The CEO of Fortegra Financial believes he has a distinct edge ashe competes to acquire property and casualty wholesale brokeragesand regional specialty agencies to add to his firm's suite ofinsurance-service operations.

|What is the advantage? Being a New York Stock Exchange-listedpublic company.

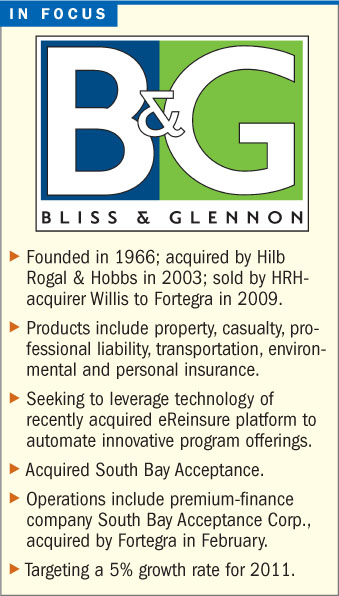

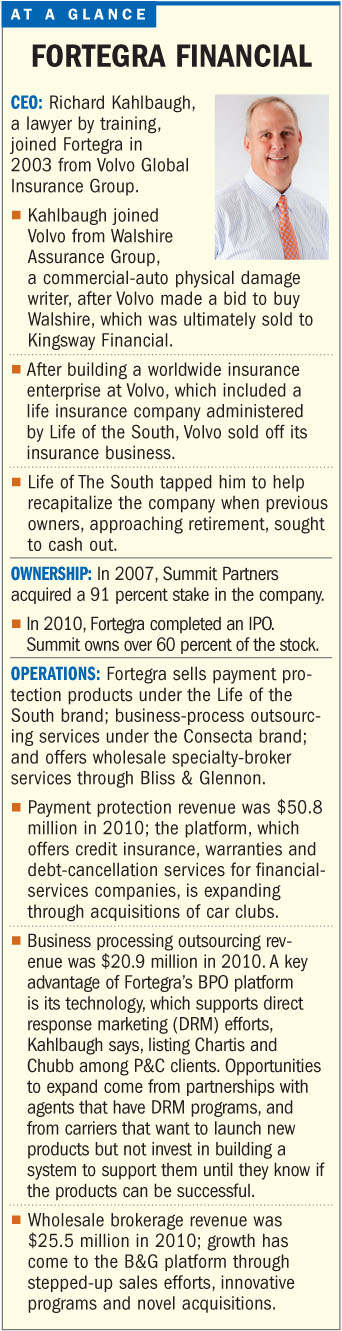

| “We think the public-company[status] is critical to rewarding the brokers who make yourbusiness happen,” says Richard Kahlbaugh, who heads a group thatincludes credit-insurance operations, abusiness-process-outsourcing (BPO) platform, and Redondo Beach,Calif.-based wholesaler Bliss & Glennon (B&G).

“We think the public-company[status] is critical to rewarding the brokers who make yourbusiness happen,” says Richard Kahlbaugh, who heads a group thatincludes credit-insurance operations, abusiness-process-outsourcing (BPO) platform, and Redondo Beach,Calif.-based wholesaler Bliss & Glennon (B&G).

“That is a distinct advantage relative to our peers. Steve[DeCarlo] or Pat [Ryan] can offer them equity, but unless you haveliquidity for that equity, it is of no immediate value,” he says,referring to the leaders of competing wholesalers AmWINS andupstart Ryan Specialty Group, two of the most active acquirers inthe specialty producer/managing general agency space.

|“Our brokers, through options or restricted stock, can reap thebenefits of the contributions they make,” says Kahlbaugh, as heoutlines plans to add on to the B&G acquisition his group madeback in 2009 (a year before Fortegra's initial publicoffering).

|This ability to offer such compensation is a key reasonKahlbaugh “expects [Fortegra] to be in the cadre of four or fivecompanies that would be the dominant players [in thewholesale-brokerage space]. That's our plan and focus.”

