLIproduct leader, told National Underwriter that it is tooearly to tell precisely what direction rates are going in, butgenerally they are holding flat and the range of increase ordecrease, “if any” is consistent with the fourth quarter of 2011with a range of increase or decrease of 5 percent.

|She says that as far as companies getting rate increases lastyear, carriers had more success with small companies by justifyingtheir actions because of increased losses and claims fromindividuals.

|It was more difficult with midsize clients, says Adele, becauseof pushback from the broker who demanded justification for rateincreases. Carriers were successful with accounts where claimsexposure increased due to lay-offs and M&A activity.

|Because of the increase in EEOC enforcement actions, Adele saysthere were more small and midsize companies purchasing EPLIcoverage for the first time. She says the number of large companiesmaking purchases held steady.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.