From social media to Google Street View, Web 2.0 has transformed the way businesses operate today. Industries like property and casualty (P&C) insurance are shedding their paper-based processes as quickly as they adopt state-of-the-art connectivity—and they expect their service providers to be equally techno-savvy and skilled as well.

From social media to Google Street View, Web 2.0 has transformed the way businesses operate today. Industries like property and casualty (P&C) insurance are shedding their paper-based processes as quickly as they adopt state-of-the-art connectivity—and they expect their service providers to be equally techno-savvy and skilled as well.

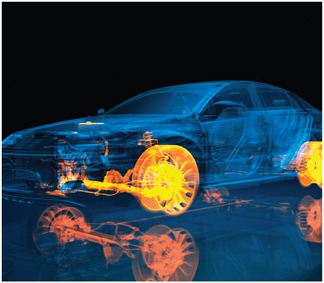

Accident Reconstruction 2.0 takes a look at the newer resources available to the engineers who investigate vehicular accidents and focuses on how they are using them to help insurance adjusters resolve automotive claims. The result is a business model that can offer efficiencies, especially as more vehicles are equipped with event data recorders (EDRs), but there are working realities that hinder usage and cost savings. Claims staffs who understand the strengths and limitations of state-of-the-art accident reconstruction resources will be able to resolve vehicle accident claims with greater skill, speed, and success.

Luddites in a High-Tech World

The next-generation internet revolution is not without challenges for accident investigators. As many insurance carriers go paperless, some few companies and industry partners remain married to lower-tech processes—a "no tech" senior attorney recently even dared to request a vehicle inspection narrative on VHS tape. Caught between extremes, engineers and other expert service providers need to be flexible to service clients with variable appetites for technology.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.