On the personal-lines side, the adoption of real-time processingtechnology—and the significant efficiencies that go with it—isbecoming widespread.

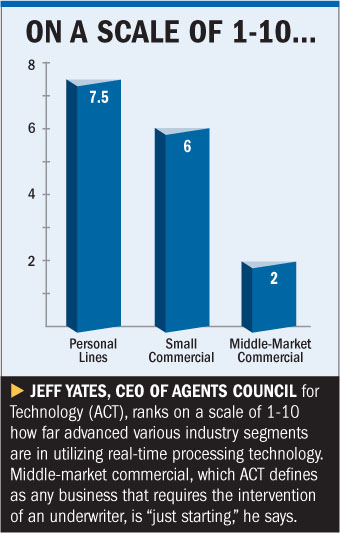

| The “next frontier,” according toJeff Yates, CEO of ACT (Agents Council for Technology), isreal-time processing for commercial lines—a development that willhave “huge payback” for independent agents and brokers.

The “next frontier,” according toJeff Yates, CEO of ACT (Agents Council for Technology), isreal-time processing for commercial lines—a development that willhave “huge payback” for independent agents and brokers.

“There is definitely a goal and interest to make this happen,”adds Cal Durland, director of member relations for ACORD(Association for Cooperative Operations Research andDevelopment).

|At the moment, real-time capabilities on the commercial sideremain limited. Most of the progress to date is occurring aroundsimpler, small-account, business-owners policies (BOP), where theindustry's technology innovators are “succeeding pretty well” atcreating the software applications that make real-timefunctionality possible, says Durland.

|Yates agrees that BOP is where most of the commercial-sidereal-time advances are being made. He credits Applied Systems with developinga commercial-lines quoting system for BOP that can generatemultiple quotes through its agency-management system—while othersystems, he says, are still managing only one quote.

|MONKEY IN THE MIDDLE

|When moving up the complexity scale to middle-market commercialaccounts, real-time processing becomes much more of a challenge:the standardization of applications and forms has proven to bedifficult, and unlike personal lines, the active engagement of anexperienced underwriter is hard to eliminate.

|Noting the many variables that are involved with this class ofbusiness, the Council of Insurance Agents & Brokers hasspearheaded the creation of the Insurance Exchange in an effort tocreate real-time transaction capabilities for middle-marketcommercial accounts.

|Frank X. Sentner, The Council's director of strategictechnology, explains that in 2009 his organization and LexisNexisbegan to talk about the creation of a system that would allowagents, brokers and wholesalers to submit their client applicationsand accompanying data to carriers in a secure environment. Thesystem would do away with multiple e-mails and deliver the data toa carrier in one, seamless electronic transaction.

| Today, the Insurance Exchange isan open platform that allows any carrier and broker to have accessto the system without charge. Brokers can only submit business tocarriers with which they have an appointment or other workingrelationship. The program is still in the early-adopter phase withfive carriers and 18 brokers.

Today, the Insurance Exchange isan open platform that allows any carrier and broker to have accessto the system without charge. Brokers can only submit business tocarriers with which they have an appointment or other workingrelationship. The program is still in the early-adopter phase withfive carriers and 18 brokers.

The exchange is overseen by the Insurance Exchange Trust,comprised of insurance-industry executives who are charged withproviding guidance and insight to LexisNexis in operating theexchange in the interests of the industry.

|While the use of the exchange is open to the industry at nocharge, there are services available only to paid subscribers.

|Subscribing carriers get to brand their company, display theirappetite profile, get their data the way they want it in theire-forms, access reports and analytics on producer business, andenjoy integration opportunities between the exchange and theirindividual data systems.

|Subscribing producers receive similar benefits.

|Sentner says the underlying understanding of this system is thatunlike personal lines and small commercial lines, the underwritercan't be eliminated.

|“We need a platform where we can have a human being in theprocess, but make the process much, much easier,” he says.

| REAL-TIME ADVANTAGES

REAL-TIME ADVANTAGES

When (not if, argue industry experts) real-time processingbecomes a more common commercial-side solution, what will be someof the key advantages delivered?

|One of the big benefits for producers will be the ability toautomatically upload vehicle schedules and other time-consuming,data-heavy applications from within their agency-management systemsdirectly to carriers.

|“The major idea is to get rid of keystrokes,” says Yates, whoexplains that the norm today requires agents and brokers to gooutside their agency-management systems and re-key data into theone used by a carrier (or, with middle-market accounts, to e-mail aspread sheet with the information).

|Take, for example, a vehicle schedule that lists in anagency-management system all the data about each individual auto ina company's fleet—its description, registration, usage, etc.Typically, when communicating with a carrier, all that data needsto be re-entered.

|And all this re-keying that occurs today is not only a drain ontime—it's also a source of errors, so real-time processing canreduce or eliminate the mistakes that can delay a quote.

|“There is definitely a growing awareness of the need toeliminate this double entry of data,” Durland says.

| Producers also would benefit frombeing able to receive batch transactions: Carriers could send overa trove of data that would be automatically accepted into theagency-management system and stored in their data-storage files orallocated to an individual or individuals for disposition.

Producers also would benefit frombeing able to receive batch transactions: Carriers could send overa trove of data that would be automatically accepted into theagency-management system and stored in their data-storage files orallocated to an individual or individuals for disposition.

And not only retail producers would benefit—excess andsurplus-lines producers would also gain efficiency, Yates says.

|Real-time processing, he adds, would not be limited toapplication submission, quoting and rating, but would also extendto claim submissions and updates.

|“Those that take the plunge are finding significant advantages;the trick is to take the plunge,” says Yates.

|Indeed, with such major upsides for agents and brokers—helpingthem get their job done better, faster and more cheaply—someindustry observers predict that those carriers that are first toembrace real-time solutions on the commercial side could seizeserious market share from competitors.

|HURDLES REMAIN

|So why are some carriers resisting?

|One argument carriers make about adopting real-time processingfor commercial accounts is that it commoditizes their business andthat commercial applications and the accompanying documentation,especially for E&S business, simply can't be standardized.

|But Durland counters that the collection of commercial data isessentially the same for all carriers and that the standardizationchallenges can be worked out, even for E&S carriers. Durlandadds that carriers shouldn't be looking to differentiate themselveson the application process but on underwriting, service and payingclaims.

|“The key is the relationship and underwriting,” saysDurland. “Let the agent have more time for relationship penetrationof the account.”

|“I'm definitely excited that we can figure this out, but I can'tsay it will happen next year, or when it will happen, but we aremaking progress,” Durland adds. “Ultimately we will get there andmid-market commercial lines will be as easy as BOP.”

|“We do not know what technology is around the corner, but we doknow the younger generation does not want to get stuck with thecurrent processes.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.