A lot, according to an analysis developed by Citizens Property InsuranceCorp.

|The state-created insurance carrier was asked to draw updetailed numbers for Gov. Rick Scott and members of the FloridaCabinet that would spell out just how much more policyholders—thosein and out of Citizens—would have to pay if a large hurricanestrikes.

|Those homeowners with Citizens' policies could find themselvespaying $1,000 more in the first year following a 1-in-100 yearstorm. That's the amount that they would pay between increasedcharges on both their property insurance policy and otherassessments that can be placed on other types of coverage,including auto insurance policies. Those not insured by Citizenscould still wind up paying as much as $323 more in assessments.

|The study shows that Floridians could be paying an additional$39 to $47 per year on auto insurance policies after that firstyear for the next 29 years.

|"Someone is going to pay the piper here,'' said Cabinet memberand Chief Financial Officer Jeff Atwater.

|

Scott and the Cabinet asked for the analysis aspart of an effort to understand the consequences if Citizens had topay out huge claims associated with a large hurricane.

Since his days on the campaign trail the governor has beenadvocating making changes to Citizens to transform it once againinto the state's insurer of last resort. Citizens right now is thestate's largest property insurer with 1.35 million policyholdersand a total exposure of $460 billion.

|Lawmakers did not make any substantial changes to Citizens thispast session, and Scott says that he wants more done to reduce itsexposure.

|"I don't think we'll be there until we have a robust systemagain and when Citizens is the insurance company of last resort,''Scott said.

|Sizable Assets

It's not that Citizens doesn't have a fair amount of resources totap into if a storm hits.

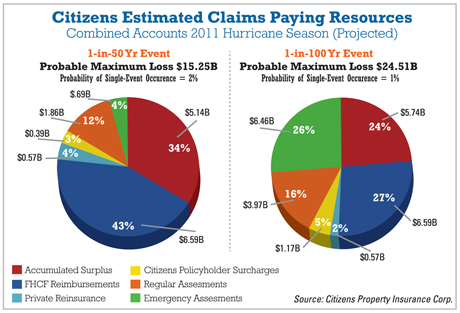

Because Florida has had 5 hurricane-free years, the company hasbuilt up a decent-sized amount of surplus. The new numbers showthat Citizens expects to have a total surplus of more than $5.7billion by the end of 2011.

|The company also has $2.9 billion worth of bond proceeds it cantap into, as well as $575 million worth of private reinsurancecoverage and another $6.59 billion worth of reinsurance coveragefrom the state-created Florida Hurricane Catastrophe Fund. Thecarrier is also seeking to borrow an additional $900 millionheading into this storm season.

|The analysis conducted by Citizens shows that the carrier couldeasily withstand a 1-in-5 year storm similar to Hurricane Francesin 2004 or even a storm of a 1-in-25 year magnitude. That cushion,however, would be lost with a major storm.

|A 1-in-50 year storm similar to 1992's Hurricane Andrew wouldoccasion the need for nearly $3 billion worth of surcharges andassessments on insurance bills in Florida. A 1-in-100 year stormwould trigger nearly $12 billion worth of additional charges.

|The way these charges and surcharges work is somewhatcomplicated, and involves three separate accounts that the carriermanages.

|Citizens' policyholders are grouped in one of three accounts: apersonal lines account that provides residential multi-perilaccounts; a commercial lines account that covers apartmentbuildings, condominium associations and office buildings; a coastalaccount that provides both wind-only coverage and multi-perilcoverage along the state's high-risk areas closest to the water. A deficit in any of the three accounts cantrigger one of three assessments on insurance bills. The firstassessment that is charged is called a Citizens' policyholdersurcharge and it is paid only by Citizens' customers. However, thesurcharge can be up to 15 percent for each account for 12 months.That means in the event of a truly large storm the surcharge couldhike Citizens' policyholder bills by as much as 45 percent.

|The second type of assessment is called a regular assessment. Itis charged to non-Citizens' policyholders, including all propertyinsurance and auto insurance policies in the state. (Worker'scompensation, medical malpractice, and federal flood insurancepolicies are exempt.) This assessment can be up to 6 percent ofpremium or 6 percent of the deficit for one year.

|Then there is an emergency assessment, which can be up to 10percent of premium and can be collected for any length of time,even as long as 30 years. Floridians right now are still paying offan emergency assessment of 1 percent triggered by 2005 storms.

|However, the problem isn't just Citizens' ability to deal withthe Big One.

|A series of smaller storms in one year—similar to what happenedin 2004 and 2005—could also trigger surcharges and assessments.

|"Forget about the Andrews and Katrinas. We got in this decade aproven track record of multiple small to medium sized storms,''said Agriculture Commissioner Adam Putnam during the Citizens'presentation.

|Citizens' officials have acknowledged that is a concern. Earlierin the year Citizens did a presentation to state legislators thatsuggested two 1-in-10 year storms could trigger both thepolicyholder surcharge and the regular assessment.

|Building Up Resources

This concern about multiple storms was one of the chief reasonsCitizens took steps to shore up its finances heading into thisyear's hurricane season.

After a contentious debate, the board that oversees the carrieragreed in late May to borrow up to $900 million this year and spend$125 million to purchase $575 million worth of private reinsurancecoverage.

|By law, Citizens must purchase mandatory coverage from theFlorida Hurricane Catastrophe Fund. However, the Citizens' boardhas usually not purchased additional private reinsurance.

|Some of the board members questioned the expense of privatereinsurance and said it should only be purchased in the event of asecond storm. They noted that the odds were extremely low thatlosses would be high enough to even trigger a reimbursement.

|But Sharon Binnun, the chief financial officer for Citizens,justified the purchase of private reinsurance as a way of"transferring the risk out of Florida." She said having privateinsurance would lessen the need to turn to Floridians to help covermassive losses.

|The major difference between the bonds and the reinsurance isthat the bonds will give Citizens access to cash that can be usedas a bridge to help pay off claims right after a storm. Bycontrast, Citizens will only get a return on its reinsurancepremiums in the event that losses are so high that it is forced tomake a claim. The reinsurance policies are also only good for oneyear.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.