NU Online News Service, Jan. 3, 2:23 p.m.EST

|The shift from single or small groups of physicians practice tomulti-specialty and multi-state physician networks and hospitalswill likely drive a change in the medical professional liability(MPL) insurance sector, says a report from Moody's InvestorService.

|Alan Murray, vice president at Moody's and author of the report,says there will be a “shift in market share toward MPL (also knownas medical malpractice) insurers with multi-specialty andmulti-state underwriting and claim-servicing capabilities for bothindividual medical practitioners and institutional healthcareorganizations over time.”

| Healthcare is becoming more institutional in its deliveryof services and “more corporate in its oversight and governance,”says the report, and given then difference in coverage needs forindividual medical professionals and institutional providers,“Moodys' finds that the participation in the MPL sector byspecialty MPL underwriters—for whom the MPL line is theirpredominant business line—is more significant in the individualpractitioner and small-to-medium group market.

Healthcare is becoming more institutional in its deliveryof services and “more corporate in its oversight and governance,”says the report, and given then difference in coverage needs forindividual medical professionals and institutional providers,“Moodys' finds that the participation in the MPL sector byspecialty MPL underwriters—for whom the MPL line is theirpredominant business line—is more significant in the individualpractitioner and small-to-medium group market.

Multi-line and multi-state underwriters will gradually have agreater share of the institutional market, Moody's says.

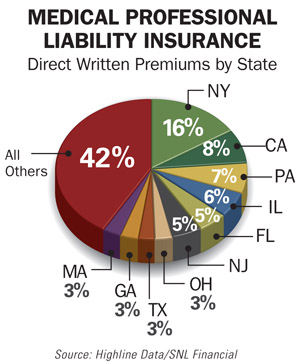

|Currently, the MPL sector remains fragmented with more than 200insurance groups participating—the largest of which has a 7 percentshare of direct written premiums. Many carriers are state-specific,but they could be pressured by the larger, multi-state carriers ifthe state-specific carriers “lack the expertise in thisdually-focused insurance market,” or lack the financial strength tooffer adequate limits.

|Opportunities in the market may arise as there continues to be acontinued “downward shift” of services provided by trained orlicensed non-physician medical professionals, who also need MPL.Coverage here will likely be new and different.

|Though it accounts for just 2 percent of annual direct premiumsin the U.S. P&C industry, MPL is integral to the healthcaresystem and has performed well in recent years thanks to a hardmarket in the early 2000s and a drop in severity due to tort reformand court precedents, according to Moody's.

|The combined ratio in the sector has dropped from more than 140in 2011 to about 60 in 2010, leading to ample margins in MPLinsurers' reserves. Moody's says the sector is likely to enjoyfavorable ratios for at least the next 1-2 years.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.