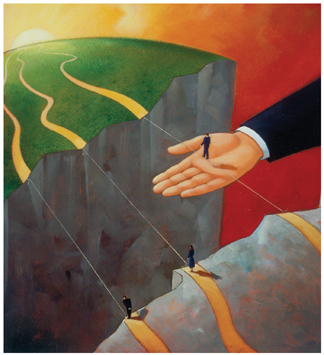

Effectively managing claims has historically proved to be a complex task, to put it mildly. With so many steps and variations in each process, it is no wonder that insurers struggle to consistently improve claims operations. Because total cost of indemnity represents a significant portion of an insurer's costs, reducing the expense of claims processing is imperative for any insurer. However, cost efficiencies cannot come at the expense of a policyholder's service needs and right to receive a fair and equitable settlement for a valid loss. Given that the claims experience is a primary driver of policyholder satisfaction and loyalty, the need to deliver a high-quality experience is equally as important as cutting costs.

Insurers pursuing opportunities to transform and optimize claims functions frequently consider packaged applications. All too often this technology-driven approach ignores the business outcomes an insurer is trying to achieve and fails to consider the people, process, and integration components needed to enable holistic improvement. In addition, packaged applications rarely offer the agility needed to support claims operations and processes that undergo frequent change, forcing insurers to adapt their business to the way the systeem works. The result is isolated and broken processes beset with cumbersome manual handoffs and work-arounds that only increase costs and can lead to policyholder dissatisfaction.

BPM Benefits

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.