|OUTSOURCING SOLUTIONS

|The chair, president and CEO of Fortegra offered this assessmentto NU earlier this month, as he addressed questions aboutcompeting bidders for P&C wholesalers; B&G's ambitious goalof becoming a top 5 wholesaler; and the most obvious question: Howdoes B&G fit in a group of insurance-services companies thatbegan as a credit-insurance operation and later developed atechnology-driven BPO segment providing policy-administrationservices, mainly to life insurers and financial-services firms?

|“I get asked that a lot by investors,” Kahlbaugh reports. Hisresponse: “If you think about every one of our businesses, they'reall outsourcing solutions in one form or fashion. Our value lies inmaking the transactions and processes we touch better for[business] customers and their end-market consumers.”

|The BPO segment, for example, operating under the Consectabrand, is “a classic outsourcing model” under which insurancecompanies outsource underwriting and general administrationfunctions to Fortegra.

|Providing the link to P&C wholesale, he says, “The way welook at it is [that] underwriters are outsourcing market-managementfunctions to us. They are asking us to manage the relationshipswith a variety of retailers that have a variety of needs, and toact as the conduit through which they interact with themarketplace.”

|Describing the wholesale-broker activities of B&G, he saysthe firm can act “as a conduit through which information andtransactions flow,” adding that B&G also manages programs andhas the power to underwrite and bind business for some insurers.During a March investor presentation, Kahlbaugh reported thatB&G represented more than 130 carrier markets and had 25binding-authority contracts.

|B&G BUY: ACTIVE PURSUIT OROPPORTUNISTIC?

|Asked whether Fortegra was actively seeking a P&C wholesalerwhen it purchased B&G from Willis two years ago, or if theopportunity just landed on his desk, Kahlbaugh says it was a littleof both.

|“We always wanted to be in P&C,” he says, noting that thefirm made a conscious decision to pursue a wholesale-distributionmodel over retail. “Every time we've gone direct to the customer,we've not done very well. Our specialty is business-to-business.That's where we do best,” he says.

|After looking around and being invited into the bidding processby the banker working on behalf of the seller, Kahlbaugh says theB&G asset had appeal for three strategic reasons.

|“They have a wonderful underwriting reputation. They had areally strong presence in California and Texas”—two keysurplus-lines states. “And perhaps most importantly, there was awell-illuminated path to growth,” he says, explaining that B&Gdid not have a presence in New York and only a small one in Chicagoand Florida.

|“The game plan was set for us to grow the enterprise,” hesays.

|B&G's GROWTH STRATEGY

|Growth has come to the B&G platform in three ways: throughstepped-up sales and marketing efforts, through innovativeprograms, and through novel acquisitions.

|“We are reaching out to retailers throughout the United Statesand letting them know about the quality of our underwriting and ourmarkets [carriers] in a regular and systematic way,” saysKahlbaugh, introducing a discussion of Fortegra's sales andmarketing efforts on behalf of B&G. “That's different from whatthey were used to do,” he says, suggesting that B&Gprofessionals were more accustomed “to wait for the business tofall in their laps.”

|Last year, B&G added 600 new retailers—to a group that nowincludes more than 4,000 across the country—by just doing a betterjob “getting the word out” about B&G's underwritingreputation—one that was well known to its existing retailers, butnot to any others.

|“We either had a great reputation with retailers, or none atall,” Kahlbaugh says, noting that Fortegra decided to spend moneyto create a sales team—“not a team of underwriters, not brokers,but sales people who go in and articulate the B&G advantage ina way that's meaningful to the retailer.”

|He reports that the team made 1,600 sales calls in the firstquarter of this year—the target for every quarter.

|Referring to last year's recruiting success, he concedes thatsigning up 600 retailers does not mean B&G will get businessfrom 600. “It's the 80-20 rule. You actually have 100 that producefor you.”

|Beyond the sales efforts, Fortegra management has challengedB&G leadership to develop new and novel programs, such asinsureyourwine.com—an online platform (profiled in NU'sApril 18, 2011 edition) that allows brokers and wine collectors togo to a website to cover wine collections against variousperils.

| The idea, Kahlbaugh says, is tobring to bear Fortegra's enterprise-wide technology advantages inthe P&C specialty marketplace. While the wine program is small,programs like this “have tremendous operating leverage,” he says,explaining that you put underwriting metrics into a system thatoperates 24 hours a day, seven days a week, “and nobody has to manit.”

