Copper thieves have fueled an explosion of claims for insurersof vacant and idle properties, but increased loss potential has notdeterred competition in either the residential or commercialvacant-property insurance markets, two special-risk expertssay.

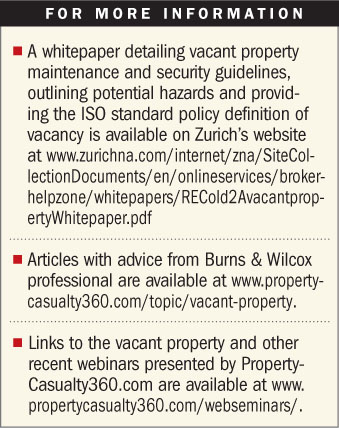

| During a webinar titled “The New Edifice of Vacant Property: ProtectingAsset Value as Commercial Real Estate Slowly Recovers”presented by PropertyCasualty360.com, Jeff Shearman, seniorrisk-engineering consultant for Zurich Services Corp., reports thatZurich saw “a big spike in copper claims when the price of scrapcopper went over $3 per pound.”

During a webinar titled “The New Edifice of Vacant Property: ProtectingAsset Value as Commercial Real Estate Slowly Recovers”presented by PropertyCasualty360.com, Jeff Shearman, seniorrisk-engineering consultant for Zurich Services Corp., reports thatZurich saw “a big spike in copper claims when the price of scrapcopper went over $3 per pound.”

Referring to thieves as “people who mine resources” inunoccupied buildings, Shearman describes a case in his town—“alow-crime area”—involving someone who climbed up to the roof of astrip mall to remove air-conditioning units of vacant tenant spacesin order to get the copper out of them.

|Both Shearman and co-presenter Christopher Zoidis, vicepresident of the Special Risk Division of wholesaler/MGA Burns& Wilcox, say other scrap metals, such as aluminum, are alsofueling a jump in insurance claims from insured vacantbuildings.

|While outside air-conditioning units are easy targets, Burns& Wilcox is also seeing claims where there is entry into thebuilding to remove copper plumbing pipes and wiring.

|“We have had more than one instance where the thief actuallystayed for a period of 24 or 48 hours and literally stripped outevery piece of copper tubing and every piece of copper wiring,”Zoidis says, noting that there is typically a lot of damage done tothe building itself as these parts are being removed.

|More creative thieves will pose as uniformed maintenance people,rather than breaking and entering, he says.

|A slide displayed while Zoidis was describing thesevacant-property insurance-claims examples indicated that the dollarfigure associated with the copper claims is $275,000 and up. Incontrast, claim values for two other common sources of losses—water damage caused by freezing pipes and trip-and-fall claims forthird parties outside insured premises—were roughly $75,000 and$30,000, respectively.

|VACANT BUT VALUED

Zoidis said vacantbuildings—both residential and commercial—have become moreappealing to sellers of insurance.

“A few years ago, carriers began to pursue vacant property as adesired class”—especially on the excess-and-surplus lines side, hesays.

|By 2010, both standard and E&S carriers had become “very,very aggressive” in pursuit of this business, Zoidis says,referring to carriers' willingness to liberalize endorsements tostandard ISO (Insurance Services Office) policy forms that wouldhave otherwise excluded perils like vandalism, theft and waterdamage.

| In the post-2010 environment, “inmany cases, the market drove a vacancy discount,” making it cheaperto insure a building that was vacant than it was when it wasoccupied, he adds.

In the post-2010 environment, “inmany cases, the market drove a vacancy discount,” making it cheaperto insure a building that was vacant than it was when it wasoccupied, he adds.

This is the reverse of the situation that has traditionallyprevailed. Prior to 2010, rating penalties existed because insurersperceived a high moral hazard on vacant properties—in other words,a high likelihood that a distressed insured would perpetrate a lossto collect policy proceeds.

|And many standard carriers would cancel or nonrenew an existingpolicy once a building became vacant, he recalls.

|But the characteristics of vacant properties have changed,driving altered insurer views of the hazard potential, Zoidis says,explaining that a vacant property is often no longer an old,rundown, abandoned-looking building in an undesirablelocation.

|Now, there are vacant buildings that are newly constructed andhighly protected with automated sprinkler systems andcentral-station burglar alarms. And “they are located in everyneighborhood on both the residential and commercial side,” hesays.

|Zoidis reports that there are some signs the market is“tightening up a bit” as losses pick up for vacant properties, buthe asserts that the class is still aggressively pursued by carrierstoday.

|“It is very prevalent to see a special [commercial] form orDwelling Property 3 [all-risk personal] form,” he says, adding thatsome personal insureds can even get replacement-cost coverageinstead of just actual-cash-value coverage.

|But forms vary by carrier, and some have security requirements(a central-station burglar alarm, for example) before they will addtheft, he says.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.