Sudden natural disasters such as the tragic Tohoku earthquake inMarch are not the only catastrophes that can impact insurers'balance sheets and policyholder surplus. Such well-publicizednatural catastrophes only account for about 7 percent of insurers'notable capital and surplus impairments triggering regulatoryaction and concern.

| Of the remaining 93 percent, byfar the largest cause of impairments over the past 30 yearsemanated from inadequate pricing and deficient lossreserves—resulting in approximately 40 percent of the cases,according to a May 2011 study (“A.M. Best Special Report: 1969-2010Impairment Review”).

Of the remaining 93 percent, byfar the largest cause of impairments over the past 30 yearsemanated from inadequate pricing and deficient lossreserves—resulting in approximately 40 percent of the cases,according to a May 2011 study (“A.M. Best Special Report: 1969-2010Impairment Review”).

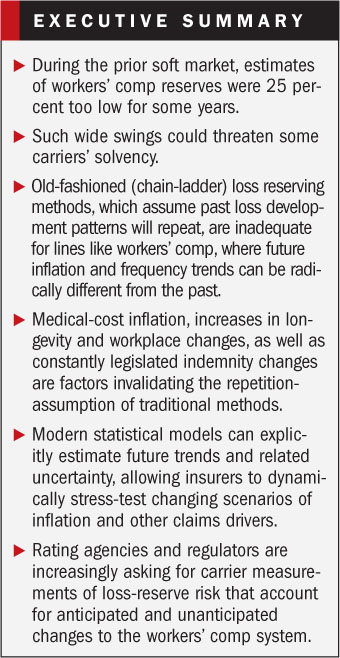

Loss-reserve uncertainty is arguably one of the most difficultrisks on an insurer's balance sheet to estimate and monitor. Theworkers' compensation line of business represents the largestportion of the U.S. property and casualty industry's net reserves,contributing nearly a quarter of total current net-loss andadjustment-expense reserves.

|The risks of managing a long-tailed, heavily legislated linelike workers' comp are widely known. It has been nearly impossibleto accurately estimate medical inflation, increases in longevity,changes in the workplace and constantly legislated indemnity overthe course of a 20-year time horizon. The uncertain economicenvironment has also increased uncertainty in estimating ultimatelosses.

|Emerging Estimation Risks

|Reforms enacted in the mid-2000s resulted in lower premiums andloss costs and favorable frequency and severity trends. However,workers' comp medical expenses, which are higher than the overallmedical Consumer Price Index, have outpaced favorablelower-claims-frequency trends.

|According to the National Council on Compensation Insurance,medical costs now contribute a staggering 58 percent of totalcomp-loss costs, up from 49 percent in 1991. The combined netimpact of these trends resulted in deteriorating combined netratios from 99 percent in 2006 up to 111 percent in 2009.

|Since the 2009 global financial crisis, much of the P&Cindustry has been on the road to recovery, yet workers' compunderwriting results have continued to weaken. This is due to aconflux of factors, including decreasing payrolls; decliningpremium volume emanating from both competitive rate decreases andprior-year return-premium adjustments; the highest medical-costtrends among all industry segments; and lower long-term investmentreturns.

|Further, the Obama administration's health-care reforms createnew and unprecedented uncertainties associated with potentialmedical-loss-cost shifts between workers' comp insurers and healthinsurers.

|THE Historical Evidence

|Loss reserves for workers' comp are essentially forecasts oflosses that will be paid over five, 10 and 15-plus years. As aresult, they are among the most challenging balance-sheet risks toquantify.

|Under standard reserving methods, known as chain-ladder methods,an actuary examines historic data, measures existing patterns andmakes forecasts based on the assumption that those patterns willrepeat.

| Sometimes there is insufficientdata to measure the pattern reliably on a given line of business.Yet other times trends change and the patterns from the past eithersimply do not repeat or are difficult to capture.

Sometimes there is insufficientdata to measure the pattern reliably on a given line of business.Yet other times trends change and the patterns from the past eithersimply do not repeat or are difficult to capture.