The idea, Kahlbaugh says, is tobring to bear Fortegra's enterprise-wide technology advantages inthe P&C specialty marketplace. While the wine program is small,programs like this “have tremendous operating leverage,” he says,explaining that you put underwriting metrics into a system thatoperates 24 hours a day, seven days a week, “and nobody has to manit.”

Such ideas offer a solution to a profit-margin problem that allplayers in the P&C specialty space must face as a result ofmarket cycles, he says. “When the market hardens, and businessgrows very rapidly, the traditional approach is you staff up…Whatwe want to do is create more of a technology-driven environment, sothat in certain programs, you can enjoy some operatingleverage.”

|STRATEGIC ACQUISITIONS

|Kahlbaugh highlights Fortegra's March 2011 $37 millionacquisition of eReinsure—a web-based platform for managing theplacement of facultative-reinsurance risks—as a means ofintroducing new technology to the overall E&S brokerageplatform.

|“The [eReinsure] technology brings together willing buyers andsellers of facultative reinsurance, allows a certain negotiationflow, and documents all of that. Algorithms pull together willingbuyers and sellers of common types of risks,” he explains.

|Fortegra plans to “cross-pollinate the technology” into theE&S program business, “so that when a retailer sends in [asubmission] over the Internet, the software will read what type ofrisk it is, drive it to the right program and then begin theelectronic underwriting process.”

|“It will enhance speed to market, it will enhance the speed ofthe return quote, and it will create more systemized and uniformunderwriting approaches,” he says—something Kahlbaugh contends hasalways been a big struggle in E&S, where it's hard to getconsistent underwriting data on a hodgepodge of fringe risks.

|Kahlbaugh stresses that experienced underwriters also arehelping B&G gain share in a soft market.

|“What we're trying to do is shift the paradigm a little bit. Ina soft market, you have to work hard on market share, [and] marketshare is a function of speed, responsiveness, quality of marketsand quality of underwriting,” he says. Experienced underwriters addto B&G's competitive advantage because they can look at risksquickly, price them and get them back out.

|ADDING REGIONAL TALENT

|Kahlbaugh also describes the thinking behind anotheracquisition—a premium-finance company called South Bay AcceptanceCorp. that was added to the B&G platform lastFebruary.

|The ability to offer retailers a premium-finance option, inorder to help customers dealing with the impact of a tough economy,gives B&G brokers an “extra arrow in their quiver,” hesays.

|Although B&G has not yet added another E&S broker to thegroup, Kahlbaugh says he views himself as an acquirer, rather thana target for hungry wholesalers already in the top five—a tier thetop-20 B&G aspires to reach in time.

|“Our perspective is there are significant attractiveopportunities…with small to midsize enterprises that are looking tojoin a larger, growing and public insurance-services business,” hesays.

|What exactly is Fortegra looking for in a P&Cspecialty-producer acquisition that it would consider making?

|“We're looking for regional agencies that are very well run,where the management wants to hang around and create something ofnational and international scale with us,” Kahlbaugh says. But, headmits, finding a company that meets all those criteria can bedifficult.

|Often people interested in selling are looking for an exitstrategy, he explains. “That's not attractive to us.”

|“We're looking for management, talent and market skills because,in the end, the insurance business is about three things: capital,technology and people.”

|“Capital is a commodity. It just depends what you want to payfor it. And the technology I can fix for them.”

|“But the skills of the people, their relationships with themarkets, their relationships with the retailers—I can't replacethat. That's always the difficult part of thatequation.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.