NU Online News Service, Sept. 1, 1:56 p.m.EDT

|Homeowners with flood insurance are less satisfied with theirpolicy coverage than those who opt not to carry it, according to asatisfaction survey of homeowners insurance released by J.D. Powerand Associates today.

|The Westlake Village, Calif.-based marketinginformation-services company says that among homeowners with floodinsurance, overall satisfaction averages 735 on a 1,000-point scalein this year's study.

|By comparison, satisfaction among homeowners with earthquakeinsurance coverage averages 766.

|Overall satisfaction with homeowners insurance companiesaverages 769, an improvement of 19 points from last year'sstudy.

| Jeremy Bowler, senior director of the insurance practiceat J.D. Power, says he believes there are a few reasons for thisdissatisfaction with flood insurance. Consumers are not happy thatthey often have to go out and purchase the coverage separately fromtheir homeowners policy and what they purchase “is not great” norsuited to their needs. Consumers, he believes, also feel that theyare not getting what they pay for.

Jeremy Bowler, senior director of the insurance practiceat J.D. Power, says he believes there are a few reasons for thisdissatisfaction with flood insurance. Consumers are not happy thatthey often have to go out and purchase the coverage separately fromtheir homeowners policy and what they purchase “is not great” norsuited to their needs. Consumers, he believes, also feel that theyare not getting what they pay for.

However, satisfaction with homeowners insurance companies ranksbelow the average for auto insurance companies, which averaged 790in the report released in June.

|In its 11th year, the study is based on responses from more than9,100 homeowners insurance customers. It was conducted betweenApril and July.

|The study measures customer satisfaction with homeowners insurance companies byexamining five key factors: policy offerings; price; billing andpayment; interaction; and claims.

|Reflecting on Hurricane Irene, J.D. Power says fewer than 1 in10 homeowners insurance customers in New England and theMid-Atlantic states report carrying flood insurance prior to thestorm.

|A higher proportion of policyholders in the Gulf states—morethan 25 percent—carry flood coverage, but J.D. Power calls thatnumber “a relatively low proportion, considering the frequency ofhurricanes and other severe weather events in the region.”

|“So far, 2011 has been a tough year for the property insuranceindustry due to the occurrence of multiple natural catastrophes[throughout the United States], which have driven home thenecessity among many U.S. consumers of having adequate homeownersinsurance coverage,” says Bowler.

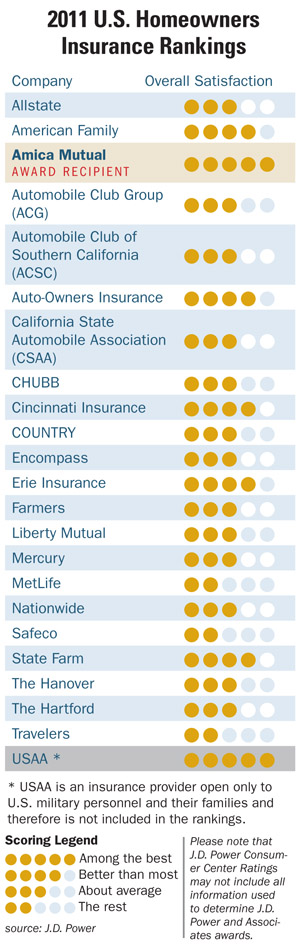

|As far as company rankings are concerned, Amica Mutual rankshighest for the 10th consecutive year among homeowners insurancecompanies and performs particularly well in all five factors thatcontribute to overall customer satisfaction.

|Following Amica Mutual in the rankings are Auto-Owners Insuranceand Erie Insurance (in a tie), Cincinnati Insurance, State Farm andAmerican Family.

|USAA, an insurance provider open only to U.S. military personneland their families, and therefore not included in the officialrankings, also achieves a high level of customer satisfaction.

|This story was updated to show the correct score for COUNTRYin the data chart.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.