NU Online News Service, Nov. 16, 11:35 p.m.EST

NU Online News Service, Nov. 16, 11:35 p.m.EST

Another legislative battle over Florida's personal injuryprotection automobile insurance system is brewing, with the state'sgovernor and chief financial officer leading the charge.

|In a joint statement, Gov. Rick Scott and CFO Jeff Atwateroutlined four steps to reform the no-fault law, first enacted inthe early 1970s, which requires drivers to have PIP that provides$10,000 in coverage per person for medical bills, regardless offault in an accident.

|Scott said the state "must have significant PIP reform."

|The proposal from Scott and Atwater was supported by thePersonal Insurance Federation of Florida (PIFF), who said reformsto the "broken system" are "long overdue."

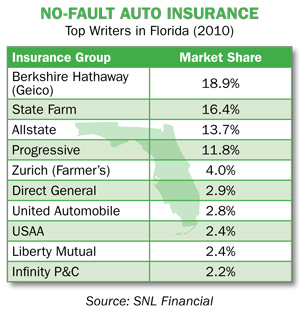

|While the reform proposal "should encourage consumers that helpis on the way," PIFF remains "cautiously optimistic about thedirection" of any PIP reform legislation, said Michael Carlson,executive director of PIFF, whose charter members include StateFarm, Allstate and Progressive.

|"Part of the reason Florida is in the midst of an auto insurancefraud crisis is due to timid, superficial changes which have simplypushed the problem off for decades," he added in a statement.

|PIP reform was not addressed during the 2011 LegislativeSession.

|A report on the no-fault law in Florida published by theNational Association of Mutual Insurance Companies says the state'slawmakers have "always seemed a step behind trying to combat thelatest healthcare tactics," resulting in "runaway increases in PIPcosts.

|For years the industry has alleged fraud by the state's healthcare clinics, along withoutrageous attorneys' fees and organized staged-accident rings totake advantage of holes in the system.

|"Regrettably, our state's auto insurance system has been takenover by a circling pool of piraya—fraud clinics, lawyer referralservices and organized crime—that have been making millions on thebacks of every Floridian with a car in the driveway," Atwater saidin a statement.

|Scott and Atwater's reform proposal includes measures to preventfraud, and reform the role attorneys and medical providers play inthe PIP system.

|The Property Casualty Insurers Association of America (PCI)recently released a special report on Florida's no-fault system, concluding thatfalse claims have cost the state's drivers more than $800million.

|The National Insurance Crime Bureau has said Florida led theU.S. in staged motor vehicle accident "questionable claims" between2007 and 2009. Four out of the 10 U.S. cities with the highest rateof questionable auto claims are in Florida.

|The report published by NAMIC was written by Jeffrey O'Connell,Peter Kinzler and Dan Miller. O'Connell proposed no-fault autoinsurance in 1965 with the intent to rectify failures in the tortliability system.

|However, Florida and other no-fault laws did not keep up withchanges in cost-control mechanism," the report says.

|From the 2008 fourth quarter through the 2010 first quarter, PIPcosts were up 40 percent and the Insurance Research Councilestimates a 50 percent increase, measure to the 2010 fourthquarter.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.