The worst cases of adverse reserve development occur when thereare material and unpredicted changes in the underlying trends, aswe are experiencing in the current climate.

|For example, for accident-year 2000, the estimate of ultimateloss increased by around 25 percent from its first estimate at theend of 2000 to its re-estimate nine years later.

|The 1997-2002 soft market was underpriced just as workers' compmedical-cost inflation escalated erratically relative to previouslyassumed assumptions.

|How to Minimize Inaccurate Estimates

|Over the past 20 years, actuarial pioneers have worked to applymodern statistical theories to loss reserves. In practice, however,these ideas have not been widely adopted. New reserve methods onlong-tail casualty lines will need to offer demonstrable advantagesthat override the natural instinct to keep time-tested ways.

|Insurers require a solution with proven accuracy and resultsthey can verify and explain. Programming advanced statisticalmethods may be too time-consuming for individual companies, socommercial software is needed. Up until recently, there haven'tbeen many practical, cost-efficient solutions available.

|Our firm is among those that are now using a statisticalapproach known as generalized linear modeling (GLM) to identify anddisplay trends in an insurer's workers' comp data that previouslywere hidden under a chain-ladder method. (See related textbox fortechnical explanation.)

|Under GLM, future trends and related uncertainty are explicitlyestimated. The default is not to assume that future trends—inoverall inflation or medical-cost inflation or claims frequency,for example—will be the same as in the past and understate lossreserve risk. It is possible under GLM to capture changing trendswhile stressing various dynamic and inflationary scenarios tocurrent net loss reserve positions.

| Currently, companies that attemptto measure loss-reserve risk (the uncertainty inherent in theirloss-reserve estimates) use one of two techniques (known as theMack and Bootstrapping techniques), both of which are based on thechain-ladder method. As we have seen, the chain-ladder method,rooted in the assumption that the future will look like the past,has produced inaccurate point estimates of ultimate losses fordecades. It follows that any technique designed to measureuncertainty that relies on that basis premise will be flawed.Future trends will certainly be different from the past, and thisuncertainty is being ignored by current methods, significantlyunderstating reserve risk.

Currently, companies that attemptto measure loss-reserve risk (the uncertainty inherent in theirloss-reserve estimates) use one of two techniques (known as theMack and Bootstrapping techniques), both of which are based on thechain-ladder method. As we have seen, the chain-ladder method,rooted in the assumption that the future will look like the past,has produced inaccurate point estimates of ultimate losses fordecades. It follows that any technique designed to measureuncertainty that relies on that basis premise will be flawed.Future trends will certainly be different from the past, and thisuncertainty is being ignored by current methods, significantlyunderstating reserve risk.

Since loss-reserve risk can account for the greatest drain oncorporate capital, it is essential that insurers' reserve modelingaddresses previous models' limitations while contemplating soundstatistical principles. Furthermore, the factors that driveloss-reserve risk also contribute to underwriting risk forlong-tail business.

|Insurers may initially be drawn to GLM for its ability tomeasure loss-reserve risk, especially since they increasingly arebeing required to report these numbers to regulators and ratingagencies. For example, A.M. Best has added a newenterprise-risk-management section to its latest SupplementalRating Questionnaire that inquires about several specificinflationary trends and scenarios—both anticipated andunanticipated—that could impact carriers' net reservepositions.

|In a broader sense, GLM will also help insurers navigate thelong-tail risks in the dynamic workers' comp environment. Theessential premise of this approach— particularly relevant in thisenvironment—is that trends may change. The modeling displays thereal trends in an underlying workers' comp insurer's data, whetherthey have been steady or changing.

|This improved understanding of the past has led to importantadvantages and improvements. Forecasting decisions can now be wellinformed, transparent and explainable. In addition, reserve riskmodeling can better contemplate the risk of a changing future andthe risk drivers that dynamic reserve modeling measures can beincorporated into a capital model.

|Now, insurers can better manage the risks of long-tail workers'compensation business in the context of their corporate capitalrequirements.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- All PropertyCasualty360.com news coverage, best practices, and in-depth analysis.

- Educational webcasts, resources from industry leaders, and informative newsletters.

- Other award-winning websites including BenefitsPRO.com and ThinkAdvisor.com.

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.