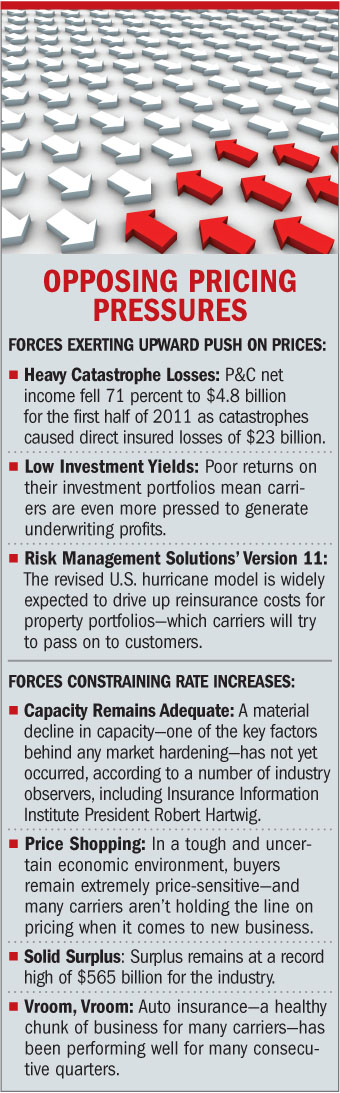

After a year of near-recordcatastrophe losses, increasing combined ratios and highlydisappointing investment yields, the natural expectation is thatinsurers looking to stabilize their books have but one choice: toraise prices.

After a year of near-recordcatastrophe losses, increasing combined ratios and highlydisappointing investment yields, the natural expectation is thatinsurers looking to stabilize their books have but one choice: toraise prices.

And yes, some signs of a market hardening are becoming visible:The most recent Council of Insurance Agents & Brokers pricingsurvey, for example, indicated average rates in the third quarterturned positive for the first time since the end of 2003.

|Also, MarketScout’s latest pricing barometer yet again showed norate decrease, prompting its CEO, Richard Kerr, to opine, “With twoconsecutive months of a flat market, we are on the cusp of acomposite rate increase.”

|But the degree (how high will prices go?) and extent (how manylines of business will see a bump?) of the hardening is very muchan open question—and plenty of factors are conspiring to keep ratesconstrained.

|“When you look at the underlying indicators, we should be seeingmore movement in rate—but we’re not seeing it,” says AlastairSwift, CEO of global placement for Willis Ltd.

|What accounts for this?

|Capacity, while not exactly robust, is still strong enough tomaintain the market at its current state, according to some brokersand others.

|“There’s still plenty of capacity in the market to dampenprices,” Ken A. Crerar, president of the Council of InsuranceAgents & Brokers, said in an October statement.

|And while some insurers insist that it’s high time theircompanies start making serious moves to boost rates, the reality—atleast for many—is that cash-conscious clients could be lost ifsqueezed too hard.

|“While carriers are dealing with making less money, clients havetheir own economic challenges,” says Eric Andersen, CEO of Aon RiskServices U.S. “Customers are struggling in their own businesses anddo not have more money to pay for insurance increases.”

|And then there’s the fact that while business is tough forinsurers, it isn’t horrendous.

|Marty Hughes, chairman and CEO of Chicago-based insurance brokerHub International, notes that carriers’ return on equity is around6 percent. This isn’t good, but it also isn’t the figure thattypically marks the end of a soft market—where most carriers reachzero and work to improve underwriting earnings through rateincreases.

|SPLIT PERSONALITY ONPRICING

|So how to characterize this pricing environment, with someforces auguring for a pricing shift and others working hard to holdback a true hardening?

|“The markets seem to be a bit schizophrenic,” says Hughes. “Someparts are up; other parts are down. There is clear pressure pushingrates up, and carriers are asking for rate on renewals—but they arebeing very aggressive on pricing new business.”

| And the outlook for next year? “Isee the markets stabilizing a bit, but I don’t see anythingresembling a hard market in the near future,” Hughes says.

And the outlook for next year? “Isee the markets stabilizing a bit, but I don’t see anythingresembling a hard market in the near future,” Hughes says.

Kevin Brogan, managing director and national practice leader forP&C products and services at Wells Fargo Insurance ServicesUSA, also believes the markets in 2012 will probably look a lotlike the second half of 2011, barring some major loss that movesthe marketJoe Plumeri, Willis Group Holdings chairman and CEO,observed during an October conference call with financial analysts,“What we are getting from carriers is a sense [of] hope…that rateswill go flat in the U.S. to maybe up a little bit, because thestatistics require it and the economics require it.”

|But that optimism may be misplaced. While carriers “would liketo see a little bit of a breeze, I haven’t seen it in exposures,and I haven’t seen it in real rates,” Plumeri said.

|Indeed, in Andersen’s view, carriers are not hopeful butactually “very depressed” and fearful that the same factors keepingprices where they are now will continue for the next 12 to 18months.

|David Eslick, chairman and CEO of Marsh & McLennan Agency,concedes that carriers are definitely suffering. Losses arestraining reserves, and loss in investment income is adding to themisery. Ultimately, the only place to make money isunderwriting.

|But unless they exhibit “stiffer backbone” and stop competing soruthlessly with each other for new business, they will not begin toget the rate they need, Eslick adds.

|LINE-BY-LINE

|While an overall hardening of the market may not be guaranteed,a consensus exists that individual lines will turn.

|“There is clear belief that there will be some turn on price” in2012 on a line-by-line basis, asserts H. Wade Reece, chairman andCEO of BB&T Insurance Services.

|Willis’ Swift adds there are already patches of rate firming incertain lines, such as property and workers’ compensation.

|Brogan at Wells Fargo agrees that workers’ compensation ishardening, with small accounts experiencing small increases, whilelarger national accounts are increasing their retentions to keeptheir premiums steady.

|Auto, too, is consistently getting rate increases.

|SOME POSITIVE SIGNS FOR 2012

|One positive sign for insurers is an improving wholesale market,says Reece, whose BB&T owns the wholesale-brokerage firm CRCInsurance Services.

|And on another positive note, Reece adds that the excess andsurplus lines market is seeing some rate increases, and businessthat had moved to the retail market is returning—as admittedcarriers show more underwriting discipline.

|“It’s a good sign for the industry,” says Reece.

|Brogan adds that upward rate changes are significant forcommercial accounts with property risks that have any exposure towind, flood or catastrophe—a shift driven in part by the revisionsto Risk Management Solutions’ Version 11 of its U.S. hurricanemodel.

|Property accounts without these exposures may see smallincreases—but probably not enough to satisfy insurers’ needs forunderwriting profit.

|George A. “Shad” Steadman III, vice chairman of Rutherfoord, amember of Marsh & McLennan Agencies, says that his overallsense of the markets is that “there is no significant firming ofrates, but stabilization.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.