Catastrophe-risk modeler EQECAT has dramatically changed itsestimate of insured losses from the Tohoku, Japan earthquake tobetween $22 billion and $39 billion.

|Shortly after the March 11 earthquake EQECAT released aninsured-loss estimate of between $12 billion and $25billion.

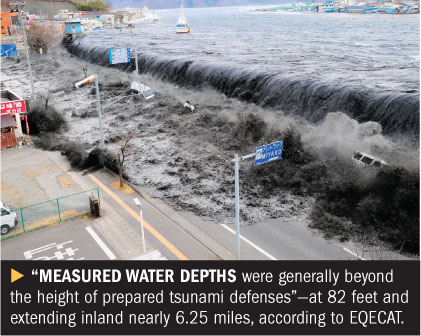

| EQECAT says the upward shift inestimating losses is due to several factors. First, water depthsfrom the tsunami that followed the earthquake were thought to beeight meters (26 feet), but the depths were more than 25 meters (82feet) and extended inland about 10 kilometers (nearly 6.25miles).

EQECAT says the upward shift inestimating losses is due to several factors. First, water depthsfrom the tsunami that followed the earthquake were thought to beeight meters (26 feet), but the depths were more than 25 meters (82feet) and extended inland about 10 kilometers (nearly 6.25miles).

“Measured water depths were generally beyond the height ofprepared tsunami defenses,” EQECAT says. “In many coastal areaseven the tallest buildings were completely inundated with water.Damage to wood structures was virtually 100 percent—houses werecompletely removed from their foundations.”

|Losses were also adjusted due to a better understanding ofdamages caused by liquefaction, landslides, power outages,transportation interruption and disruption at the nuclear powerplant in Fukushima.

|Property insurers will bear a large portion of losses. Revisedproperty-loss estimates resemble EQECAT's original prediction forlosses to the entire market—between $15 billion and $25 billion. Ofthis amount, $7 billion to $12 billion is attributed to Japan'sunregulated cooperative insurance companies, collectively known asKyosai. Kyosai does not cede losses to the government's JapanEarthquake Reinsurance Pool (JER) like the general non-lifecompanies do. Losses to the general non-life companies areestimated to be in the range of $3 billion to $5 billion, EQECATsays.

|The non-life commercial insurers, which rarely cover businessinterruption, are expected to pay out between $5 billion to $8billion, the modeler adds.

|EQECAT's overall loss estimate also includes marine, auto, lifeand personal-accident lines of coverage, as well as demand surge.The estimate does not include loss-adjustment expenses, contingentbusiness interruption or losses related to the current emergency atpower plants.

|The adjustment comes after reinsurance-brokerage firm Holbornsays modelers were underestimating market losses from the quake byas much as $23 billion. Holborn puts insurance-market losses atbetween $35 billion and $55 billion after adding coverages notincluded in predictions given by the three catastrophe-riskmodeling firms: EQECAT, AIR Worldwide and Risk ManagementSolutions.

|Aon Benfield said last week that catastrophe models may not beas accurate as some carriers might expect and cautioned insurers toexamine their loss estimates more closely. Aon Benfield says theinsurance industry has recently witnessed evidence of models bothunderestimating and overestimating loss estimates.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.