NU Online News Service, Feb. 22, 3:08 p.m.EST

|Consumers do not want to do all their insurance shopping online,they care about more than just price, and good claims service issomething consumers expect, rather than an extra bonus that willhelp a company's retention rate, according to the findings of anErnst & Young survey.

|The survey polled 24,000 respondents across 23 countries.E&Y breaks down the results for the Americas respondents in areport, “Voice of the Customer: Time for Insurers to Rethink Theirrelationships.”

|Regarding property and casualty consumers' online habits,E&Y notes that “received wisdom” is that internet resources aregrowing and that in the future, online will be the dominant channelfor both research and transactions. But the study says, “Ourresearch indicates that while online is an important part of thefuture, it is just one component of an integrated channelmanagement capability that is critical to growth.”

|In the Americas, E&Y says 23 percent of customers are usinga range of online channels to research purchases, well under the 32percent of customers in Europe and 39 percent in Asia-Pacific thatare using online sources.

|As for actual insurance purchases, just 7 percent of consumersin the Americas use online channels compared to 14 percent in bothEurope and Asia-Pacific.

|E&Y expects, based on experience around the globe, thataggregators and competitive websites will gain in prominence in theAmericas, describing the online insurance world today as “still inits infancy.”

|But the study contends that personal contact is still essentialnow and will continue to be in the future. “Customers clearlyvoiced a desire for both improved online access and continualpersonal contact when it matters.”

|E&Y adds, “In our opinion, a true multichannel approach toservicing the customer is essential, not just today, but in theyears to come.” In fact, E&Y adds that customers expectinsurers to integrate different methods of communication so theycan choose the method that best suits them at any given time.

| On consumer attitudes toward pricing, E&Y says thisfactor is “particularly sensitive” for new business, but that atrenewal, customers will also consider the service they havereceived and the confidence they have in the provider.

On consumer attitudes toward pricing, E&Y says thisfactor is “particularly sensitive” for new business, but that atrenewal, customers will also consider the service they havereceived and the confidence they have in the provider.

While price remains a key driver for purchasing behavioroverall, with 58 percent of Americas consumers saying it was thekey factor in purchasing insurance, the consumers also considerwhether the brand is well known or trustworthy (42 percent),customer service (34 percent), whether they hold another productfrom the same insurer (31 percent), the company's track record orreputation (29 percent), and the company's financial strength andstability (25 percent).

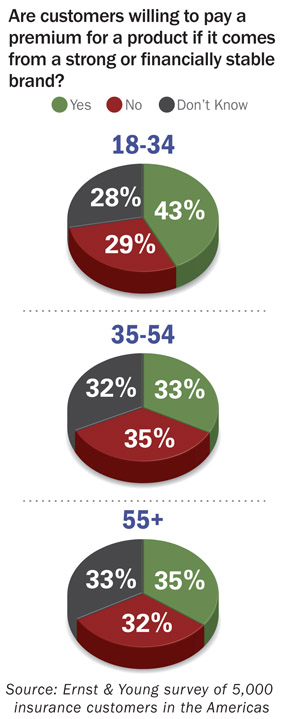

|Additionally, a relatively high proportion (43 percent) of youngconsumers (18-34) say they are more willing to pay a premium for afinancially stable brand. Only 33 percent of customers in the 35-54age bracket say the same.

|E&Y recommends that insurers pay attention to price, butalso focus on product flexibility, brand positioning, customersegmentation and ease and simplicity of the sales and renewalprocesses. Furthermore, E&Y says insurers must manage theirbrand online to “ensure that blogged and tweeted comments reflecttheir brand values.”

|For claims service, E&Y says that while “received wisdom” isthat a good claims experience will drive loyalty, its researchshows that a good claims experience is now expected.

|“Excellent claims service is expected and will not, in itself,drive loyalty or customer retention,” the study says. However, apoor claims service is likely to drive customers away.

|The study addresses other issues, such aswhether customers respond to cross selling. While many insurersfeel customers resent insurers trying to sell them additionalproducts, E&Y says research shows that insurers who understandcustomers' needs and offer the right products can cross-sell,up-sell and repeat-sell effectively.

|E&Y also says insurers can influence customer retention morethan they may believe. “Our research shows that customers, as ageneral rule, do not wish to switch product providers in theAmericas,” the study says. “Some 65 percent of consumers are eithernot likely or not at all likely to change insurers in the next fiveyears.”

|However, E&Y notes that across nearly all countries,consumers will switch if the insurers make little or no effort toretain them. “This is particularly unfortunate given that in allbut one of the countries we surveyed, more than half of consumersindicated that they would have been more likely to renew had theybeen contacted by their insurer or agent.”

|For a breakdown of the habits of life and annuity customers, seethe LifeHealthPro story, E&Y Debunks the Top 5 Life and Annuity Myths.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.